Crypto ATMs seem to be simple and convenient to use, which is exactly why they’ve become a powerful tool for scammers. For many people, these machines feel familiar—like a normal cash ATM—but they operate very differently from banks, exchanges, or payment apps.

Understanding how crypto ATM scams work is important because the harm often happens fast, quietly, and without obvious warning signs. This guide breaks down what these scams are, why they’re so effective, how victims are guided step-by-step through the scam, and what can realistically be done to reduce the risk.

What Are Crypto ATM Scams?

A crypto ATM scam is a type of fraud where scammers trick people into sending cryptocurrency through a physical machine that looks similar to a regular cash ATM. These machines are officially called Convertible Virtual Currency (CVC) kiosks, and the most common version is a Bitcoin ATM. Unlike crypto exchanges or mobile wallets, these kiosks are designed mainly for cash-to-crypto conversions, where you put in cash and the machine sends cryptocurrency directly to a wallet address.

That simplicity is what creates the problem: You have no account, no support agent, and no built-in safety checks like you’d find on an exchange. Once the transaction is sent, it goes straight to the blockchain. Scammers exploit this by convincing victims to use the kiosk for urgent “payments,” knowing the funds move fast and are extremely hard to recover.

Why Scammers Love Crypto ATMs

Scammers are drawn to crypto ATMs because they combine speed and simplicity, and have very few safeguards. The biggest appeal is transaction irreversibility—once a crypto transaction is sent, it cannot be canceled or reversed like a bank transfer or card payment.

Crypto ATMs also operate on a permissionless blockchain, which means anyone can receive funds without approval from a bank or central authority. Victims are usually told to send money to a crypto wallet, which is simply a digital address used to store and receive cryptocurrency. In scams, this is often a third-party wallet transfer, meaning the wallet belongs entirely to the scammer, not to any company or institution.

Because there is no identity check of the recipient and no customer support that can stop the transaction midway, crypto ATMs create a fast, one-way payment path that scammers know is very hard for victims to undo.

Stay Safe in the Crypto World

Learn how to spot scams and protect your crypto with our free checklist.

The Scale of the Problem: Losses, Victims, and Trends

Reports from consumer protection and law enforcement agencies show that crypto ATM scams are not rare or isolated—they’re a growing problem. The Federal Trade Commission tracks fraud complaints nationwide and has warned that crypto ATMs have become a major payment tool for scammers. In its analysis, FTC Data Spotlight “Bitcoin ATMs: A payment portal for scammers,” highlights how losses linked to these machines have risen in recent years.

Law enforcement is seeing the same trend. The Federal Bureau of Investigation collects victim reports through the Internet Crime Complaint Center, and its IC3 Cryptocurrency Fraud Report in 2023 shows that crypto-related scams cost victims billions overall, with crypto ATM cases standing out for their speed and severity.

Older adults are especially affected by these scams, which is why the National Elder Fraud Hotline regularly reports cases where retirees and seniors lose their life savings after being sent to a crypto ATM. Together, these reports paint a clear picture: losses are rising, victims are often vulnerable, and scammers are increasingly focused on crypto ATMs as an effective tool.

