Hedera scheduled a testnet upgrade to v0.67 for Wednesday, Oct 22 at 17:00 UTC, with an estimated 40-minute window. The status page flags expected service disruption during the rollout

Earlier in October, maintainers posted and then canceled a mainnet v0.66.0 upgrade on Oct 8 due to a technical issue. The incident log records the scheduling, the in-progress state, and the cancellation note.

Operational housekeeping continued as Council operators completed node maintenance, including a Mondelēz International node service on Oct 14. These entries signal routine platform care alongside the pending testnet work.

Hedera detailed HIP-551 “Batch Transactions”, which let developers compose multiple HAPI calls into a single atomic operation that either fully succeeds or fully fails. The official blog frames the feature as ACID-compliant and aimed at complex workflows.

Community and media posts this week amplified the rollout’s impact, noting simpler multi-step flows like mint-and-transfer within one submission. Summaries emphasize reduced complexity and stronger transactional integrity.

Together with recent core upgrades, Batch Transactions position Hedera’s stack for cleaner app logic and fewer edge-case failures. The timing also aligns with the October maintenance cycle documented on the status portal.

Onboarding push: Hashport opens an HBAR faucet

Hashport launched an HBAR Faucet beta on Oct 1 to give qualifying new accounts a nominal HBAR “drip” for fees. The announcement cites smoother first-use experiences as the goal.

Foundation and ecosystem channels surfaced the faucet alongside Hashport’s onboarding toolset (“HashPass”). Posts outline eligibility and intent to lower friction for newcomers.

Practically, the faucet can shorten time-to-first-transaction for wallets and apps that need initial HBAR to interact with the network, complementing cross-chain bridging that Hashport already provides.

Governance context: Arrow Electronics joins the Council

For enterprise context, Arrow Electronics joined the Hedera Governing Council in June. Arrow will run a node and collaborate on supply-chain visibility and compliance initiatives.

Company materials describe a DLT use case aimed at real-time tracking across complex, multi-party logistics networks. Public releases from both sides confirm the supply-chain focus.

This governance addition underscores Hedera’s enterprise posture while core engineering advances—like Batch Transactions and scheduled upgrades—continue in parallel.

