SEI traded near $0.29 on Sept. 23 after sliding from its Sept. 2025 highs near $0.34. The token’s largest single-day loss in the month came on Sept. 22, as SEI prices fell during the market crash. However, bulls defended the zone near $0.28 and kept the price from deeper losses.

Amid the pressure, analysts stayed bullish. They pointed to fresh accumulation on dips, technical breakout structures, and a new buy signal from TD Sequential at the monthly open.

Analysts Agree On SEI’s Bullishness, But Not on Timeline

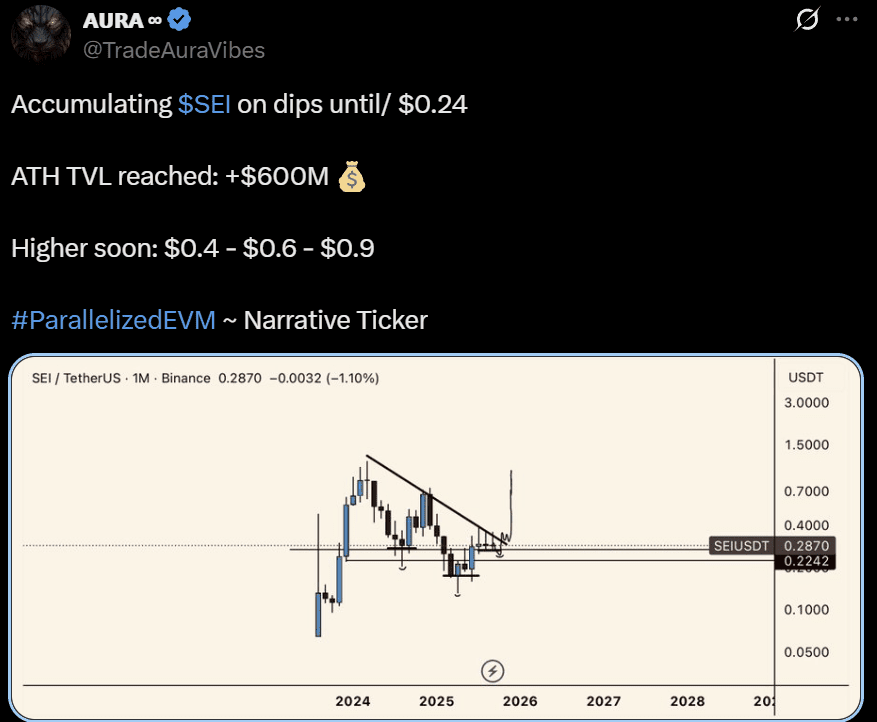

Three fresh calls on SEI set the tone for the week. Independent analyst Aura framed the move as an accumulation story after the latest shakeout.

The analyst favored buys on dips toward the upper $0.20s, citing DeFi TVL above $600 million as support for patience. The stance matched the monthly structure, where repeated defenses of that band kept sellers from building momentum. A clean trendline break on higher timeframes would strengthen the analyst’s case and put higher bands in play.

