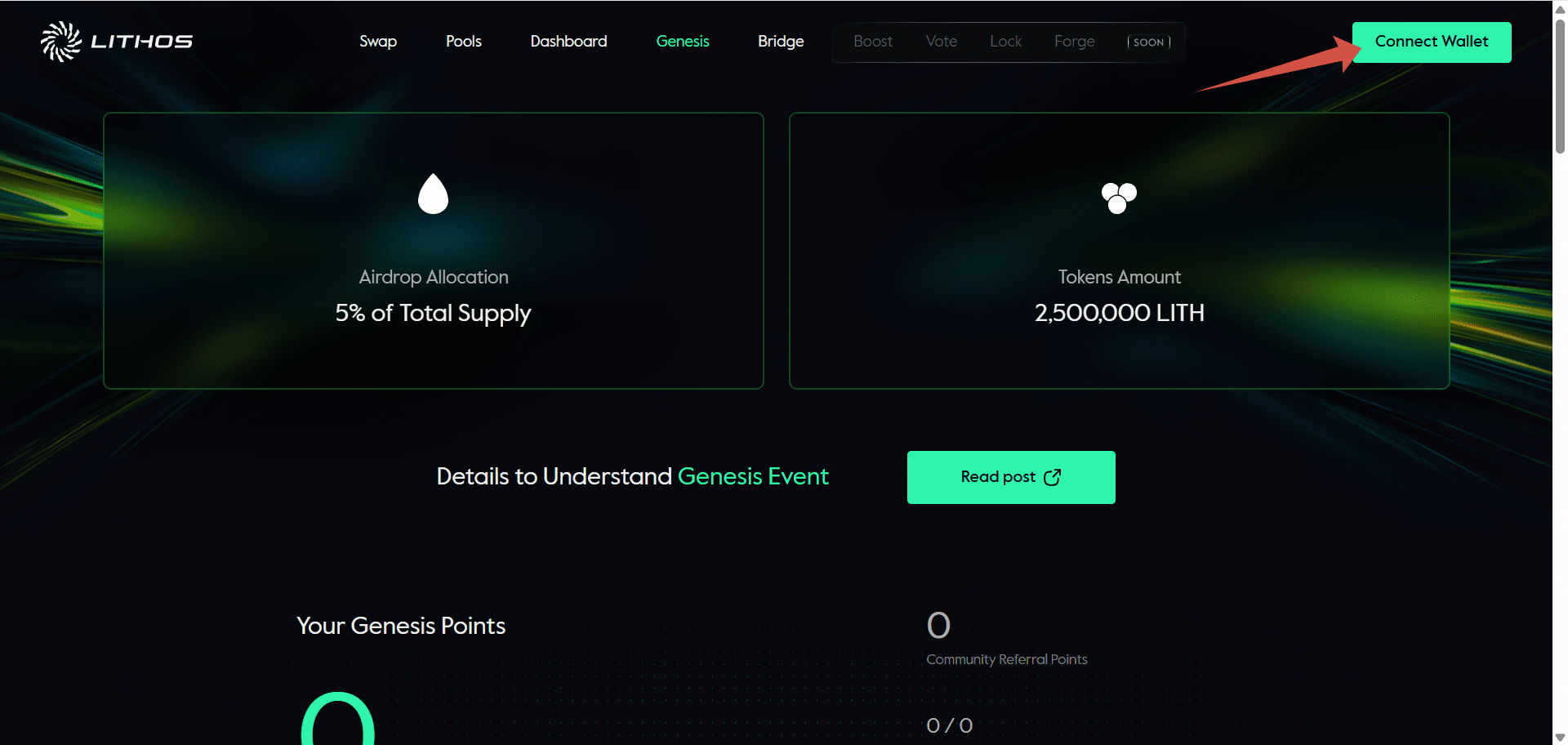

The Lithos airdrop distributes 5% of the total LITH token supply through the project’s Genesis Bootstrapping program. Running from October 1, 2025, to January 11, 2026, the initiative is designed to establish liquidity and enable price discovery for the Lithos DEX on the Plasma blockchain, rewarding early and consistent participants.

