House of Doge, the corporate arm authorized by the Dogecoin Foundation, said it will go public on Nasdaq through a merger with Brag House Holdings. The deal provides a listed vehicle and access to public-market capital. It also formalizes a go-to-market plan around payments, tokenization, gaming, and yield.

Moreover, the parties placed the merger in a broader distribution push. Brag House has continued operating updates around the transaction window, signaling execution work under way. These communications keep the listing track visible for stakeholders following corporate actions rather than token price.

In parallel, House of Doge underscored its ties with 21Shares, noting Europe’s Dogecoin ETP sits near $26 million AUM with roughly 107 million DOGE. That datapoint positions DOGE inside an established exchange-traded wrapper outside the U.S. while the Nasdaq process unfolds.

Payments and loyalty: inKind integration targets 3.5M users

Separately, House of Doge and Brag House announced a strategic partnership with inKind, a hospitality payments and rewards platform. The plan introduces Dogecoin payments and loyalty to more than 3.5 million users through the inKind app. Thus, distribution runs through an existing consumer wallet rather than bespoke onboarding.

Furthermore, the integration frames DOGE as a medium for real transactions across 4,750-plus U.S. venues, according to coverage. That footprint spans restaurants, bars, cafes, and nightclubs, offering immediate test environments for settlement flows.

As a result, the initiative shifts the narrative from speculation to usage. It gives merchants and users a defined flow for earn-and-spend mechanics inside a live network, independent of exchange listings or short-term price.

U.S. ETF landscape: filings in queue, rules in focus

House of Doge’s materials also reference an expanded 21Shares partnership that includes U.S. spot and levered Dogecoin ETF proposals. Public reporting indicates the SEC has the filings under review, with decision timelines governed by the agency’s rulebook. Therefore, the path remains procedural rather than promotional.

At the same time, the broader ETF setting is moving. U.S. regulators recently allowed a memecoin-backed Dogecoin ETF from Rex-Osprey to proceed, signaling a shift in product tolerance while still drawing industry debate about investor understanding and fees. This context matters for any future DOGE-linked products.

However, leverage remains a live policy topic. The SEC has cautioned that higher-multiple ETFs (3x–5x) face compliance hurdles, reinforcing that approvals are not guaranteed and that leverage limits can constrain product design around crypto exposures.

Corporate treasury: CleanCore installs DOGE-first reserve strategy

In corporate finance, Nebraska-based CleanCore Solutions disclosed a Dogecoin-focused treasury program. The company named Quinn Emanuel partner Alex Spiro—known for representing Elon Musk—as board chair to oversee the effort. CleanCore described a nine-figure capital raise intended to fund DOGE purchases as primary reserves.

Additionally, the company linked its initiative to the Dogecoin Foundation and House of Doge, presenting a coordinated push to formalize DOGE inside public-company balance sheets. Market reaction was mixed, yet the structure itself marks a departure from the usual Bitcoin-first treasury model.

Consequently, DOGE now features in an active corporate treasury playbook. That development extends mainstream touchpoints beyond ETFs and wallets, placing DOGE inside board-level capital allocation decisions.

Development track: no new core release this week

On the engineering side, Dogecoin Core shows no new tagged release this week. The most recent version remains v1.14.9 from December 2024, which delivered bug fixes and upstream cleanups. Developers have not posted a fresh release candidate or mandatory upgrade today.

Therefore, node operators and service providers face no immediate maintenance window tied to a new Core drop. The quiet repo cadence contrasts with a busy corporate and product cycle around payments and ETFs. This split keeps operational risk low while business headlines drive attention.

In sum, Dogecoin’s “m-today” non-price news centers on a public-listing route, a live consumer integration, regulatory queueing for U.S. funds, and an explicit DOGE treasury model—each expanding real-world surface area without requiring a protocol upgrade.

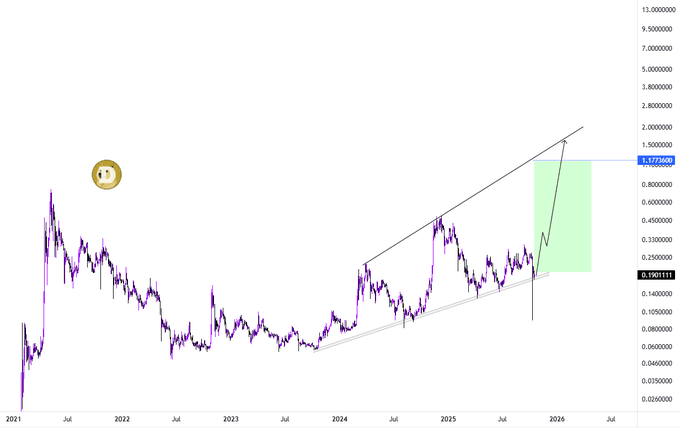

DOGE chart read: rising wedge into $0.80–$1.00 zone, but trendline is the key

First, the chart spans 2021–2026 on a higher-timeframe and plots a rising structure with two converging trendlines—classic rising wedge behavior. Price now sits near the lower wedge support after a series of higher lows since early 2024. The author’s path shows a brief dip to trendline support, then a sharp advance into a green target box roughly $0.35–$0.85 before stretching toward the wedge top near $1.