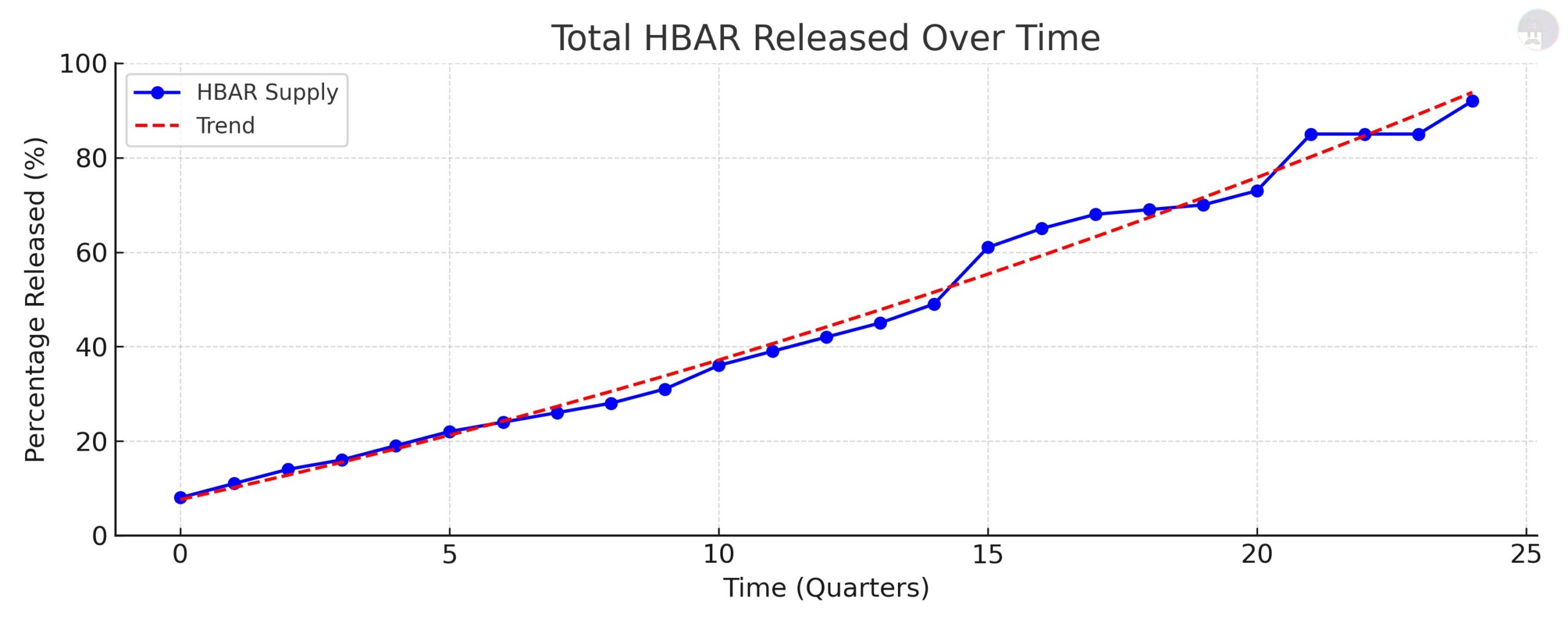

HBAR supply unlocks near completion

The chart tracks HBAR’s circulating supply climbing from under 10% to the mid-90% range across 25 quarters. The fitted trendline points to full release soon, meaning the long, scheduled token unlock program is almost finished.

As unlocks fade, dilution pressure from new tokens entering the market naturally declines. Therefore, calendar-driven sell-side events should matter less than before. Liquidity remains high, but the “overhang” from future distributions narrows.

However, “inflation = dead” overstates it. The chart shows release of the fixed 50B supply, not the creation of extra tokens beyond the cap. With most supply already out, future circulating growth slows, yet price still depends on demand, treasury movements, and on-chain activity. In short, supply headwinds ease; fundamentals and flows take the wheel.

HBAR chart thesis: ascending channel with Elliott-wave roadmap

The chart frames HBAR/USD inside a long ascending channel from 2020, with recurring bounces at the lower trendline and capped moves near the upper boundary. It marks the 2021 all-time high at $0.58 and proposes that price remains mid-channel after a higher-low retest. Therefore, the structure argues the broader trend is up while the channel holds.

The author overlays Elliott-wave counts that segment rallies into five-wave advances and pullbacks into corrective phases. In this path, the latest green check near the lower rail implies a completed corrective leg and a fresh impulse. Consequently, the projected ovals point to a staged climb toward the channel top over the next cycles.

Horizontal supply and demand zones reinforce the view. Red bands highlight former ceilings that later acted as support, suggesting a base-building process within the channel. If price keeps closing above these bands, the map favors continuation inside the rising structure; if not, momentum can stall at mid-channel resistance.

Finally, the graphic posts a long-range target near $1.80 at the channel’s upper line with a terminal wave label. Treat that as scenario-based, not predetermined. The thesis invalidates on a decisive breakdown of the lower trendline or a failed reclaim of the marked support blocks. Wave labeling is interpretive, so risk controls and confirmation signals matter before assuming the full path.

