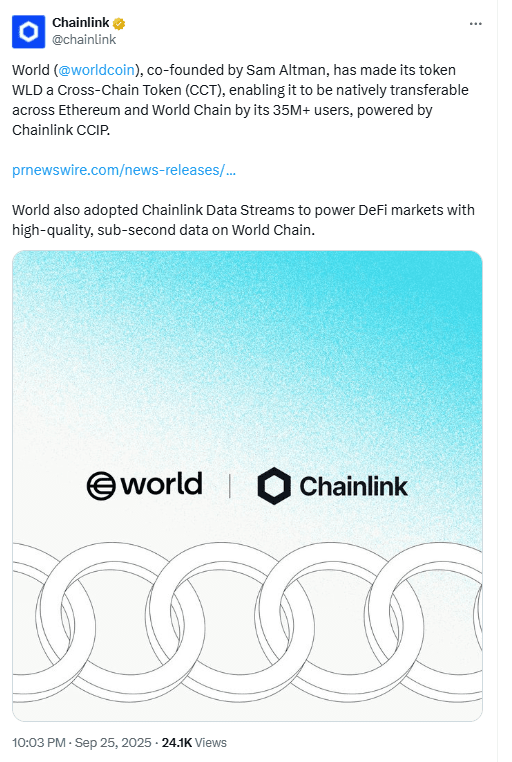

World Chain switched on Chainlink’s cross-chain rails today. Canton, an institutional blockchain, also elevated Chainlink to “Super Validator.” Together, they expand Chainlink’s reach across consumer and regulated networks within two days.

World Chain adds CCIP and CCT for WLD

World Chain adopted Chainlink’s Cross-Chain Interoperability Protocol and the Cross-Chain Token standard for Worldcoin’s WLD. The launch enables native transfers between World Chain and Ethereum while standardizing how tokens move across chains. Chainlink said Data Streams also went live to supply market data.

The CCT standard matters because teams can convert existing ERC-20 tokens into cross-chain native assets under CCIP’s security model. That approach reduces bespoke bridge work and operational risk for developers who want a single, audited pattern for movement across networks. It also streamlines user flows between an L2 and Ethereum.

World Chain and Chainlink amplified the update on social channels, calling out WLD’s status as a CCT-enabled asset. The posts framed today’s cutover as production, not a pilot, and positioned Data Streams alongside CCIP in the same stack.

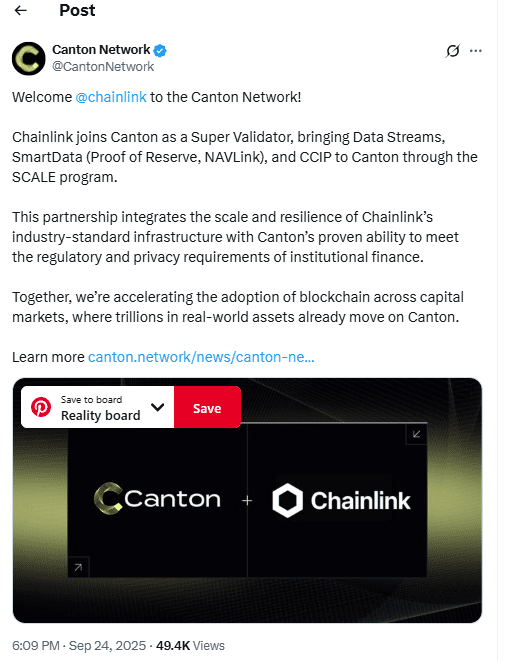

Canton names Chainlink a Super Validator

Canton Network entered a strategic partnership with Chainlink and integrated Data Streams, “SmartData” services such as Proof of Reserve and NAVLink, and CCIP. The network also joined Chainlink’s SCALE program, which offsets oracle costs during early growth. The goal targets tokenization and settlement in regulated settings.

Under the deal, Chainlink Labs becomes a Super Validator that participates in Canton’s Global Synchronizer, which orders cross-domain transactions. That role sits close to the network’s core time-ordering and finality layer and supports multi-application workflows across permissioned domains. Canton and Chainlink highlighted these responsibilities in coordinated posts.

Trade and market infrastructure outlets presented the tie-up as a way to speed pilots for banks and asset managers on privacy-preserving rails. With SCALE covering part of data-service costs, institutions can test feeds, cross-chain messaging, and reserve attestations without heavy initial overhead.

Proof of Reserve goes live for ETP collateral

Deutsche Börse Group’s Crypto Finance switched on Chainlink Proof of Reserve for nxtAssets’ physically backed Bitcoin and Ethereum ETPs. Reserve data, orchestrated by the Chainlink Runtime Environment, is published on Arbitrum for public verification. The firms described this as a live deployment enabling independent checks of backing versus liabilities.

Industry coverage underscored that the model writes attestations on-chain and exposes them for investors, auditors, and counterparties. Arbitrum’s post amplified that reserves become viewable via Chainlink’s Proof of Reserve pages, improving auditability for listed products. The focus remains on transparency rather than secondary-market trading.

Additional summaries noted the collaboration details—issuer nxtAssets, custodian Crypto Finance, and Chainlink oracles—and placed the rollout within a broader move to standardize attestations for tokenized instruments. The update adds a capital-markets use case alongside consumer and enterprise-chain news this week.

Why it matters now

Today’s World Chain launch puts CCT to work in a large user environment and turns WLD into a natively transferable cross-chain token. It packages CCIP and Data Streams in the same deployment, which can reduce fragmentation for apps that need both token movement and market data.

Yesterday’s Canton deal embeds Chainlink inside a permissioned network that targets regulated finance. The Super Validator role and SCALE economics aim to lower barriers for pilots that require standardized data, cross-domain messaging, and auditable reserves.

