Tom Lee said Ethereum could surpass Bitcoin’s market capitalization in the future. He made the comment during an interview with ARK Invest CEO Cathie Wood on Thursday. He framed the idea as a “working theory,” not a forecast.

At present, Bitcoin’s market cap stands near $2.17 trillion. Meanwhile, Ethereum’s market cap is about $476.33 billion. Therefore, Bitcoin is roughly 4.6 times larger than Ethereum.

Lee oversees an Ethereum accumulation strategy at BitMine. He said he remains a Bitcoin bull. Yet, he argued that structural shifts could favor Ethereum over time.

A 1971 Parallel: How Wall Street Flipped Gold

Lee pointed to the 1971 “Nixon Shock” as a historical guide. When the United States ended the gold standard, the dollar became fully fiat. That move changed how markets priced and traded value.

He said Wall Street then created products that helped the dollar win. Over time, equity markets swelled. According to his example, equities reached about $40 trillion in market value versus gold’s $2 trillion.

Moreover, Lee cited the dollar’s rising dominance after that period. He referenced gains in central-bank reserves and transaction share. In his view, financial plumbing and products shifted the balance.

Tokenization as the Catalyst for Ethereum

Lee argued that tokenization could play the role that Wall Street once played for the dollar. He said “everything becoming… tokenized” is Ethereum’s opportunity. In his view, demand could flow into on-chain assets and rails.

He pointed first to stablecoins as dollars on the blockchain. As he sees it, that process already moves traditional money onto crypto networks. Then, he extended the idea to stocks and real estate.

According to Lee, thesetokenized assets could live and settle on Ethereum. If that shift scales, he said Ethereum could gain the kind of dominance the dollar achieved in the fiat era. He presented this as a pathway, not a guarantee.

The Flippening Debate: Years of Claims and Pushback

The “flippening” has circulated in crypto for years. Supporters say Ethereum’s utility and settlement layers can outgrow Bitcoin’s lead. Detractors say Bitcoin’s monetary role will remain larger.

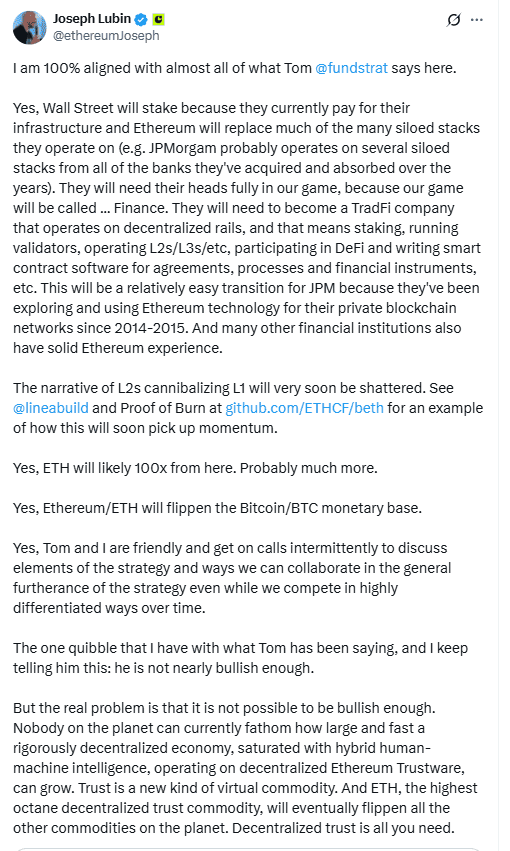

In August, ConsenSys founder Joseph Lubin said Ethereum could “surge by 100 times” and flip Bitcoin as a “monetary base.” His view placed Ethereum at the center of a new settlement stack. It emphasized scale rather than short-term moves.

However, Bitcoin advocates push back. In the same period, Jan3 founder Samson Mow said capital would rotate back into Bitcoin once ETH prices rose enough. His argument focused on Bitcoin’s monetary clarity and longer track record.

Market Context: Size, Performance, and Narrative

Today, the size gap remains wide. Bitcoin’s market value is still multiple times larger than Ethereum’s. That difference anchors the current standings, even as narratives evolve.

Over the past 30 days, Ethereum fell 13.31%, according to CoinMarketCap. The recent slide does not change the long-term debate, but it frames current momentum. It also underscores how market prices can diverge from structural theses.

Even so, the discussion focuses on rails and usage. Pro-Ethereum voices highlight smart contracts and tokenization. Pro-Bitcoin voices highlight monetary properties and security. The argument continues across cycles.

Product Infrastructure: From Gold to Dollars, from Dollars to Chains

Lee’s analogy tied outcomes to infrastructure. After 1971, financial products and markets boosted dollar usage. As he told Wood, those channels multiplied demand for dollar-based assets.

He applied the same logic to blockchains. If capital markets move to tokenized formats, settlement layers could capture value. In that case, a chain with broad developer tools and on-chain finance could gain share.

Therefore, his thesis centers on plumbing rather than slogans. It weighs what people will use to issue, move, and settle assets. He placed Ethereum squarely in that lane.

Bottom Line: A Theory, Not a Call

Lee reiterated that his view is a “working theory.” He did not withdraw support for Bitcoin. Instead, he described a path where tokenization lifts Ethereum’s role.

The flippening debate continues with new data points. Market caps, product growth, and adoption trends will shape it. For now, the gap remains, and the thesis remains under test.

As more assets touch blockchains, use cases will sharpen. Participants will watch where issuance, liquidity, and settlement concentrate. The answer may decide whether Ethereum can close the distance—or not.