Lithos Positions Itself as Plasma’s Core Liquidity Layer

Lithos serves as the central liquidity hub of the Plasma blockchain, bringing trading, governance, and emissions under one coordinated framework. The protocol uses the ve(3,3) model to align incentives across participants, creating a system where traders benefit from deep liquidity and reduced slippage, while liquidity providers earn both trading fees and emissions.

At the governance level, veLITH holders direct where emissions flow each week, shaping liquidity distribution across the ecosystem. Meanwhile, new projects can bootstrap liquidity and community trust through the Foundry Launchpad, supporting a broader network effect. Together, these mechanisms aim to create a sustainable liquidity base for Plasma that balances participation, governance, and long-term ecosystem growth.

A Two-Stage Liquidity Drive Defines the Lithos Airdrop

The Genesis Bootstrapping campaign allocates 5% of the total LITH supply through a structured, two-stage liquidity program. Lithos, a 3,3 DEX built on Plasma, uses the ve(3,3) model to align incentives among traders, liquidity providers, and governance holders.

Rather than relying on short-term farming, the Lithos airdrop rewards users who maintain liquidity over time. The two phases include:

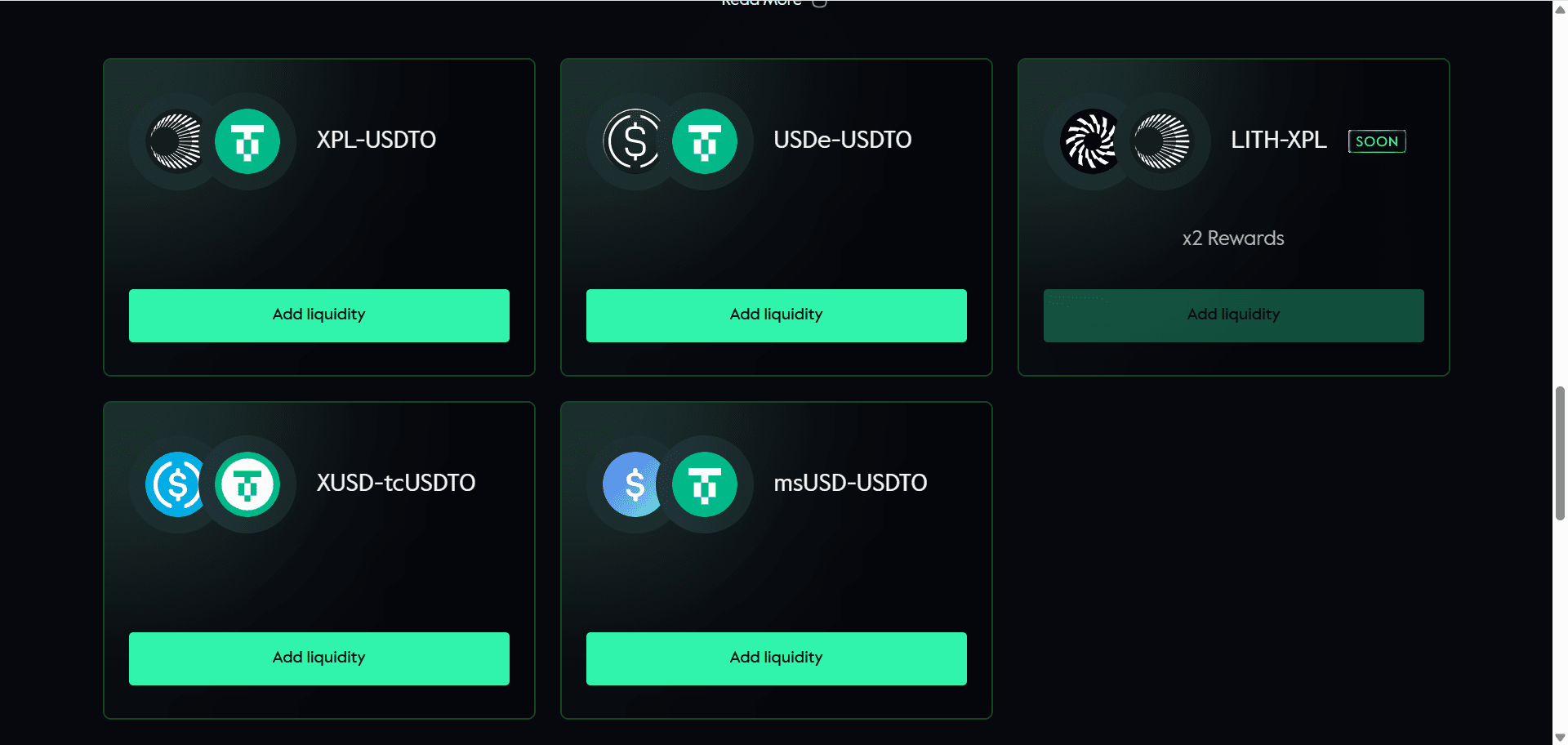

- Stage 1 (Oct 1 – Dec 1, 2025): Focused on building liquidity for XPL/USDT0 and USDe/USDT0 pairs.

- Stage 2 (Oct 11, 2025 – Jan 11, 2026): Expands incentives to the LITH/XPL pool following the Token Generation Event (TGE) on October 11 at 16:00 CET.

Rewards are issued as veLITH (locked governance tokens) and LITH (liquid tokens), with a reward curve favoring early deposits and longer commitments.

