Almost half of all EIP-7702 authorizations since May 7—about 768,000 of 1.58 million—are tied to phishing or fund theft, according to Wintermute’s analysis published this week. The report reframes a security feature as a ripe target for crime. Developers and wallet teams moved the topic up their queues.

Wintermute’s dataset shows 48% of EIP-7702 activations associate with criminal behavior, placing the tool at the center of a safety debate. The figures cover activity since the feature went live on May 7 and quantify a problem that user anecdotes only hinted at.

EIP-7702 temporarily converts an externally owned account into a smart-contract wallet to authorize actions. Attackers now weaponize that flow by tricking users into malicious authorizations, turning a safer signing path into an abuse vector.

Core contributors flagged mitigations on recent coordination calls, weighing UX guardrails and shadow-fork dry runs to validate fixes before wider rollout. The agenda puts security checks alongside schedule pressure for the next upgrade.

Ethereum client and infra teams set a phased Fusaka timeline across Holešky, Sepolia, and the newer Hoodi testnet, starting late September into October, to stage mainnet readiness. Blog briefings outline the cadence and staging logic that reduces risk between forks.

Several outlets report a December 3, 2025 target for Fusaka on mainnet, pending testnet outcomes and audits, aligning teams on a public date while keeping contingency space. The community continues to treat the date as schedule guidance, not an immutable deadline.

All-Core-Devs Execution notes describe executing a shadow fork before Holešky and again ahead of each subsequent testnet. This narrows unknowns, catches regressions early, and shortens the gap between forks without skipping safety steps.

The same notes revisit whether to keep one or two weeks between Holešky and Sepolia, showing active debate on speed versus assurance. Organizers prefer consistent, clearly communicated windows to help operators and dapps plan. Forkcast’s recording of ACDE #220 documents these decisions in real time, providing a reference for client implementers and tooling teams as they cut release candidates.

Erigon shipped v3.1.0 “Pebble Paws,” with release notes highlighting changes such as default receipt persistence, updated dependencies, and operational tweaks; the team confirmed the series and linked docs publicly. Node runners get a path that works with existing data.

Together, these releases aim to keep the execution layer steady while testnets turn over. Operators gain clearer defaults and fewer edge-case stalls as the network approaches the Fusaka window.

Consensus-side briefings note ongoing work on blob parameters, audit tracks, and bug lists that feed directly into mainnet readiness. With testnet forks scheduled, the emphasis stays on predictable execution rather than feature sprawl.

Meanwhile, stateless-Ethereum work logs show active planning for binary-tree testnets and client sequencing, with Geth’s state-layer rewrite affecting lead timing. These threads connect today’s forks to tomorrow’s state-size relief.

In practice, that means teams ship, measure, and adjust.

As testnets advance and Holešky winds down, Ethereum’s near-term story is operational: stage changes, audit results, and client hygiene over price moves.