Some Analysts Foresee a Tighter Timeline

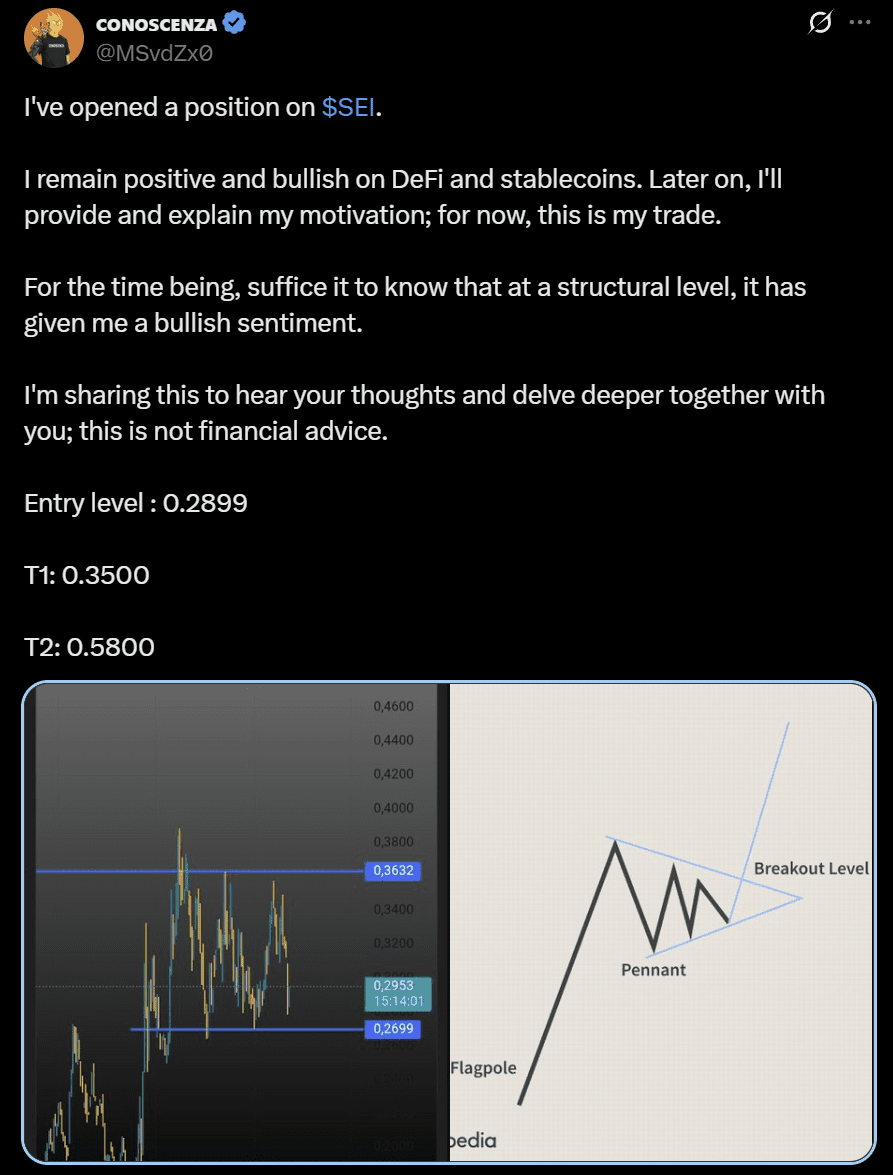

Meanwhile, trader Conoscenza worked a tighter window. He entered near $0.29 and mapped a textbook pennant after summer gains. The pattern called for compression to resolve higher, with staged targets into the mid-$0.30s and then the upper-$0.50s.

The SEI USD pair respected the range through Sept. 2025, with buyers stepping in on tests of the high-$0.20s shelf. The read stayed valid while candles held higher lows, but repeated pushbacks in the mid-$0.30s demanded proof through a strong close above that area.

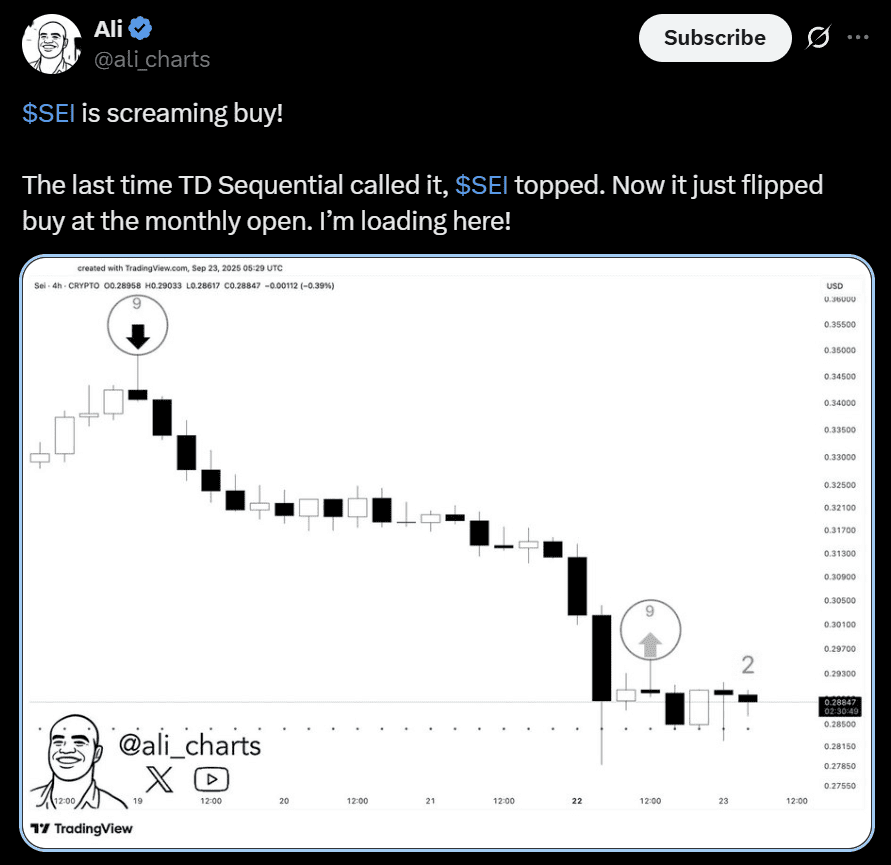

Moreover, analyst Ali zeroed in on momentum. Ali’s TD Sequential flipped buy at the monthly open after a string of heavy red candles. The last prominent signal marked a top, so traders treated this flip as a potential inflection. Such signals worked best after capitulation phases, when SEI sellers looked tired and liquidity thinned. Intraday basing near $0.29 supported that view, though any decisive break below late-September wicks would weaken the impulse.