How to Join the Lithos Airdrop Campaign

1. Visit the official Lithos Genesis portal and connect an EVM-compatible wallet.

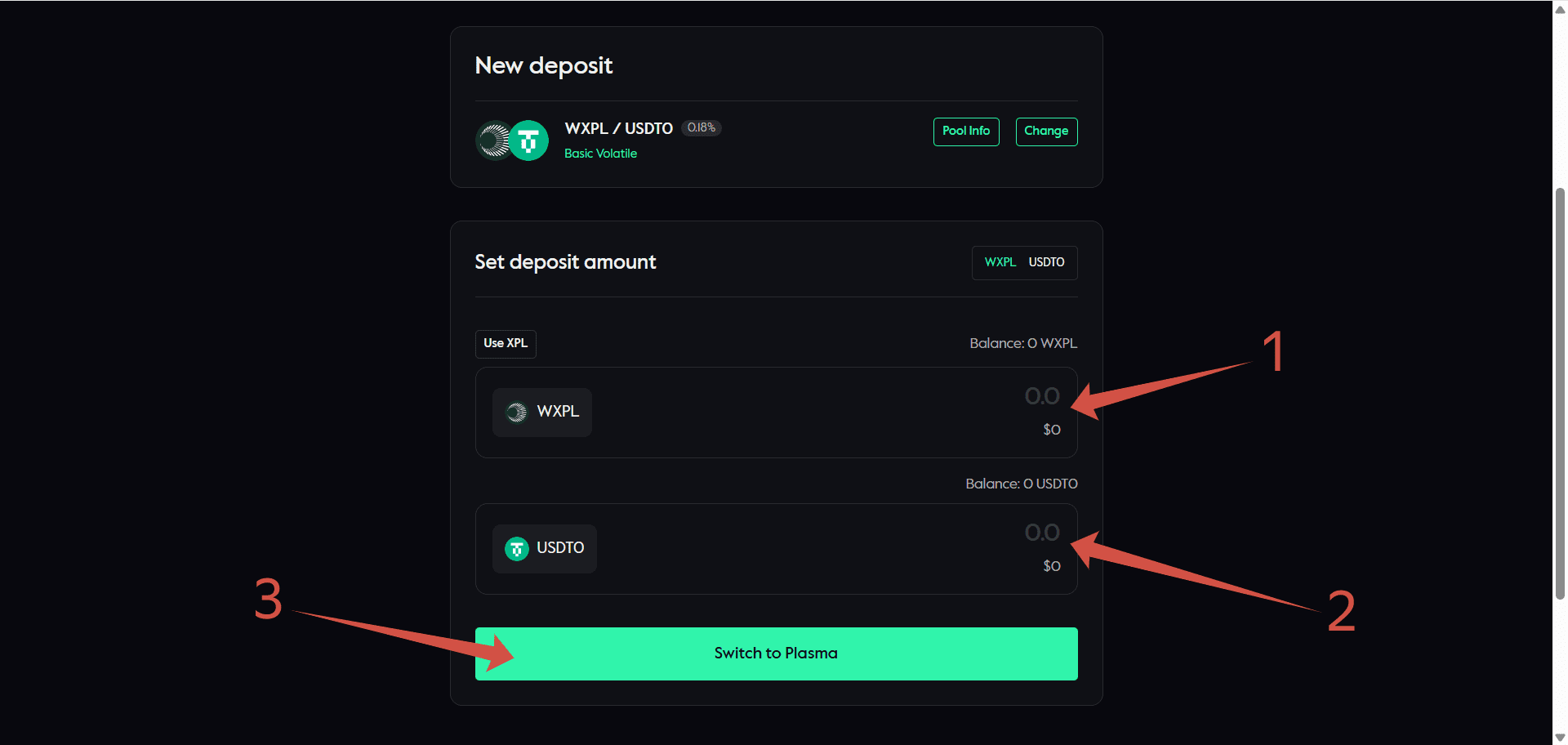

2. Acquire the required tokens for liquidity. In Stage 1, deposit into XPL/USDT0 or USDe/USDT0 pools. From October 11, add liquidity to LITH/XPL for Stage 2.

3. Select a pool, approve the transaction, and confirm your deposit. Rewards begin accruing immediately after confirmation.