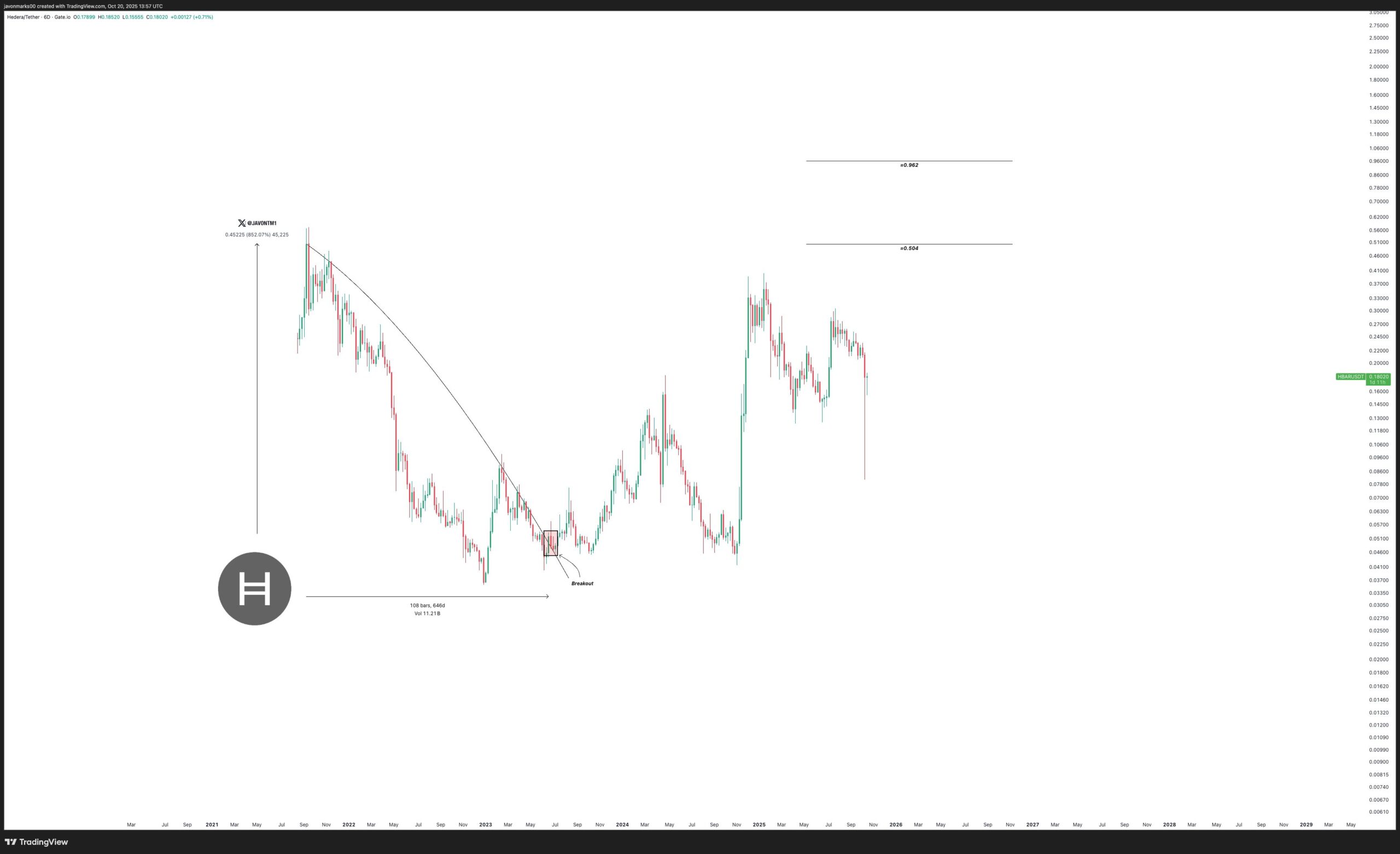

HBAR chart analysis — Source: JavonTM1 on X

The chart shows HBAR building a higher-low structure after its long downtrend, which ended with a breakout in 2023. The visual highlights the full corrective move from the 2021 peak and then marks the breakout box where momentum shifted. Therefore, the analyst treats the downtrend as completed and the current action as part of a new upward phase.

The first marked target sits near $0.504, which aligns with a major resistance zone from a prior breakdown area. Because the price has spent many months consolidating underneath that level, the idea is that a clean move through it could confirm trend continuation. The analyst also frames this level as the midpoint target before any larger rally attempt.

If HBAR closes above the $0.504 resistance, the chart assigns a secondary target around $0.962, reflecting the next unfilled range from the previous cycle. This structure implies a “stair-step” path in which HBAR must flip old supply zones into support before advancing. The thesis loses momentum if price fails to hold its breakout zone and returns into the prior range.