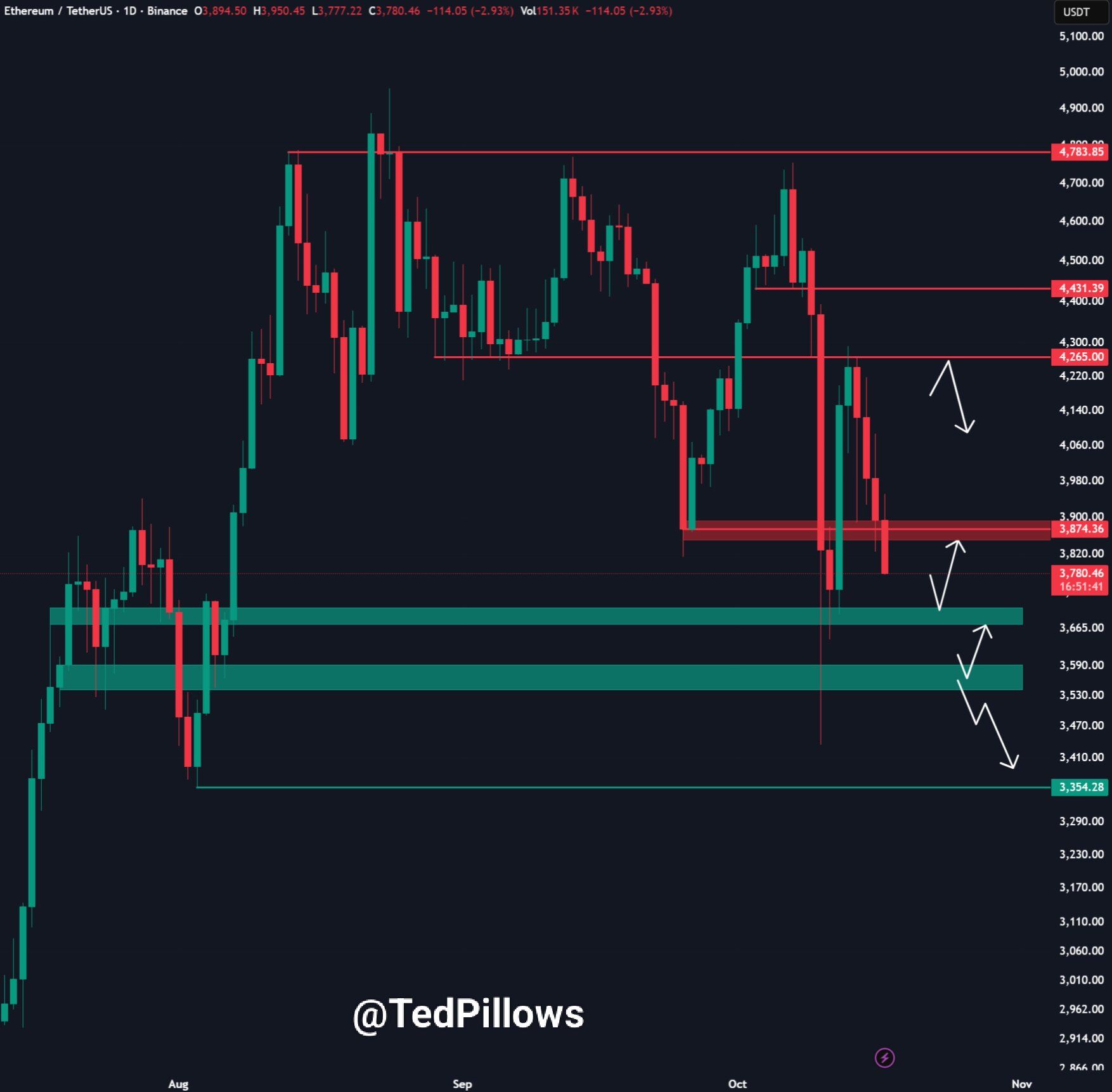

Ethereum fell through the $3,800 support area on the daily ETH/USDT chart, shifting near-term bias to the downside. Analyst @TedPillows flagged $3,600 as the next demand zone likely to be retested, based on recent consolidation and prior buying reactions in that band.

If price stabilizes at $3,600, bulls will look for a swift reclaim of $3,800 to neutralize breakdown risk. However, momentum turns constructive only after a clean move back above $4,000, which capped multiple rebounds in October. Until then, lower supports inside the $3,500–$3,600 range remain in play, as indicated by successive lower highs and failed bounces.

Structure on the chart shows a decisive rejection from the mid-$4,200 area, followed by a break of the $3,800 floor with rising sell volume. Therefore, intraday rallies face resistance first at $3,780–$3,820 and then $3,950–$4,000. A daily close above $4,000 would invalidate the immediate bearish sequence and reopen the path toward $4,200. Conversely, a sustained close below $3,600 exposes $3,520 and $3,450 as subsequent support zones highlighted on the map.

Michaël van de Poppe said Ethereum could start a new upside leg within one to two weeks. He argued that price has retested a prior resistance zone, which now acts as support, and that this structure often precedes continuation. He added a cycle target of $10,000 for ETH, framing the call inside his broader bull-market view.

On his chart, the ETH/BTC pair pulled back into a gray demand box near the prior breakout band. The move coincides with price hovering around the short-term moving average, where buyers defended across several sessions. Therefore, he sees the retest as constructive as long as the zone holds on closing bases.

He noted that confirmation hinges on a clean reclaim of recent swing highs. If momentum returns, he expects higher-highs to follow and for Ethereum to outpace Bitcoin on the ratio. If the retest fails, lower supports from late summer remain in play, which would delay the timeline he outlined.