KernelDAO advanced distribution and market access today with a confirmed Upbit spot listing and the launch of its Season 3 airdrop.

Upbit opened a KRW market for KERNEL after publishing a same-day listing notice. The exchange said deposits and withdrawals are supported in line with standard procedures. The move adds a major South Korean venue to KERNEL’s exchange footprint.

Separately, KernelDAO released a blog post announcing that the Season 3 airdrop is live. The post details eligibility, Sybil-resistance measures, and claim steps for participants. Today’s update follows earlier Season 3 materials that outlined allocations and program scope.

Coverage today also highlighted a KernelDAO partnership touchpoint with Chainlink alongside the “Kred” litepaper reveal, positioning a credit-layer component within the project’s roadmap. These items appeared in trade-press summaries of KernelDAO’s latest communications.

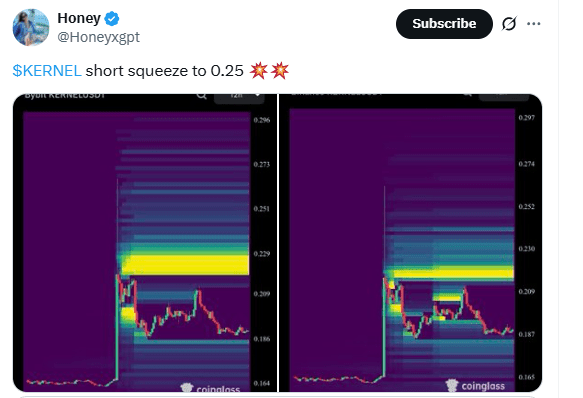

KERNEL Heatmap Signals Short-Squeeze Liquidity Toward $0.25

Trader Honey flagged a potential short squeeze to $0.25 on $KERNEL, sharing order-book heatmaps that highlight dense resting liquidity above current price. The Coinglass snapshots show bright bands around ~$0.23–$0.25, indicating stacked asks and likely liquidation clusters that can accelerate moves once price pushes into that zone.

Price has bounced inside the $0.18–$0.21 area in recent sessions. If buyers reclaim the $0.21–$0.22 shelf, liquidity thins until the next heavy band, which raises the chance of a fast run toward ~$0.25 as shorts get forced to cover. Conversely, a failure to hold the mid-range could send price back to prior support, where liquidity is deeper and moves slow.

This read comes as traders watch heatmap density and liquidation pools rather than headlines, using the concentration of orders to gauge where squeezes can trigger. It remains a market-structure observation, not a guarantee of direction.

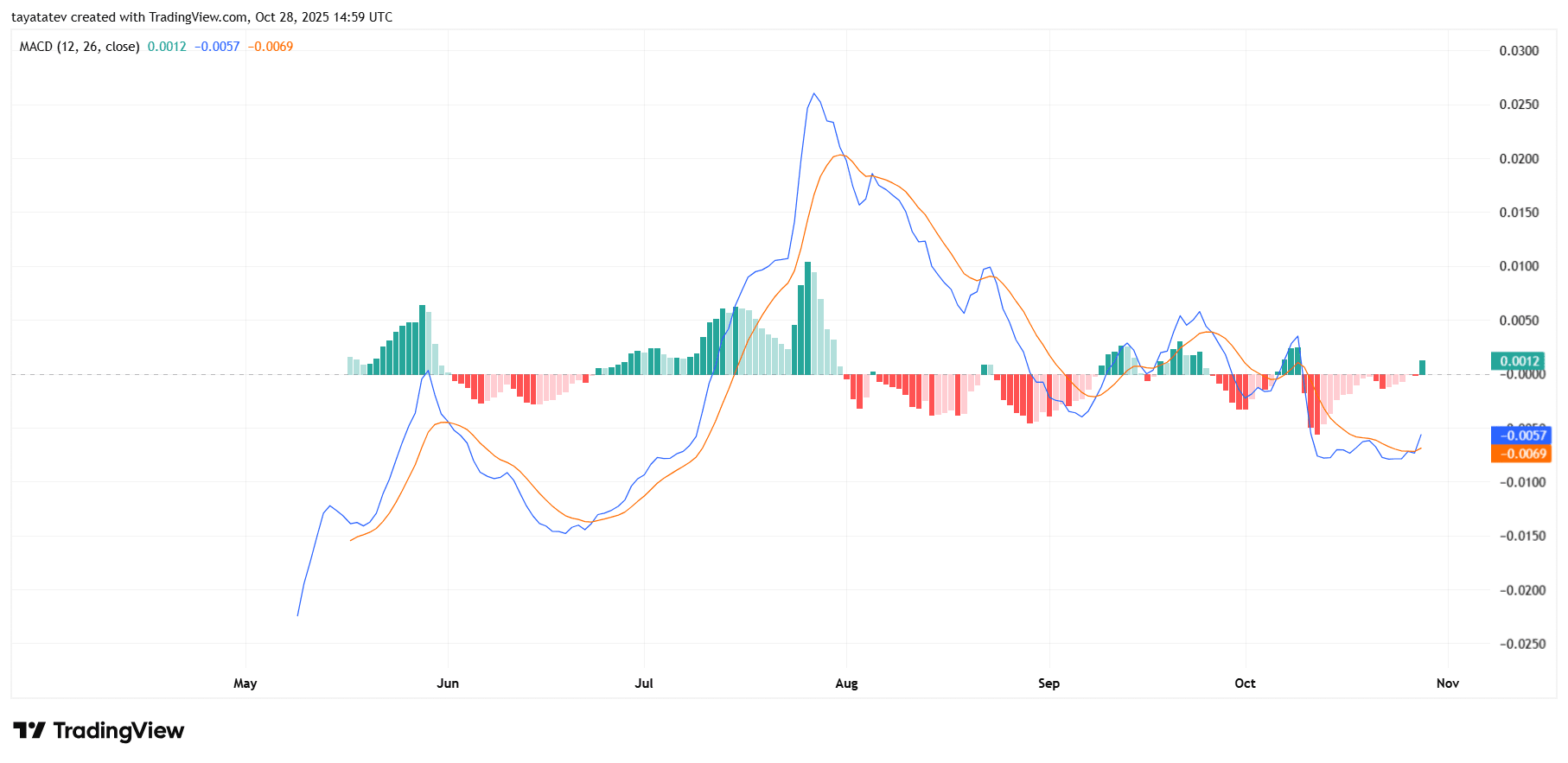

KernelDAO (KERNEL/USDT) daily MACD shows early momentum shift

KernelDAO’s daily MACD just flipped to a small green histogram while the MACD line crossed above the signal line from below zero. This crossover signals improving short-term momentum after weeks of mixed readings.

Earlier in August, MACD peaked strongly, then slipped into a broad negative phase through September and most of October. During that stretch, red histogram bars persisted and both lines trended below zero, reflecting weakening momentum. Now, the histogram has turned positive again and both lines slope upward, indicating buyers are regaining control.

However, the crossover occurred beneath the zero line. In MACD terms, that counts as an early shift rather than a confirmed trend change. A sustained build of green histogram bars and an eventual move of the MACD above zero would strengthen the case for a broader recovery. Conversely, if the lines roll over and the histogram fades back to red, it would imply momentum stalled before reaching the neutral zone.

In short, the indicator shows a fresh bullish tilt, but the zero line remains the next objective to validate a stronger trend.