Litecoin’s day centers on three developments. Grayscale advanced U.S. ETF paperwork for LTC. CoinGate’s fresh data shows Litecoin holding a near 14 percent checkout share. A Litecoin-native wallet with MWEB privacy is slated for a September release.

ETF filings keep Litecoin in the U.S. product queue

Grayscale filed new registration statements that include an S-1 for a Litecoin ETF. The batch also covered Bitcoin Cash and Hedera products under separate forms. These submissions keep LTC in the active roster of crypto ETF proposals awaiting SEC review.

The filing signals issuer intent yet sets no launch date. The SEC controls the timeline for any approval or denial. Issuers continue to refresh applications as the broader 2025 cycle moves through fall calendars.

Coverage across major crypto outlets aligns on the scope and timing. Reports date the filings to Sept. 9 and describe them as part of a wider wave of altcoin ETF bids.

Merchant payments: Litecoin holds a top-three share

CoinGate’s latest post says Litecoin accounts for nearly 14 percent of 2025 year-to-date merchant payments on its platform. The processor lists LTC among its top three checkout coins this year. The update notes low fees and quick confirmations as usage drivers.

Earlier H1 data from CoinGate supports the trend. The mid-year report tracks crypto checkout mixes and shows steady Litecoin usage across categories. It provides the backdrop for the newer near-14 percent reading.

For additional context, BitPay’s Decrypted 2024 report listed Litecoin as its most used coin by transaction count last year. That placement frames LTC’s role in payments going into 2025.

Privacy wallet targets MWEB and network-leak protections

On Sept. 8, the Litecoin Foundation and AmericanFortress announced a Litecoin-native wallet scheduled for release this month. The partners say it integrates MimbleWimble Extension Blocks for confidential amounts. They also highlight c-filters to reduce IP-to-wallet metadata leaks.

The Foundation amplified the announcement on X. The post calls it the American Fortress Litecoin Wallet and describes handling a wide spectrum of network features. It positions the client as purpose-built for Litecoin’s model.

MWEB runs as an opt-in extension block parallel to Litecoin’s base chain. It enables confidential transaction amounts while keeping main-chain compatibility. Official explainers describe the feature as optional privacy with pegging in and out between layers.

