Hedera’s (HBAR) first U.S. spot ETF debuted with just $8 million in day-one trading, according to Bloomberg’s Eric Balchunas. In addition, the underlying token’s market activity exploded more than 400% within 24 hours.

Hedera ETF Launch Draws Cautious Start

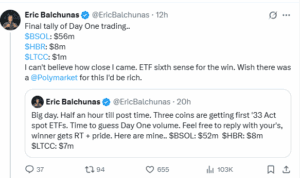

The Canary Capital HBAR Spot ETF (HBR) opened for trading on Nasdaq on Oct. 28. Bloomberg’s Eric Balchunas reported about $8 million in day-one volume, compared with $56 million for Solana’s BSOL ETF and $1 million for Litecoin’s LTCC.

The listing came under the SEC’s new rule that lets exchanges approve crypto-linked ETFs without individual product reviews. HBR uses BitGo as its custodian and CoinDesk Indices for pricing. The launch adds Hedera to the small group of digital assets with regulated investment products in the U.S.

While ETF inflows were limited, spot market activity around HBAR surged. Daily spot volume jumped from roughly $270 million to more than $1 billion—about a 400% increase within 24 hours. The HBAR price rose nearly 26%, hitting $0.205 before cooling near $0.196 today on Oct. 29 afternoon.

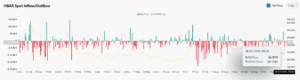

On-chain data reinforces that the buying pressure came from retail markets rather than institutional desks.

HBAR recorded net outflows of $4.37 million from exchanges on Oct. 28, even as prices spiked — a sign that traders were moving coins into self-custody after buying on the news.

You May Also Like: Will Hedera (HBAR) Reach $1 by the End of 2025?

Such patterns typically signal short-term speculative positioning rather than long-horizon accumulation.

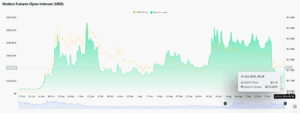

Open interest in Hedera futures doubled from $123 million to about $213 million, showing that traders responded more aggressively in the derivatives market than through the ETF itself.

Technical Setup Near Key Resistance

On the weekly timeframe, HBAR trades around $0.197, holding above its 200-week exponential moving average (EMA) at $0.16 and near the 50-week EMA ($0.19). The chart shows a descending trendline from the March highs near $0.30, capping recent recovery attempts.

A breakout above $0.21 — the 20-week EMA — would invalidate the current downtrend and open room toward $0.23–$0.25.

Conversely, a rejection at the trendline could push prices back toward support zones between $0.16 and $0.17.

The weekly Relative Strength Index (RSI) at 48 signals a neutral setup: neither overbought nor oversold, suggesting that momentum could strengthen if the HBAR token closes above its short-term averages.

ETF participation typically lags token-market enthusiasm. Institutional investors often wait for settlement data, net asset reporting, and liquidity consolidation before entering. In comparison, the Solana ETF’s $56 million debut signals faster adoption due to its stronger institutional presence in staking and DeFi.