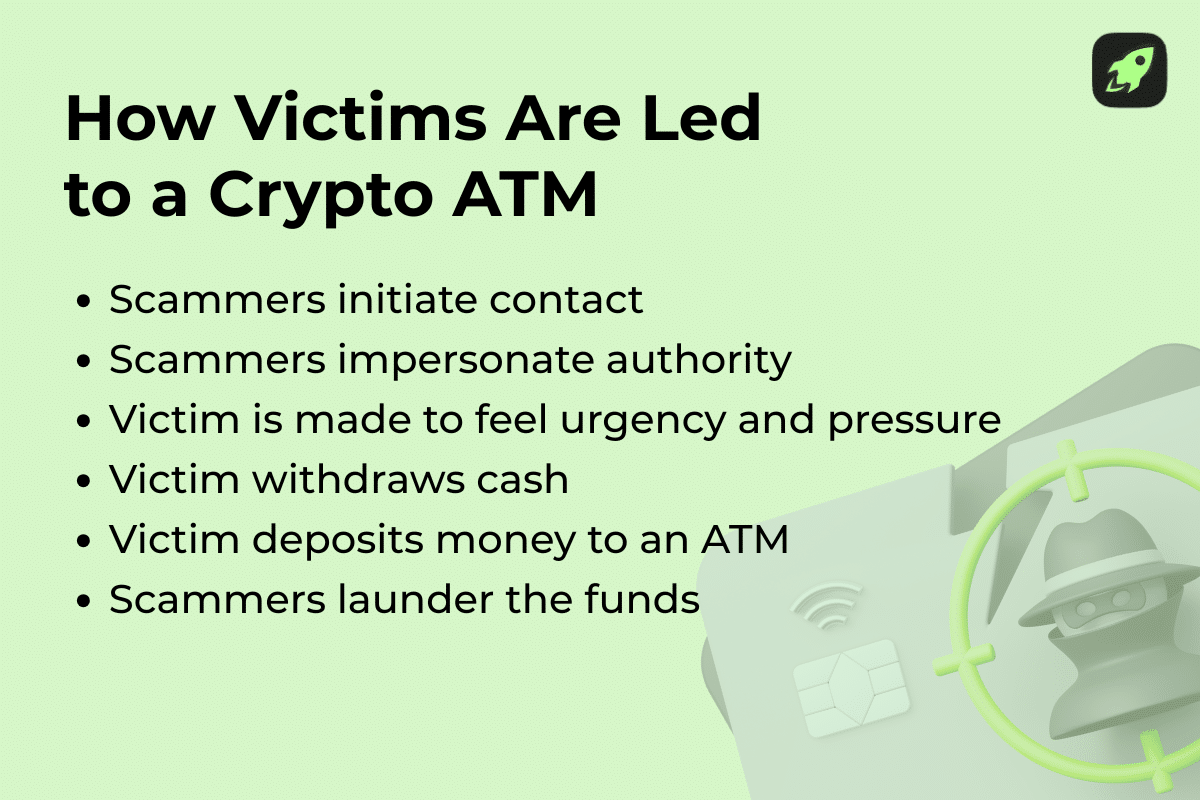

How a Crypto ATM Scam Works (Step by Step)

Like most scams, ATM scams follow a specific structure aimed at lowering the victim’s guard and disorienting them enough to part with their money.

- Step 1: The hook (text, call, pop-up, email)

Most crypto ATM scams begin with social engineering. Someone manipulates emotions to influence decisions. The goal is to gain attention and trust before introducing urgency. - Step 2: Impersonation + urgency (bank, government, or tech support)

Once contact is established, the scammer escalates pressure by posing as an authority figure. Scammers may impersonate government representatives (fake police officers or tax agents), a bank employee, or tech support warning about malware. Urgency is key here: threats, deadlines, or warnings are used to stop the victim from thinking clearly or seeking others’ advice. - Step 3: Cash withdrawal and isolation tactics

Next, the victim is instructed to withdraw cash and prepare for a scam payment. Scammers often insist the victim has to stay on the phone and not speak to bank staff or family. They direct the victim to a nearby CVC exchange, framing it as a safe or necessary payment channel. This isolation prevents last-minute warnings that could stop the scam. - Step 4: The kiosk (QR code or wallet address)

At the machine, the scammer provides exact instructions. Most often they ask to scan a QR code or enter a wallet address. Victims are told this address belongs to a company or authority, but in reality, it’s controlled by the scammer. - Step 5: Funds disappear (laundering and why recovery is rare)

Once the transaction is complete, the money is quickly moved. Scammers might launder the money by breaking it into smaller transfers or routing funds through a money mule—someone paid to move the money onward. In larger cases, these scams can be performed by a transnational criminal organization (TCO) operating across borders. Because crypto transactions are fast and final, recovery is extremely rare once this stage is reached.

The Most Common Crypto ATM Scam Scripts

There are several common scam scenarios that follow a predictable pattern. While the stories differ, the structure and pressure tactics are largely the same.

