On Nov. 11, the U.S. Securities and Exchange Commission (SEC) is expected to decide on the proposed spot ETF for Hedera (HBAR). If approved, it would become the first U.S.-listed ETF directly tracking a token outside Bitcoin (BTC) and Ethereum (ETH). The decision could open institutional floodgates for HBAR — but how high can the token go, realistically?

How the HBAR ETF Came to Be

Canary Capital LLC, a U.S. digital-asset fund, filed a Form S-1 registration with the SEC in late 2024. The document proposed creating a Hedera Hashgraph Trust, designed to hold real HBAR tokens and issue shares reflecting their market value. The goal was simple: give traditional investors an easy, regulated way to gain exposure to HBAR without owning crypto directly.

In March 2025, Nasdaq joined the process, submitting a Form 19b-4 to list the shares on its exchange under the ticker “HBR.” That filing officially kicked off the SEC’s 240-day review period. By June 10, 2025, the agency published a notice acknowledging the application but postponed its decision, citing the need for “further analysis.” Another delay followed on September 9, setting the final deadline for Nov. 11.

Behind the scenes, Coinbase Custody Trust Company was selected to safeguard the underlying HBAR tokens — the same custodian used for approved Bitcoin ETFs. Meanwhile, Grayscale Investments registered parallel trusts for HBAR, Litecoin (LTC), and Bitcoin Cash (BCH), signaling that altcoin ETFs were finally entering serious regulatory review.

Approval Could Be a Turning Point

HBAR’s network design gives it a strong case for institutional adoption. Hedera Hashgraph uses a Directed Acyclic Graph (DAG) consensus system — faster and more energy-efficient than traditional blockchains. The governing council includes Google, IBM, LG, Boeing, Dell, and Standard Bank, which adds enterprise credibility rarely seen in crypto.

For large investors, these factors matter. A spot ETF would let hedge funds, pension managers, and corporate treasuries gain exposure through regulated brokers rather than crypto exchanges. This bridge between traditional finance and Web3 could sharply expand liquidity.

Historically, spot ETF approvals have been pivotal:

-

Bitcoin ETFs, approved in January 2024, pulled in over $12 billion in their first month, helping BTC rally more than 60%.

-

Ethereum ETFs, approved in May 2024, attracted nearly $9 billion by Q3 2025 and pushed ETH’s price up 30%.

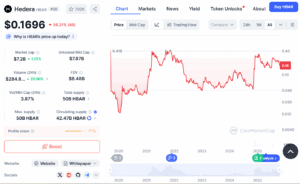

Given HBAR’s smaller market capitalization — around $7 billion at $0.17 — even a fraction of those inflows could have an outsized impact.

Speculation around the ETF has already affected HBAR’s price. In August 2025, reports linking BlackRock to a potential HBAR ETF filing triggered a 5 % intraday spike. In September, after the SEC’s delay announcement, HBAR briefly dropped 4 %, only to recover as traders priced in a likely approval.

How High Could HBAR Go?

Analysts are optimistic and their estimates depend on the scale of institutional inflows and network adoption.

If the ETF draws even modest inflows — similar to smaller Bitcoin funds — HBAR could reach $0.40 to $0.50, a ~190 % rise from current levels.

ETF approval alone doesn’t guarantee a price surge. After the Bitcoin ETF launch, BTC briefly corrected 12 % before resuming its uptrend. Ethereum also saw sideways trading for weeks post-approval. HBAR price could face a similar “sell-the-news” dip before longer-term effects appear.

Other risks include:

-

Token Unlocks: Hedera still has about 8 billion HBAR to release, which could create selling pressure.

-

Market Volatility: A U.S. rate-cut delay or global risk-off sentiment can stall crypto rallies.

-

Regulatory Delays: Even a minor SEC procedural extension beyond Nov. 11 could trigger temporary outflows.