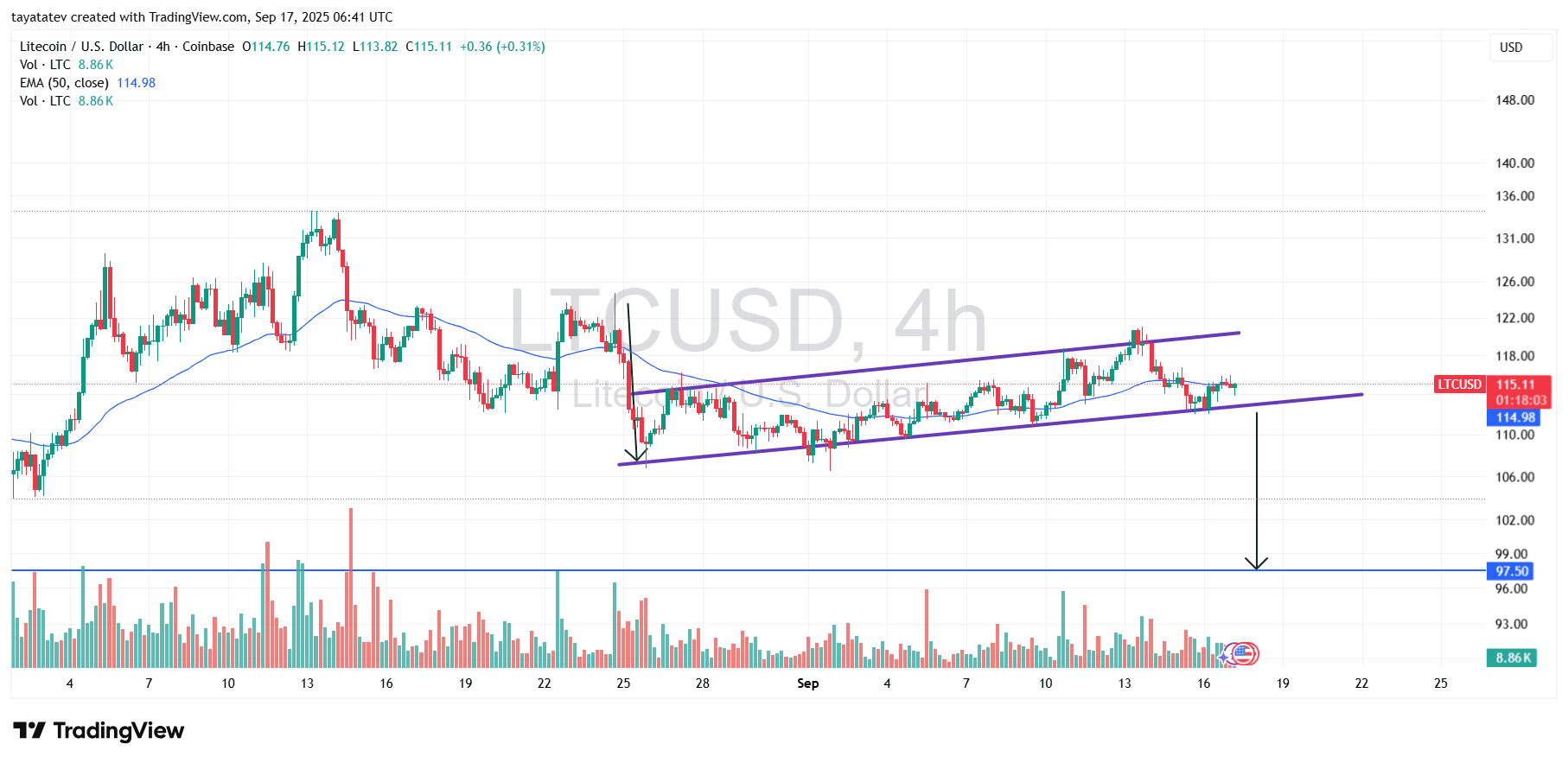

Rising wedge on four hour chart points to a 16 percent drop toward 96.69 dollars if breakdown confirms

Litecoin against the United States dollar LTC/USD has created a rising wedge on the four hour chart. A rising wedge is a narrowing, upward sloping pattern that often exhausts momentum and then breaks lower. The setup developed from late August, and price now trades near the wedge’s lower boundary.

Price sits around 115.11 dollars on the chart and hovers by the fifty period Exponential Moving Average, or EMA, at 114.98 dollars. Therefore, a decisive four hour close below the wedge support and the EMA would confirm the breakdown. Volume has stayed modest through the climb, which fits the textbook profile of a tiring advance inside a wedge.

If the breakdown confirms, the pattern implies room for a 16 percent decline from the current level to about 96.69 dollars. That target aligns with the marked horizontal support near 97.50 dollars on the chart. Thus, sellers would control the move while the wedge remains intact and price trades below the former support after the breach.