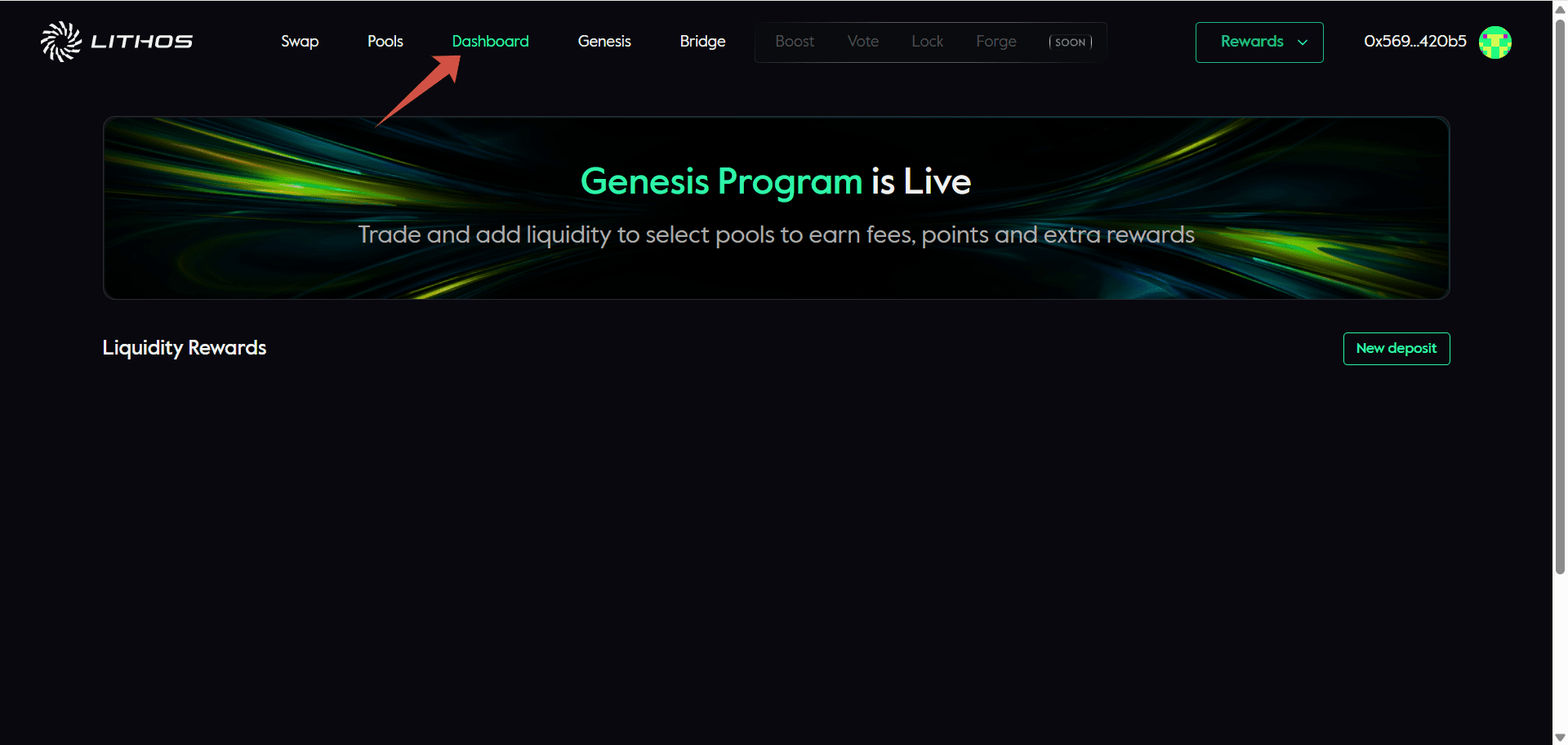

4. Track your performance through the Genesis dashboard once it becomes available.

4. Receive rewards during and after the program. veLITH distributions start on October 11 and continue biweekly, while LITH tokens become fully claimable two weeks after completion, on January 25, 2026.

Withdraw liquidity at any time if needed, but note that early withdrawals reduce final rewards under the program’s reward curve.

Reward Model Encourages Early and Long-Term Participation

The Lithos airdrop uses two multipliers to calculate participant rewards:

- Deposit Size Multiplier: Larger deposits receive proportionally higher rewards.

- Time-Based Multiplier: Rewards increase the longer liquidity remains in a pool, reaching the maximum at program end on January 11, 2026.

The model favors users who participate early, especially during Stage 1, and maintain liquidity throughout the full program duration.

The Lithos airdrop is one of several major campaigns redefining liquidity distribution across emerging DeFi ecosystems. To stay ahead of upcoming opportunities, explore our latest list of active and upcoming airdrops and discover new ways to earn rewards in the evolving web3 economy.

FAQ

Who can participate in the Lithos airdrop?

Anyone providing liquidity to eligible pools on the Plasma network during the Genesis Bootstrapping period.

Can I provide liquidity to multiple pools during Stage 1 or Stage 2?

