Intersect’s committee candidate window closes today, marking the end of the Oct. 1–24 registration period. The organization flagged this deadline in last week’s development report and said seating updates will follow through official channels. The process pushes Cardano further into member-elected governance.

The same report introduced a 2026 Budget Process to guide funding across workstreams. It also logged the first Delivery Assurance milestone report, giving contributors a clearer view of progress tracking. These items sit alongside the election timeline and frame what the next governance year will fund.

Moreover, September’s board election results set the backdrop for today’s cutoff. Intersect said a majority of its board is now directly elected, and that change set expectations for more community-driven oversight as committees form. Today’s close moves the calendar from registration to campaigning and seating.

Mithril decentralization work steps up

Mithril’s weekly note shows steady progress on “phase one” decentralization of configuration parameters. The team also enhanced the client library and CLI and exposed incremental database snapshots by epoch. In parallel, design work continued on certificate “snarkification.”

These updates matter because they improve how nodes bootstrap and verify data. Incremental snapshots reduce the amount of state a new participant must fetch, while decentralizing parameters reduces reliance on a single coordinator. Together, they tighten resilience without touching ADA price.

Additionally, last week’s post recorded integration of the Haskell DMQ node in end-to-end tests. The signer now initializes uniquely each epoch, which aligns with the broader push to harden protocol flow. The workstreams indicate a focus on tooling that operators can adopt quickly.

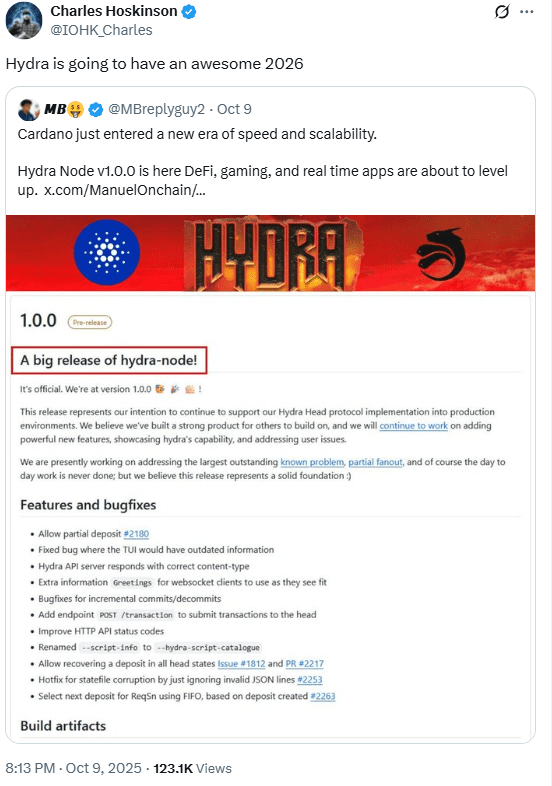

Hydra 1.0 reaches production

Cardano’s community channels confirmed Hydra node v1.0.0 earlier this month. The release positions Hydra as a production-ready layer-2 path for throughput and latency gains. Developer communications frame it as an app-level tool for DeFi, gaming, and real-time use cases.

Community and media coverage since Oct. 9 have continued to spotlight the milestone. Posts describe 1.0.0 as the point where builders can move from experiments to pilots that touch users. That tone reflects a shift from research to deployment.

Furthermore, key voices amplified the message across social channels during the month. Those posts emphasize that the mainnet path now exists for teams that choose Hydra’s off-chain heads model. The signal to developers is clear: test, then ship.