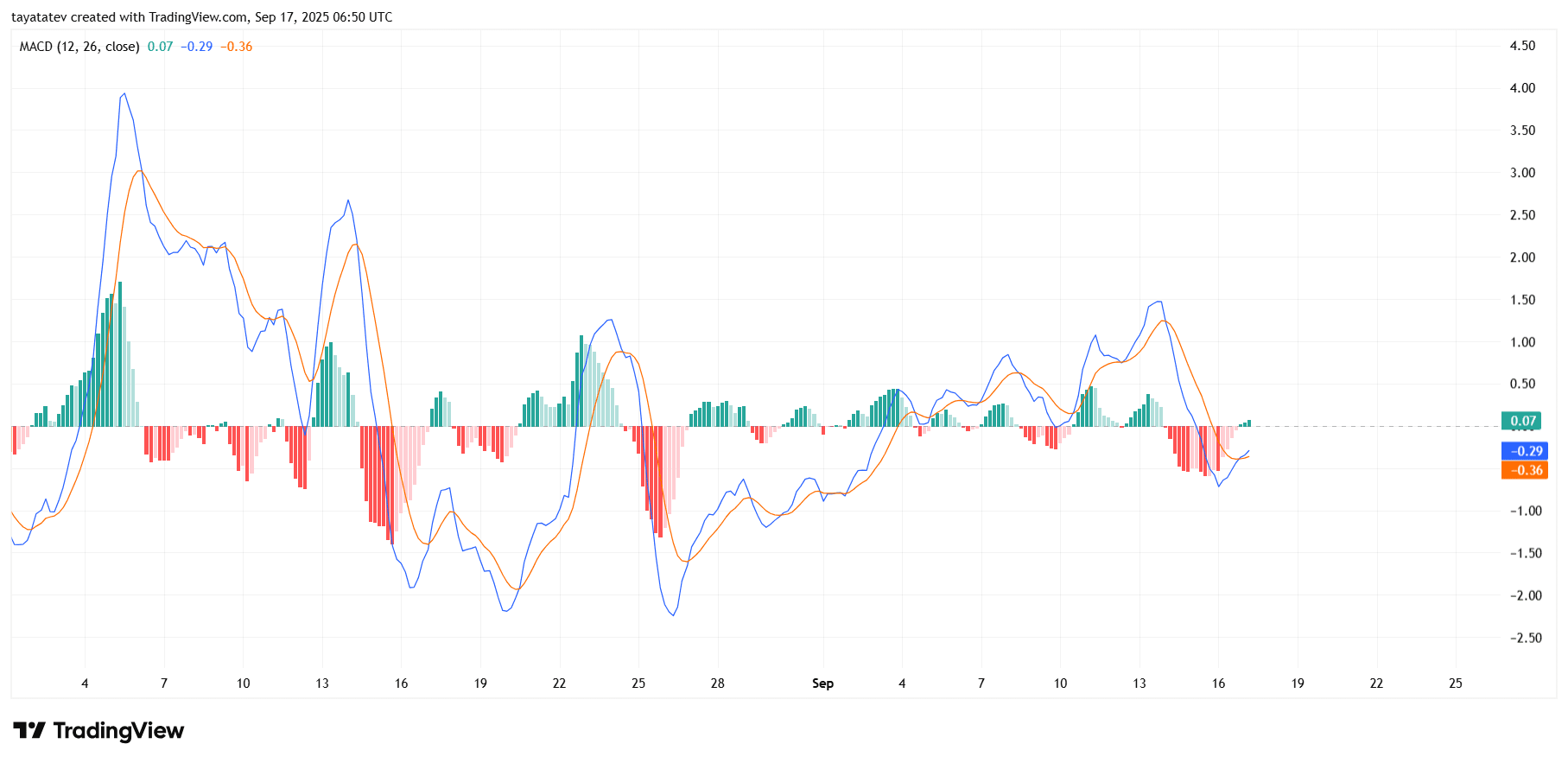

MACD turns up but stays below zero on the four hour chart

Momentum just flipped higher. Litecoin’s Moving Average Convergence Divergence, or MACD, shows the blue line crossing above the signal line from negative territory. The histogram prints slightly positive near 0.07, while the MACD and signal sit around −0.29 and −0.36. This crossover signals an early shift toward bullish momentum after last week’s pullback.

However, trend context remains cautious. Both MACD lines still sit below the zero axis, which usually marks an unfinished downtrend in this timeframe. Therefore, bulls need continued expansion in the histogram and a push of the MACD above zero to show strengthening follow-through rather than a short bounce.

This read aligns with your price structure work. If price confirms a breakdown from the rising wedge, the MACD can roll back under the signal quickly. Yet, if buyers reclaim the upper wedge area and sustain higher highs, the indicator can drive toward the zero line and into positive territory. For now, momentum improves, but the sub-zero setting says the larger trend has more to prove.

