Pro-XRP Japanese financial giant SBI Holdings has officially announced a $200 million cash investment in Evernorth Holdings Inc.

The funds will go into purchasing XRP on the open market, as Evernorth prepares to launch the world’s largest institutional XRP treasury. Notably, this newly formed U.S. company is backed by Ripple Labs and other strategic investors.

$1.1 Billion to Build the Largest Public XRP Treasury

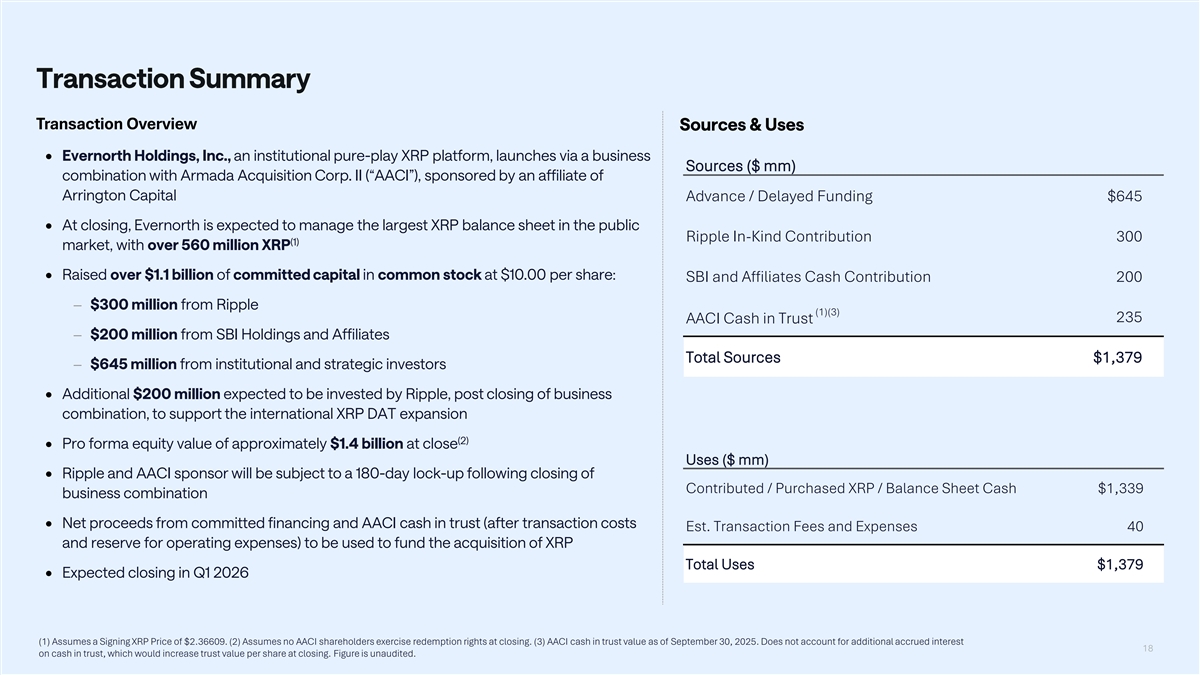

According to official transaction documents, Evernorth’s formation involves a business combination with Armada Acquisition Corp II, backed by Arrington Capital. Upon completion, Evernorth will trade on Nasdaq under the ticker symbol XRPN.

At launch, the company plans to manage over 560M XRP, becoming the largest XRP balance sheet in the public market. Evernorth has secured over $1.1 billion in committed capital, including:

- $300 million from Ripple

- $200 million from SBI Holdings and its affiliates

- $645 million from institutional and strategic investors

Buying XRP Within 10 Days of Closing

Additionally, the firm expects a further $200 million investment from Ripple post-closing to support Evernorth’s global XRP treasury expansion. The companies aim to complete the merger in Q1 2026 and plan to use the net proceeds to purchase XRP on the open market within 10 days of receiving the funds.

Notably, Evernorth aims to drive large-scale institutional adoption of XRP by managing a significant XRP treasury. It will also support the XRP Ledger by running validators, investing in DeFi protocols, and enabling institutional lending backed by XRP.

A major accounting firm will audit Evernorth’s financials to ensure transparency and regulatory compliance.

SBI’s Commitment to XRP Growth

Notably, SBI’s official press release emphasized that the $1 billion in funding will go into primarily buying XRP on the open market. The group highlighted that XRP’s clear regulatory status in the U.S. makes it one of the few digital assets suitable for institutional investors.

SBI Holdings, led by Chairman Yoshitaka Kitao, has long been one of Ripple’s strongest allies. The group co-founded SBI Ripple Asia and has consistently integrated XRP into cross-border payment solutions throughout Asia.

In its latest statement, SBI said the Evernorth investment “aligns with our strategy to build an innovative financial ecosystem centered on digital assets,” reaffirming its commitment to the growth of the XRP Ledger ecosystem.

Ripple, SBI, and the Long-Term XRP Vision

Ripple CEO Brad Garlinghouse, CTO David Schwartz, and Chief Legal Officer Stuart Alderoty will serve as advisors to the project. At the same time, former Ripple executive Asheesh Birla is leading Evernorth as CEO. Ripple Chairman Chris Larsen has also donated 50 million XRP to support the initiative.

Essentially, Ripple’s deep involvement in Evernorth underscores its long-term commitment to XRP and the XRP Ledger.

Crypto commentator Nietzbux described Evernorth as a “pure play to increase the price of XRP,” noting that Ripple is placing trusted former executives in key leadership roles.

He added that while XRP has not surged yet, Evernorth’s sustained XRP purchasing could drive long-term growth.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.