Yes. Participants can deposit into more than one pool across both stages of the Lithos airdrop.

How are rewards calculated in the Lithos airdrop?

The Lithos airdrop uses two multipliers to calculate rewards: a deposit size multiplier and a time-based multiplier. Larger and longer-held deposits earn proportionally more rewards.

What are gauges, and how do they affect the Lithos airdrop?

Gauges are smart contracts that direct where emissions go. After the airdrop, veLITH holders can vote on gauges to determine which liquidity pools receive future emissions, influencing ongoing yield beyond the Genesis program.

When can airdrop rewards be claimed?

veLITH rewards begin at TGE (October 11, 2025) and continue biweekly. LITH tokens unlock fully after January 25, 2026, following a two-week vesting period.

Can participants withdraw early?

Yes, but early withdrawals reduce the final reward allocation under the program’s reward curve.

What risks should participants consider?

- Impermanent loss: Liquidity providers may face price divergence risk on volatile pairs.

- Smart contract risk: Lithos is built on audited contracts, but DeFi always carries inherent risks.

- Governance risk: veLITH voting power can shift emissions between pools based on community incentives.

How are fees and emissions handled?

During the Genesis program, Lithos distributes trading fees directly to liquidity providers. After the airdrop, veLITH voters continue receiving emissions and bribes based on their gauge votes.