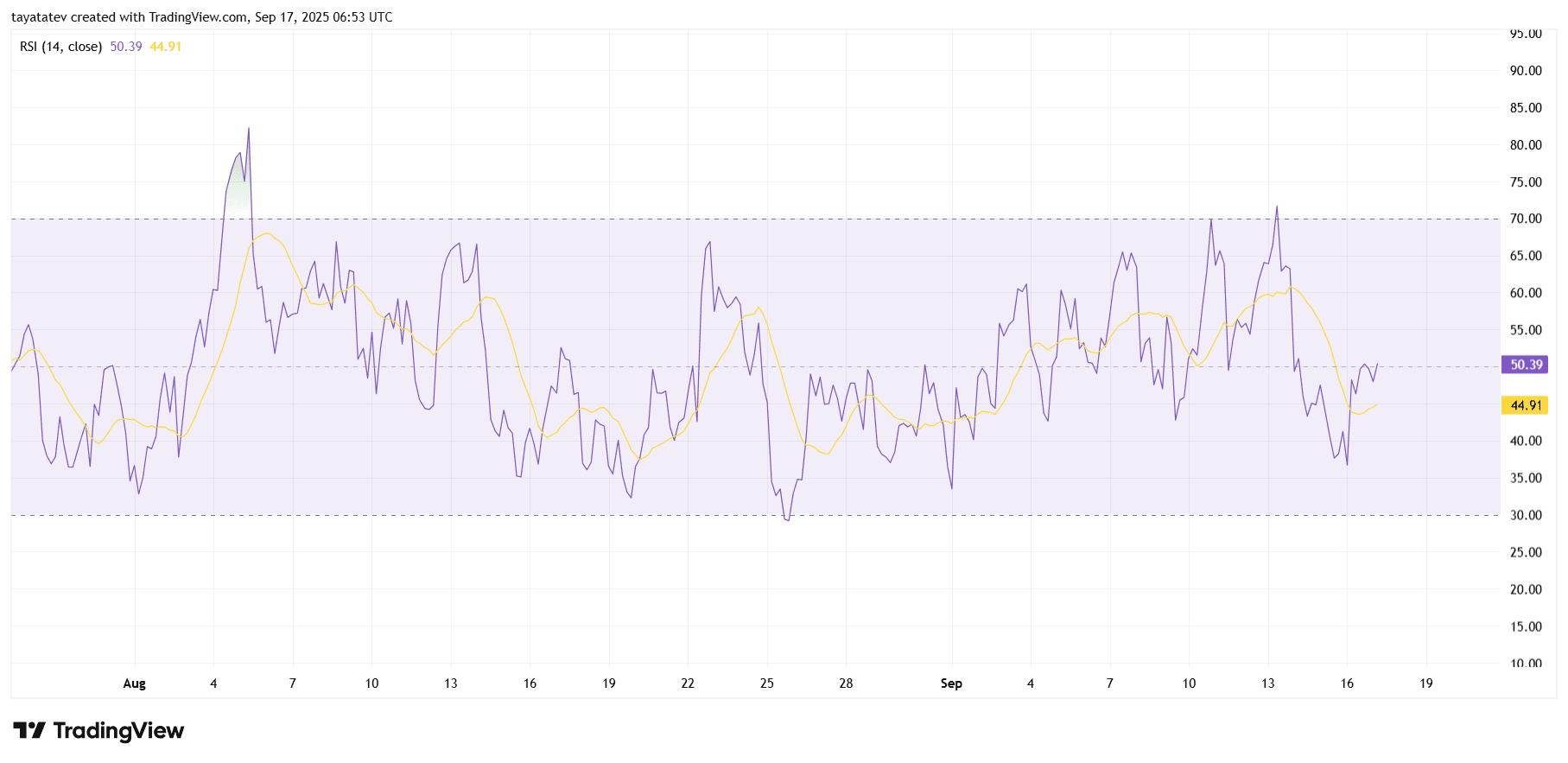

RSI returns to neutral, momentum undecided on the four hour chart

Litecoin’s Relative Strength Index (14-period) rebounded to 50.39, with its RSI moving average near 44.91. The bounce lifts momentum back to neutral after readings slid toward the oversold zone near 30 yesterday. Therefore, sellers lost some control, but buyers have not seized a clear edge.

Recent swings show cooling force. Earlier spikes into the mid-60s and low-70s faded, and the RSI has mostly traveled inside a 40–60 band. That range usually marks consolidation or an early downtrend until the oscillator escapes it. Thus, a sustained push above 55–60 would argue for improving upside follow-through, while a slip back under 45—and especially below 40—would restore bearish pressure.

This read fits the price setup you flagged. The chart shows a rising wedge, and a confirmed break of wedge support would likely pull the RSI under the 50 centerline toward the 40–30 area. Conversely, if price reclaims the upper wedge region and holds above the 50-period Exponential Moving Average, the RSI can advance toward 60–70. For now, momentum sits balanced and awaits confirmation from price