Just 4 days after President Donald Trump’s 100% tariff threat on Chinese tech exports triggered over $19 billion in crypto liquidations, the U.S. government transferred 667.6 BTC, worth about $74.8 million, to a new wallet. So, is another sell off coming? Let’s analyse.

U.S. Moves 667 BTC After Recent Market Crash

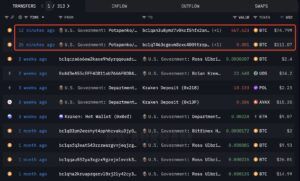

On-chain data from Arkham Intelligence showed that on Oct. 14, a U.S. government–tagged wallet moved 667.6 BTC to a new address. The wallet label was assigned by blockchain analytics firms that track wallets connected to prior government seizures or enforcement actions.

The funds were not sent to any known exchange, suggesting the transfer was internal — possibly for custody, accounting, or security purposes.

This came shortly after one of the most volatile weekends of 2025. Between Oct. 10 and 11, the crypto market experienced over $19 billion in leveraged liquidations, according to CoinGlass. The event followed Trump’s sudden announcement of 100% tariffs on Chinese tech exports. This sent risk assets lower across global markets.

Bitcoin dropped to $104,000, its lowest level in two months. Major altcoins like Ethereum (ETH) and Solana (SOL) fell by more than 15%.

Government Holdings Exceed 197,000 Token

According to Arkham Intelligence, the U.S. government holds around 197,000 BTC, valued at over $22 billion at current prices. The 667-BTC transfer represents less than 0.4% of that total. This is a small portion that is unlikely to affect market liquidity on its own.

There is no official statement from the Department of Justice or Treasury regarding the purpose of the Oct. 14 transfer.

However, analysts tracking these wallets note that the movement resembles previous internal government transactions rather than liquidation events.

In March 2025, for example, government-controlled addresses moved 19,800 BTC (worth nearly $1.9 billion at the time) to Coinbase Prime as part of a custodial reorganization. Those coins were not sold immediately and remained in storage, indicating that large movements are not always linked to active selling.

In March 2025, the White House established the U.S. Strategic Bitcoin Reserve, allowing seized Bitcoin to be classified as long-term holdings instead of liquidation assets. Under this framework, only Bitcoin approved for auction or disposal is transferred to exchange-linked wallets.

That policy provides an institutional explanation for why some large transfers, such as Monday’s 667 BTC, may occur without any immediate sale. So far, no subsequent transfers have been recorded from the new government wallet, and no exchange deposits have been identified.

Bitcoin Faces Resistance Near $116K

At press time, BTC changed hands around $112,450, down 2.4% on the day. The daily chart shows prices hovering below short-term exponential moving averages — the 20-day EMA ($116,514) and 50-day EMA ($115,557) — indicating weakening short-term momentum.

The 200-day EMA remains lower, around $108,056, and represents the next major technical floor if selling pressure extends.

The Relative Strength Index (RSI) has eased to 43, slipping below the neutral 50 mark, suggesting momentum favors sellers in the short term but remains within the broader uptrend channel.

If Bitcoin price sustains above the $108,000–$110,000 support range, the overall bullish structure remains intact.

A decisive breakdown below that area could open the path toward $100,000, while a rebound above $116,000 may restore the previous upward momentum.