- Bank “fraud department” / account compromise

Scammers pose as bank security teams and claim there is suspicious activity on the victim’s account. The victim is told funds are at risk and must be “secured” immediately, often by sending money through a crypto ATM. - Tech support pop-ups and remote access permissions

Fake alerts warn of malware or hacking. Once contact is made, the scammer pressures the victim to grant remote access and demands payment to “fix” the issue. - Government / police / “warrant” threats

The scammer impersonates a government agency or law enforcement officer, claiming unpaid fines, taxes, or an active warrant. Urgent payment is demanded to avoid arrest or legal trouble. - Family emergency / “bail” scams

Victims are told a relative has been arrested, injured, or is in immediate danger. Emotional stress is used to push for fast payments without verification. - Investment “account verification” or “tax” demands

Fake investment platforms claim withdrawals are blocked until additional fees or taxes are paid. Victims are instructed to use a crypto ATM to complete these payments quickly.

How to Spot a Crypto ATM Scam Instantly

You can spot a possible ATM scam if you know the most common warning signs. If you notice any of the points below, it’s a strong signal that something is wrong.

- “Pay with crypto to fix or protect your account”

Legitimate banks, companies, and government agencies never ask for payments through crypto ATMs. Crypto transactions are irreversible and scammers rely on this finality to quickly lock in your losses—and their gains. - “Don’t tell anyone” and “stay on the line”

Scammers try to isolate victims so no one can interrupt the process. If you are told not to speak to family, bank staff, or store employees, it’s a major red flag. - Being directed to a specific machine or location

If someone tells you exactly which crypto ATM to use and urges you to go there immediately, that’s a sign of a scripted scam. Real organizations do not control where or how you make payments. - QR codes sent by a stranger

Scammers often send a QR code to speed things up. When you scan the code, it automatically fills in a payment destination, leaving little time to review or question where the money is going. - Demands for repeated transactions or multiple kiosks

Being told to make several payments, split amounts, or visit more than one machine usually means funds are being sent to a third-party wallet controlled by the scammer. This behavior is never normal for legitimate payments.

If even one of these signs appears, it’s safest to stop, walk away from the machine, and seek advice before taking any action.

Where These ATMs Are and How Scammers Route Victims to Them

Crypto ATMs are placed in everyday locations, which makes them easy to find and easy for scammers to exploit.

- Typical placement (retail stores, gas stations)

Most Bitcoin ATMs and CVC kiosks are placed in high-traffic places like stores, malls, and gas stations. These locations feel familiar and safe, which lowers suspicion and makes the transaction feel routine. - “Nearest machine” tactics and maps

Scammers often guide victims to the closest machine using online maps or directions. They may even walk the victim through the route step by step. Public tools like Coin ATM Radar, which legitimately list nearby crypto ATMs, are sometimes misused to quickly identify machines that are easy to reach. - Why a convenient location increases scam success

Convenience plays a major role in scam success. When a machine is nearby, victims are less likely to pause, rethink, or seek advice. The faster someone reaches the kiosk, the more likely they are to complete the payment before doubts set in. Scammers understand this and design their instructions to minimize distance, time, and opportunities for interruption.

Real-World Case Patterns (What Victims Say Happened)

Real victims’ stories show how quickly a seemingly normal interaction can turn into a loss at a crypto ATM.

In one widely reported case, 85-year-old Fran Bates from Texas was convinced over the phone that her bank account was at risk, and over the next two days she was guided to a gas station Bitcoin ATM kiosk where she fed more than $23,000 in cash into the machine—money that was never recovered. In her interview about the incident, Bates recalls her own feelings: “You think if you had to listen to it, you would wonder, ‘What’s going on with that woman? Doesn’t she realize what they’re doing to her?’ No, you don’t.”

Similarly, in New Jersey, 80-year-old Marlene Betesh received a fake alert about “suspicious activity,” was instructed to withdraw cash and deposit it at a nearby crypto kiosk, and lost $9,500 almost instantly. In her interview on The Perfect Scam podcast, she recalls: “They said that I accepted a sale from Russia the morning before. He goes, ‘Marlene, you have to go to the bank and take out your money before Russia empties your bank account.’ ”

In communities across the US, seniors have repeatedly been targeted—local reports describe repeated phone calls telling people their accounts have been compromised and urging immediate payments via crypto machines before authorities or family could intervene. What these cases have in common is a persuasive “hook,” pressure to act fast, and funds disappearing into untraceable digital wallets once the cash is converted at the ATM.

