Shiba Inu (SHIB) is currently trading at $0.00001035, down 28.7% year-to-date, while its competitor Dogecoin (DOGE) is up 16%. The contrast shows SHIB’s weaker momentum within the meme-coin sector despite periodic rallies. After closing 2024 near $0.000017, investors now question whether SHIB can recover that level—or exceed it—by the end of 2025.

SHIB Struggles Under Heavy Resistance

Shiba Inu’s market capitalization of $6.09 billion shows how much capital is already priced into the token. At this valuation, even a minor 10% move upward requires hundreds of millions in new inflows, which makes exponential rallies less likely than during its early growth phase.

Its 589 trillion-token circulating supply remains the single biggest constraint on price appreciation. The huge float means that, even if billions of tokens are burned, the effect on per-unit price is minimal. This supply imbalance is why SHIB still trades in fractions of a cent.

The 24-hour trading volume of $152 million underlines shrinking liquidity. Compared with multi-billion-dollar daily volumes in 2021–22, the drop indicates weaker retail participation. Thin liquidity makes rallies fragile because fewer active traders are available to absorb selling pressure.

On the charts, SHIB price sits below a descending resistance near $0.0000129, with moving averages—20-day ($0.00001052), 50-day ($0.00001128), 100-day ($0.00001194), and 200-day ($0.00001293)—clustered overhead.

This compression often signals a market waiting for a catalyst. The Relative Strength Index (RSI 14) around 45 suggests neutrality leaning bearish, while the $0.0000090–$0.0000095 zone continues to provide structural support.

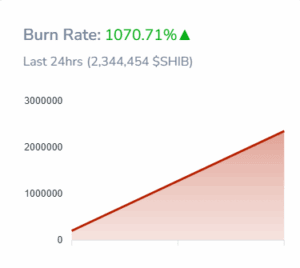

SHIB Burn Rate Surges, But Has Limited Price Impact

According to Shibburn, SHIB’s daily burn rate jumped 1,070%, removing roughly 2.34 million tokens in 24 hours.

While this spike looks impressive, it matters less in economic terms because the burn represents an infinitesimal share of the 589 trillion-token supply. This demonstrates that short-term burn events attract attention but don’t alter long-term scarcity.

For burns to materially influence valuation, sustained multi-billion-token reductions would be needed each week. Without that scale, SHIB price remains governed by market demand rather than supply compression.

Additionally, on-chain data reveal contrasting behavior between large and small holders. Wallets with 100 million–1 billion SHIB have been accumulating since June, suggesting continued retail confidence. In contrast, wallets holding 100 billion–1 trillion SHIB are distributing, indicating that larger players are taking profits or reallocating capital.

This divergence matters because it keeps SHIB in a state of equilibrium: retail buying cushions price declines, while whale selling caps rallies. Historically, such patterns precede extended consolidation phases rather than explosive trends.

Network growth has also cooled. Santiment data show new daily addresses falling from about 2,100 in July to roughly 1,000 in October, a 50% decline. Fewer new addresses mean less transactional demand and slower network velocity, both of which limit speculative activity on the blockchain.

Shibarium’s Weak Fundamentals Weigh on Sentiment

Shibarium, SHIB’s Layer-2 network, currently holds a total value locked (TVL) of $876 K, down from nearly $6 M in January 2025—an 85% decline.

As TVL represents developer and user confidence: a shrinking TVL implies fewer projects building or deploying liquidity on the network. As a result, the ecosystem’s on-chain utility has eroded, weakening SHIB’s fundamental narrative as a DeFi-capable meme coin. Until TVL stabilizes or new applications attract capital, Shibarium’s underperformance will likely keep institutional interest limited.

Shiba Inu’s Technical Scenarios for 2025

SHIB’s price chart data outline three key trajectories:

-

Bear case: Rejection around $0.0000113 could send SHIB back to $0.0000090, retesting long-term support.

-

Base case: Sideways consolidation between $0.000010 and $0.000013 as liquidity stays muted.

-

Bull case: A decisive breakout above $0.000013 could open room toward $0.000017–$0.000020 (≈ 70% upside).

A more extended rally to $0.00004 would require two simultaneous conditions: a sector-wide altcoin expansion and sustained multi-billion-token weekly burns—neither visible yet.