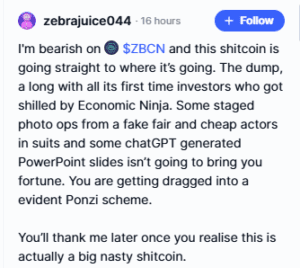

Some traders in crypto community are openly calling Zebec Network (ZBCN) a scam and a shitcoin, citing hype-driven price surges, and flashy presentations with little proof of adoption. One user with username ‘662MudSlanger’ accused it of being a “scam coin” that failed to list on major exchanges. Is ZBCN really just another shitcoin, or does it have substance? Let’s examine.

What Does Zebec Network Claim to Build?

Zebec Network describes itself as a payment infrastructure project designed for real-time settlement. Built originally on Solana and later expanded with its Nautilus chain, Zebec promotes “continuous payroll” — the idea that workers can be paid by the second directly into their wallets. Beyond payroll, the team advertises Zebec Cards, treasury management tools, and crypto-to-fiat bridges.

Its token, ZBCN, replaced the older ZBC through a 1:10 split, with a capped supply of 100 billion tokens. Around 92 billion are already circulating. In theory, ZBCN is used for governance, staking, gas fees, and incentives across the ecosystem.

Failure to get listed on major exchanges is partly true. On the one hand, ZBCN is actively traded on more than 20 platforms including KuCoin, OKX, Gate, Bitget, and HTX. Daily trading volume often reaches tens of millions of dollars, proving that liquidity exists.

On the other hand, ZBCN is missing from the very largest exchanges. Binance displays its price but does not support trading, and Coinbase lists it in its directory but does not allow deposits or withdrawals in most regions. This absence from tier-one exchanges reinforces the narrative that the project struggles for mainstream credibility, even while it thrives on mid-tier platforms.

Token Unlocks Add Continuous Risk

Perhaps the strongest argument fueling the “shitcoin” label is the token unlock schedule. Zebec will release 1.04 billion ZBCN every month starting October 16, 2025, and continuing at least through March 2026. Each unlock equals 1.04% of the maximum supply, worth around $4.25 million at current prices.

By the end of March 2026, more than 6.2 billion tokens — about 6.24% of the total supply — will have been added to circulation. These steady unlocks create recurring dilution. Unless user adoption and demand grow quickly, each monthly release risks pushing prices down.

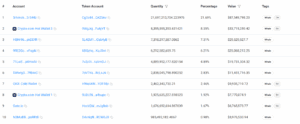

Ownership concentration worsens the concern. Blockchain data shows that the top 10 wallets control nearly 60% of all supply, with the largest single wallet alone holding more than 21%.

While some of these accounts are exchange wallets, several are identified as private whales. Such concentration means a few players can heavily influence the market, fueling fears of insider dominance. When combined with upcoming monthly token unlocks, this centralization poses a real risk of sell pressure, adding weight to the community’s claims that ZBCN behaves like a shitcoin.

Smart Contract Authority Remains With Developers

Another criticism lies in the contract itself. Security scans by Cyberscope show ZBCN’s smart contract on Solana still has an active update authority. In simple terms, this means developers can modify contract functions at any time. Truly decentralized tokens usually revoke this authority to guarantee immutability. Keeping it active raises centralization and trust issues.

Zebec Network also claims to have undergone audits from top firms, but full, detailed audit reports are not easily available to the public. Without open security reviews, investors must take the team’s word that contracts are safe.

Labeling ZBCN as an outright scam may go too far. The project has delivered real products, made acquisitions like Science Card in the UK, and kept its token actively traded. It has not vanished with investor funds, which would definitively define a rug pull.