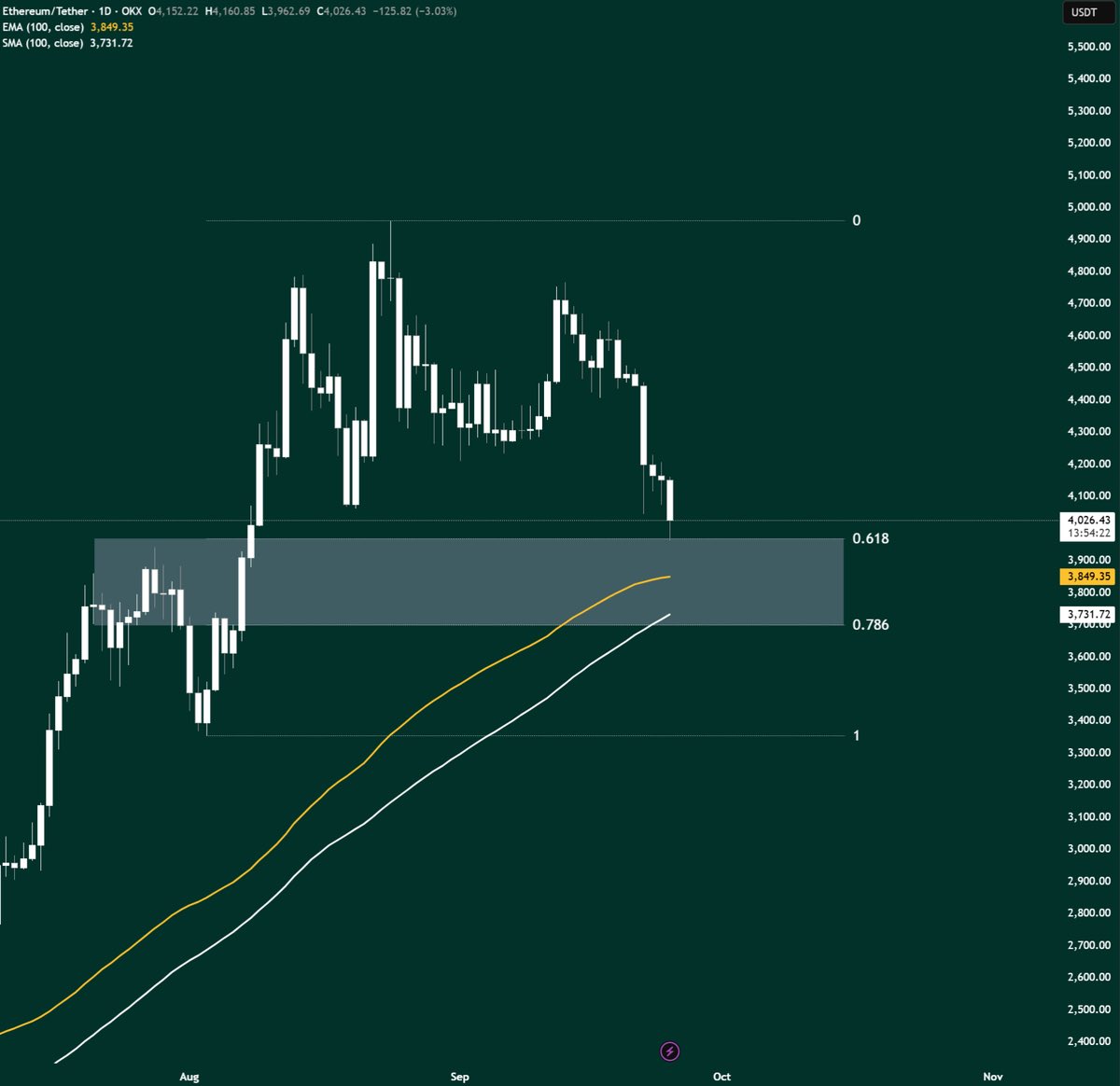

Gordon’s daily ETH/USDT chart marks a gray support box roughly from ~3,900 to ~3,800, aligned with the 0.618 and 0.786 Fibonacci retracement levels of the latest swing. Price currently presses the top of that band after a multi-day pullback from the early-September high. The rectangle also overlaps a prior August consolidation, which often acts as a memory area for bids.

The overlay shows the 100-day EMA (~3,849) curling up into the box, while the 100-day SMA (~3,732) trails just below the 0.786 line. That stacking creates moving-average confluence beneath price, a setup technicians watch for absorption on first tests. Candles print long lower wicks into the zone, signaling dip-buying attempts, though follow-through remains unconfirmed on the daily close.

The post frames this area as a “long-term buying zone” and suggests accumulating here. As news, the claim is notable because it pairs widely watched Fibonacci levels with rising medium-term trend gauges. However, confirmation would typically come from a clean reclaim of the box top or a higher low above the 100-day EMA; a decisive daily close below ~3,730 would weaken the case and shift attention to the next marked shelf near the “1” label on the chart.