Meanwhile, Proof of Reserve for Crypto Finance and nxtAssets brings on-chain verification to traditional wrappers. With reserve data published to Arbitrum, the move extends Chainlink’s footprint from consumer L2s to institution-facing infrastructure and listed ETPs—without touching token price.

Analyst flags weekly triangle breakout path for LINK

Crypto analyst Ali said a pullback toward $16 on Chainlink would be “a gift,” arguing that LINK remains in a large weekly triangle that now points to a breakout scenario. In his post, he mapped a measured move that projects toward $100 if momentum carries beyond the pattern’s apex.

His chart tracks the Binance LINK-USDT perpetual on a weekly timeframe, with converging trendlines from 2022 forming the triangle. He plotted a dotted path that advances after a clean break above the upper boundary, with interim reference zones around the 0.786 and 1.0 Fibonacci levels before the 1.272 extension near $100.

The setup implies two technical checkpoints: holding the rising trendline that intersects near $16 and then closing above the descending resistance near the low-$20s. The illustration frames $16 as potential support within the structure and shows upside milestones that align with prior reaction areas on the weekly chart.

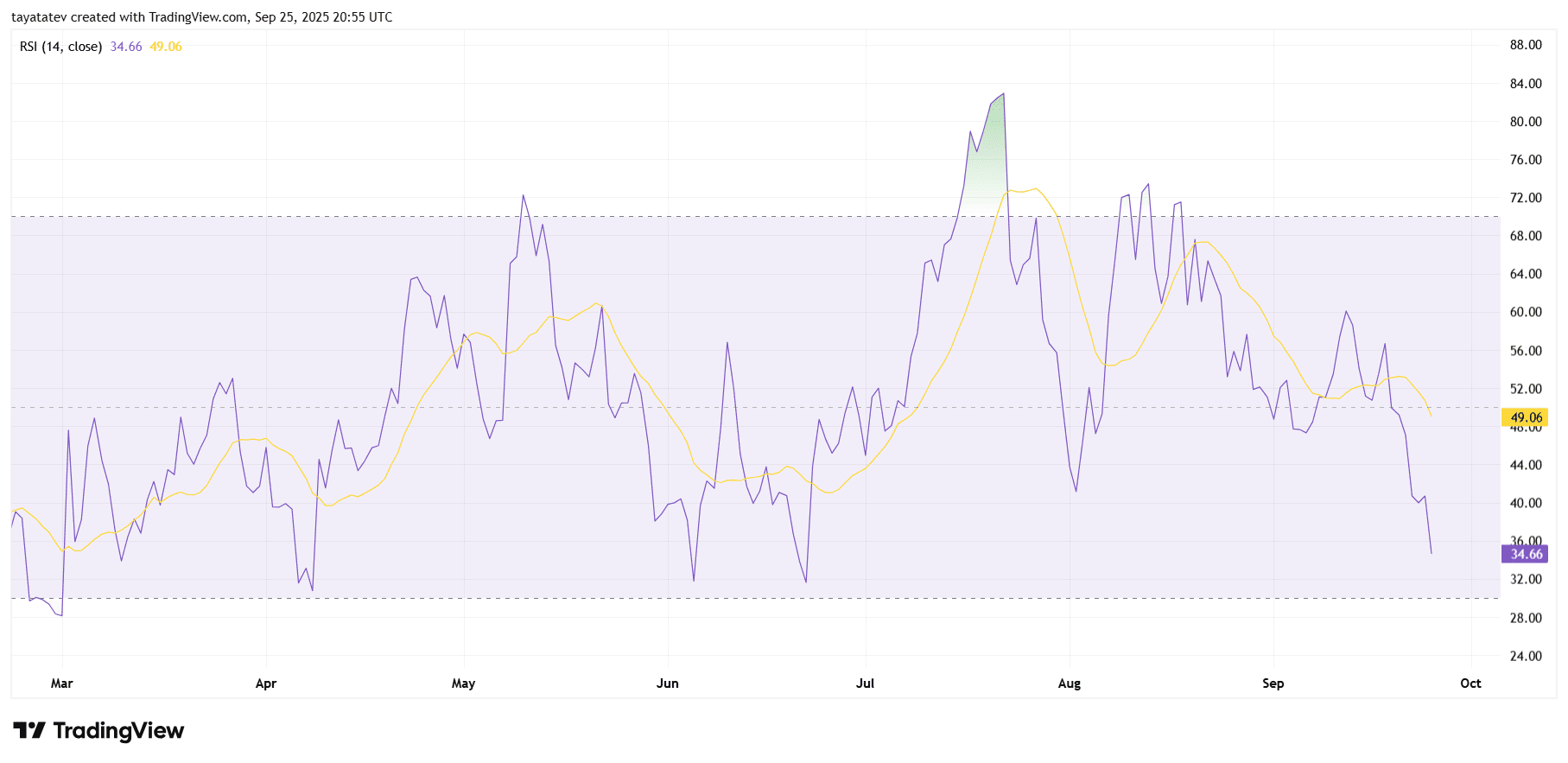

LINK daily RSI shows weakening momentum, nearing oversold

The 14-day RSI sits near 34.7, below its signal average around 49.1, which confirms bearish momentum on the daily timeframe. The RSI fell under its signal in early September and has widened the gap since, indicating persistent downside pressure.

Earlier in August, RSI briefly pushed above 70 and then rolled over, marking a shift from overbought to a steady downswing. Since then, momentum made lower highs while price action cooled, reinforcing a momentum downtrend rather than a single shock move.

With RSI approaching the 30 threshold, conditions are moving toward potential exhaustion, though confirmation would require a stabilization or a turn back above the signal line. Until that happens, the setup favors continued caution on momentum while watching for any basing behavior near the low-30s band.