The three views pointed in the same direction while speaking different clocks. Short-term momentum looked tentative under the fast-moving averages, yet the broader setup improved each time the high-$0.20s held. A push and hold above the mid-$0.30s would shift the tone toward continuation, aligning the pennant path with the longer accumulation thesis.

Stablecoin Rails and DeFi Growth Strengthen Bullish Case

Alongside technical setups, Sei’s fundamentals strengthened in recent months.

Agora confirmed the launch of its $170 million AUSDO stablecoin on the network through LayerZero. The product, backed by the Agora Reserve Fund with support from State Street and VanEck, aimed to introduce an institutional-grade settlement option. Its arrival expanded Sei’s positioning as a platform for financial infrastructure rather than only a trading venue.

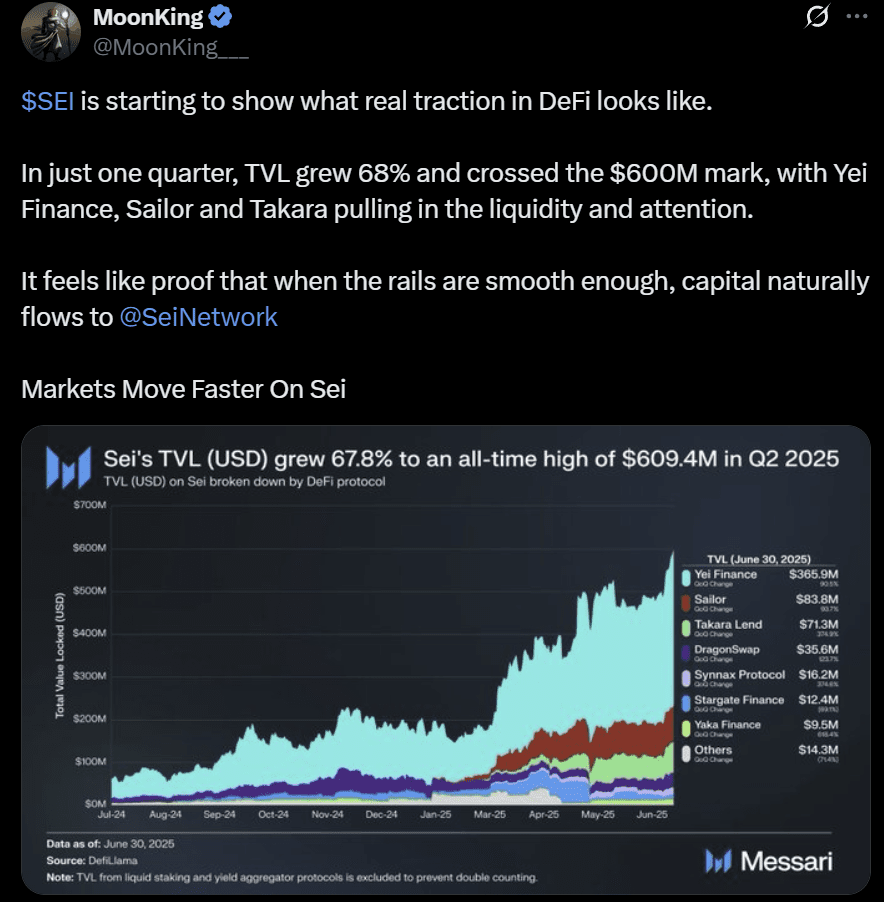

The development came as Sei’s DeFi ecosystem posted record inflows. An analyst shared a post with Messari data that showed total value locked reached $609.4 million in the second quarter, a 67.8% jump over the prior period. Yei Finance accounted for more than half the sum, with over $365 million in assets, while Sailor and Takara added additional liquidity. Smaller protocols such as DragonSwap, Synnax, and Stargate contributed to steady growth across the stack.

The expansion reflected how liquidity clustered once Sei’s execution rails proved consistent. Capital followed depth, reinforcing the perception of Sei as a layer capable of hosting both speculative and institutional-grade products. Analysts tracking accumulation patterns pointed to this growth as justification for holding positions during price pullbacks.

The combination of stablecoin integration and rising protocol activity gave traders confidence that the network’s trajectory aligned with broader demand for scalable settlement layers.