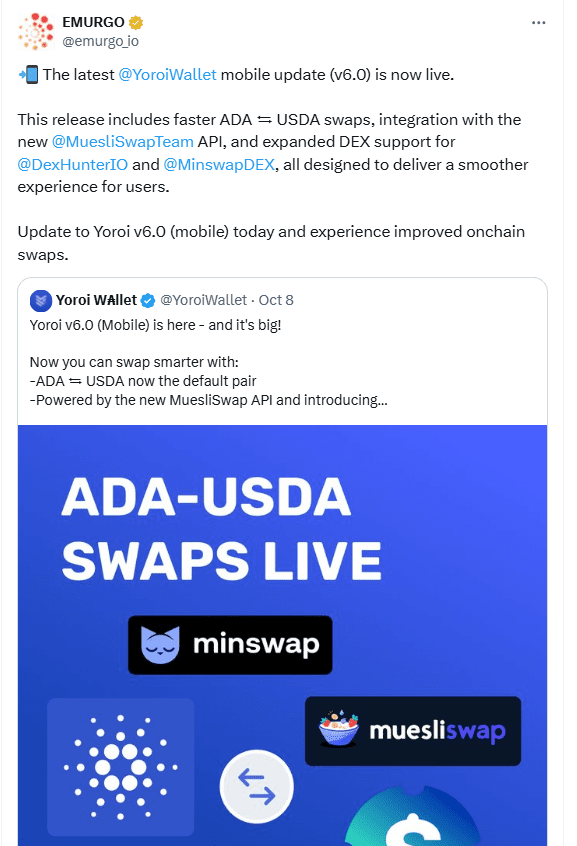

Yoroi v6.0 adds DEX access inside the wallet

EMURGO announced Yoroi mobile v6.0 with integrations for DexHunter and Minswap. The change lets users route swaps from within Yoroi rather than jumping between apps. Cardano’s weekly report on Oct. 10 listed the release among the month’s ecosystem items.

This addition targets convenience and reduces friction for common actions. Wallet-level aggregation tends to boost usage of on-chain liquidity without altering protocol rules. As a result, the upgrade fits squarely in “non-price” utility growth.

The timing also aligns with the network’s Asia-focused outreach in October, which highlighted developer and user on-ramps. Packaging swaps into a mainstream wallet meets that theme: more features where users already are.

Node diversity work publishes its Toulouse report

A full write-up of September’s Node Diversity Workshop #2 in Toulouse went live this month. The recap details participants across independent teams and foundations and captures agenda threads for alternative node implementations. It gives operators a reference for follow-up discussion.

This effort aims to broaden the set of production-capable Cardano nodes beyond the primary implementation. More choice improves resilience and reduces the risk of single-client issues. The report now anchors forum conversations for implementers.

Community channels also circulated a video summary for those who could not attend. That media trail helps new contributors catch up quickly and plug into the right sub-threads. In turn, it supports the wider goal of a multi-node ecosystem.

Inverse head-and-shoulders pattern appears

An inverse head-and-shoulders pattern has formed on the ADA/USD one-hour chart, signaling a potential bullish reversal. The setup shows a clear left shoulder, head, and right shoulder, with price now testing the neckline near the 0.64–0.65 zone. Buyers are attempting to push above this level, which is the key resistance that could confirm the pattern.

Volume has increased during the right-shoulder move, which strengthens the bullish case. At the same time, ADA is trading above the short-term EMA, showing improving momentum after a multi-day decline. If price closes decisively above the neckline, the pattern’s measured move could target higher levels in the short term.

Meanwhile, RSI is climbing from oversold territory and continues to trend upward. This momentum shift supports the breakout attempt. However, if bulls fail to hold the neckline, the pattern may invalidate and return ADA to the 0.62 support area. For now, momentum favors buyers as long as the price stays above the emerging trend line.

ADA repeats a basing range, eyes a breakout

The daily ADA/USD chart shows ADA carving a second boxed accumulation range, similar to the earlier base at the left of the chart. Price is compressing between roughly $0.62 and $0.65 while holding higher lows inside the grey rectangle. This structure signals absorption of supply after a decline and sets a clear decision zone at the range high.

Now, buyers are pressing toward the upper band near $0.65. A daily close above that ceiling would confirm range breakout and shift momentum in favor of continuation. With that confirmation, prior swing highs on the right become the next reference levels, and dips back to the former range top would likely act as support.

However, the setup still needs validation. If Cardano fails to reclaim and hold above the box, the pattern risks another rotation to the lower edge around $0.62. Therefore, watch two lines: $0.65 for confirmation and $0.62 for invalidation. Until a decisive close breaks the stalemate, the chart remains a constructive base with a bullish lean.