Next, the structure supports a bullish continuation while the lower trendline holds. Momentum swings inside the wedge have produced symmetrical rallies and retracements, which fits the projection toward the mid-range box first, then the upper boundary. However, volume is not shown; sustained upside usually needs expanding volume and strong closes above prior swing highs around the mid-$0.40s–$0.60s to keep the path intact.

However, rising wedges carry breakdown risk if support fails. A decisive close below the ascending base would invalidate the plotted path and open a move back to prior demand around the high-$0.10s–low-$0.20s. Therefore, the chart’s $1 claim depends on two checkpoints: hold the lower trendline on pullbacks and then clear the mid-range supply inside the green box with strength.

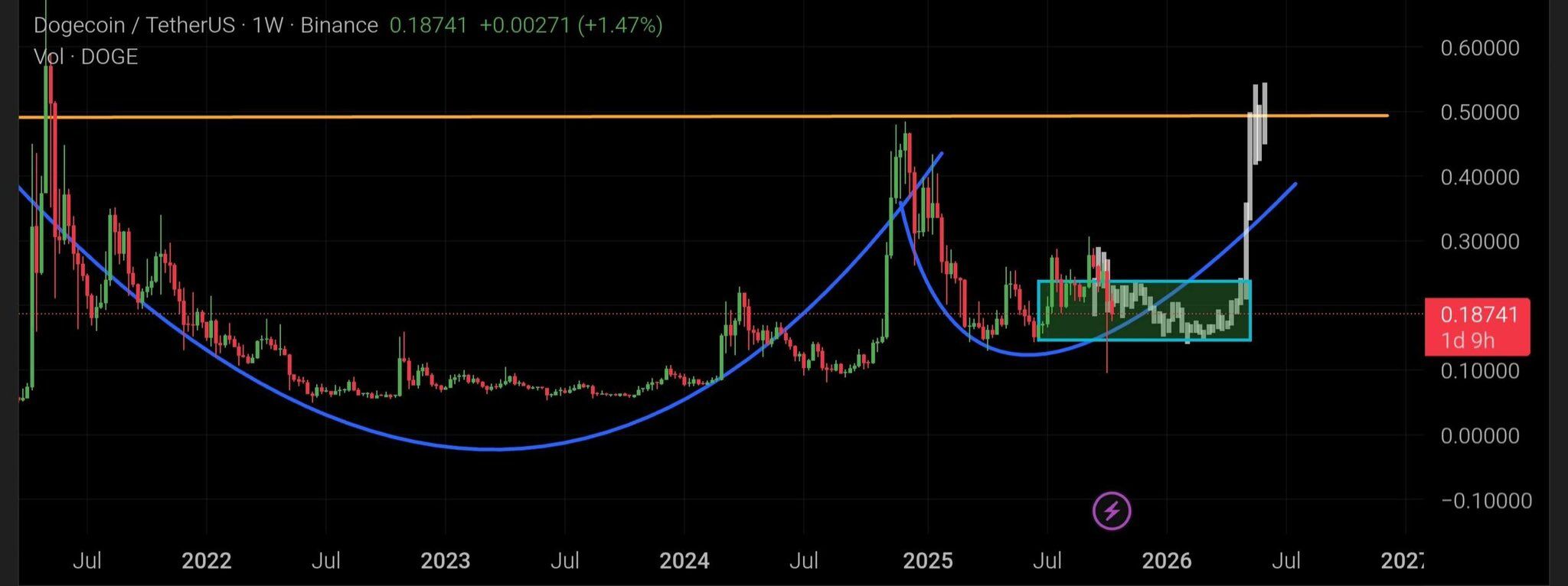

DOGE chart read: cup-and-handle breakout setup toward mid-range resistance

The DOGE/USDT chart shows a classic cup-and-handle structure on the weekly timeframe, with a rounded base from 2022 into 2024, followed by a smaller pullback forming the handle. This pattern signals long-cycle accumulation rather than a short-term spike, and it aligns with historical breakout behavior seen during DOGE’s previous expansion phases. The structure becomes valid only while price holds above the rounded-base trajectory and continues to print higher lows.

Next, the analyst highlights an accumulation box under the handle, suggesting that buyers are absorbing sell-side pressure before any breakout attempt. This zone marks the value area where consolidation replaces volatility. A weekly close above the box would strengthen the bullish case, especially if volume expands at the breakout point. In this scenario, the chart’s projected path toward the $0.50 resistance matches standard cup-and-handle measured-move logic.

However, the pattern loses credibility if DOGE breaks back below the handle support, especially under the highlighted $0.155 level. A failure there would shift momentum back to range-bound behavior and delay any breakout. Therefore, the bullish narrative depends on two checkpoints: holding the accumulation zone and clearing the neckline resistance with conviction.