What Crypto ATM Operators, Banks, and Retail Hosts Can Do

Preventing crypto ATM scams is possible when operators and on-site partners add smart friction and stay alert to warning signs.

- Friction that works (cool-downs, prompts, clearer receipts)

Small pauses can stop big losses. Time delays, on-screen warnings, and plain-language prompts that explain risks give people a moment to reconsider. Clear receipts that show fees and destinations also help. Repeated reminders of transaction fees and commission charges can prompt users to slow down, so making costs obvious reduces rushed decisions. - Monitoring red flags (structuring, repeat wallet addresses)

Operators can watch for structuring—if you’re breaking a large amount into multiple smaller deposits or sending funds repeatedly to the same wallet. These behaviors are uncommon for normal use and may indicate a scam in progress. - Training frontline staff (cashier interventions)

Store employees are often the last line of defense. Basic training helps cashiers recognize panic, scripted phone calls, or repeated cash withdrawals. When kiosks are run by a noncompliant kiosk operator, or one that lacks safeguards, staff awareness is even more important. A simple question or suggestion to pause can interrupt a scam before money is lost.

Regulation and Policy: What’s Changing (and What’s Not)

Crypto ATMs are not unregulated, but the rules around them are often misunderstood.

- In the United States, operators are subject to the Bank Secrecy Act (BSA), a federal law that requires financial services to help prevent crime.

- To comply, legitimate operators must run an AML/CFT Program, which is a set of controls designed to detect money laundering and terrorist financing.

- Most crypto ATM companies are classified as a money services business (MSB), meaning they must complete MSB Registration (FinCEN) and follow reporting rules. These include basic Customer Identification Verification (KYC), especially for larger transaction amounts.

- When suspicious behavior appears, operators are expected to file a Suspicious Activity Report (SAR), sometimes using specific identifiers like the SAR Key Term “FIN-2025-CVCKIOSK” to flag crypto kiosk activity.

- Large cash transactions may also trigger a Currency Transaction Report (CTR). What’s changing is enforcement and guidance—such as FinCEN Notice FIN-2025-NTC1, which clarifies expectations for kiosk operators.

The basic reality, however, is not changing: rules exist, but they don’t stop scams at the moment of payment, which is why prevention and awareness still matter most.

Final Words

Crypto ATM scams succeed not because people are careless, but because the system is designed for speed and simplicity rather than protection. Scammers take advantage of urgency, confusion, and the final nature of crypto transactions to push victims into decisions they would never make under normal conditions. Regulation and monitoring are improving, but they cannot replace awareness at the moment of payment. Knowing the patterns, recognizing the warning signs, and understanding how these machines differ from banks or exchanges remain the most reliable defenses.

When it comes to crypto ATMs, slowing down and asking questions can make the difference between a routine transaction and an irreversible loss.

FAQ

Can you reverse a Bitcoin ATM transaction?

No. Once a Bitcoin ATM transaction is sent, it cannot be reversed or canceled. Crypto transactions are final by design, unlike bank or card payments.

How do I get my money back from a crypto ATM scam?

In most cases, you can’t. Recovery is very rare because the funds move quickly and cannot be returned. You should report the scam immediately to law enforcement and consumer protection agencies.

Are Bitcoin ATMs regulated?

Yes, but oversight is limited. In the US, operators must follow anti-money laundering rules and register as money services businesses, but these rules do not stop scams at the moment of payment.

What would a legit company/government agency never ask you to do?

They will never ask you to pay fines, taxes, fees, or account protection costs using a crypto ATM, QR code, or cryptocurrency.

How can stores prevent scams at ATMs on-site?

Stores can train staff to recognize distress, post clear scam warnings near machines, and encourage customers to pause or ask questions before completing transactions.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.