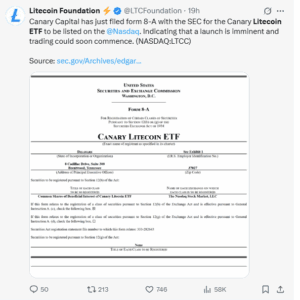

The United States has approved its first Litecoin (LTC) spot exchange-traded fund (ETF), with Canary Capital confirming the launch of the LTCC Fund on Nasdaq today. The listing makes Litecoin the first altcoin to secure a regulated spot ETF in the U.S., even as the federal government remains partially shut down.

A First for Altcoins Under New SEC Framework

Until 2025, only Bitcoin and Ethereum had cleared the regulatory hurdles required for spot ETFs. That changed in September, when the U.S. Securities and Exchange Commission (SEC) approved generic listing standards for commodity-based ETFs.

The rule lets exchanges such as Nasdaq and NYSE Arca approve listings automatically if issuers meet predefined compliance criteria. It removed the need for case-by-case SEC sign-offs that had stalled dozens of crypto products since 2023.

Canary Capital quickly seized that opening. On Oct. 7, it amended its Litecoin and Hedera (HBAR) ETF filings to remove the standard delaying amendment clause. This move triggered automatic activation after 20 days. This allowed the funds to go effective even as the SEC’s operations slowed due to the government shutdown.

You May Also Like: How High Could Hedera (HBAR) Go If a Spot ETF Is Approved?

How the Litecoin ETF Works

The LTCC fund is designed to mirror Litecoin’s market price. It holds physical Litecoin — not derivatives — in cold storage with regulated custodians such as Coinbase Custody Trust Company and BitGo Trust Company.

That makes it a spot ETF, meaning each share represents real exposure to Litecoin’s value. Investors can now buy or sell the ETF through traditional brokerages without directly managing digital wallets or private keys.

The fund charges an annual management fee of 0.95%. This is higher than most Bitcoin ETFs but typical for first-generation crypto funds. Canary said the ETF aims to “provide exposure to the daily price of Litecoin less expenses and liabilities.”

Canary’s filings were accompanied by similar submissions from Bitwise Asset Management and Grayscale Investments, which are preparing spot ETFs for Solana (SOL) and Hedera (HBAR). All are expected to begin trading this week.

Launched in 2011, Litecoin is one of the oldest cryptocurrencies still actively traded and shares much of its technical foundation with Bitcoin. Yet despite its longevity, institutional access to LTC has remained limited compared with Bitcoin or Ethereum.

The ETF launch gives brokerage-account investors and retirement funds a regulated way to gain exposure to Litecoin’s price — potentially broadening demand and liquidity.

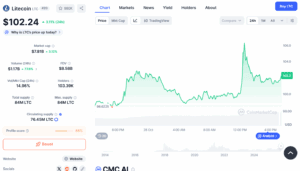

As of this writing, Litecoin’s price rose nearly 7 % in 24 hours to trade around $102 today on Oct. 28.