Mantle launched its Tokenization-as-a-Service platform during Token2049. The launch introduced a full stack for tokenizing assets, including legal structuring, licensing, KYC procedures, smart contract deployment, security monitoring, and DeFi integrations. The company positioned the platform for regulated issuers and asset managers that want standardized workflows rather than custom builds.

The platform’s structure brings together compliance and technical execution. Legal teams can use built-in modules to handle licensing and investor checks, while developers deploy smart contracts through pre-audited templates. Mantle also offers automated monitoring to flag irregular activity, which aligns the product with regulatory expectations.

At the same event, World Liberty Financial announced plans to issue its USD1 stablecoin on Mantle. The firm described the move as part of a phased rollout, including a debit card pilot expected between late 2025 and early 2026. This pairing places Mantle within the growing stablecoin issuance sector while maintaining its focus on tokenization infrastructure.

Skadi Upgrade Aligns Mantle With Ethereum’s Roadmap

Mantle completed the Skadi hard fork on August 27, 2025. The upgrade improved compatibility with Ethereum’s upcoming Prague roadmap by updating op-geth and integrating new APIs that accelerate zero-knowledge proof workflows. Developers benefit from faster execution times and improved performance when building applications on Mantle.

The upgrade also addressed technical bottlenecks that affected dApp scaling. By aligning with Ethereum’s infrastructure, Mantle ensured that new developer tools, libraries, and proofs will work across both ecosystems. This step positioned Mantle as a more seamless option for teams that operate on multiple EVM chains.

Community documentation detailed Skadi’s release timeline, including testnet deployments in September and final migration steps before the mainnet cutover. Developer channels emphasized the upgrade’s role in keeping Mantle synchronized with Ethereum’s evolving base layer.

Mantle Treasury Supports Product Growth

Mantle operates one of the largest community treasuries in the crypto sector. A public dashboard tracks its multi-billion-dollar holdings governed by token holders. The treasury funds ecosystem growth through grants, liquidity provisions, and incubation of new products. This structure gives Mantle financial independence while allowing the community to decide allocation priorities.

In Q2 2025, Mantle launched Mantle Index Four (MI4) in partnership with Securitize. The fund tokenizes institutional-grade assets, with Mantle Treasury acting as anchor investor. Legal counsel from Latham & Watkins supported the launch, which attracted industry attention as one of the first large-scale tokenized institutional funds on a layer-2 network.

This financial base allows Mantle to support new ecosystem entrants. It channels capital toward teams building compliance-ready applications, real-world asset integrations, and infrastructure products that align with Mantle’s long-term roadmap.

Real-World Assets and Compliance Strategy

Mantle’s platform focuses on real-world asset (RWA) tokenization with built-in compliance tools. Asset issuers can onboard through standardized legal modules, then connect directly to on-chain liquidity venues. This structure aims to reduce the friction between regulated markets and blockchain networks.

The company emphasized monitoring and reporting capabilities. Compliance dashboards give issuers and regulators real-time visibility into transactions, reducing reliance on third-party reporting tools. These functions align Mantle with jurisdictions preparing structured frameworks for tokenized securities.

Mantle positions itself as an Ethereum layer-2 with a community-governed roadmap. Its focus on banking-grade settlement, tokenization standards, and treasury-backed incubation distinguishes it from general-purpose rollups that prioritize throughput over regulatory integration.

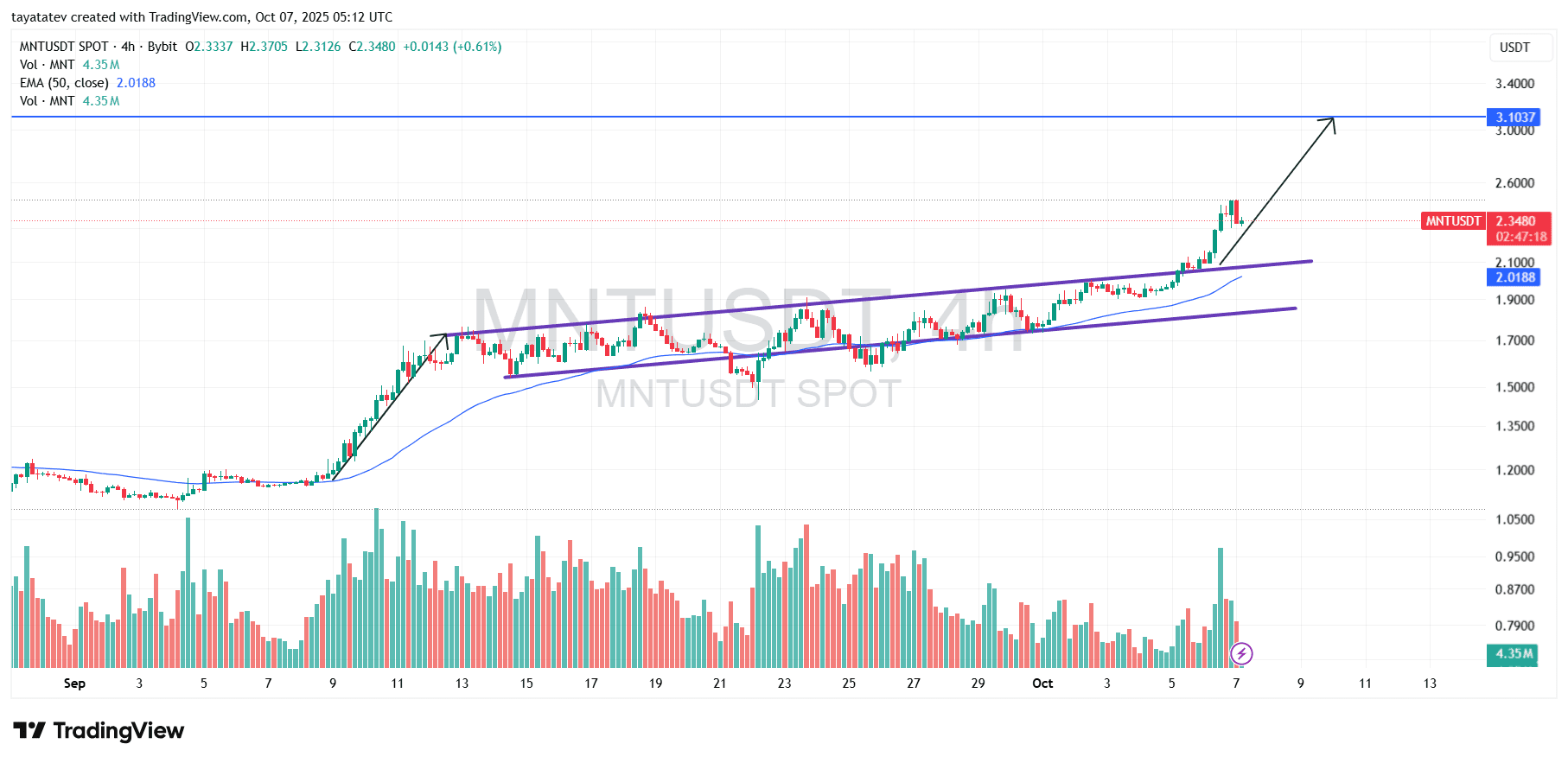

MNT breaks out of rising channel; 3.10 next if momentum holds

On Oct. 7, 2025, the MNT/USDT four-hour chart shows a clean breakout above a rising channel, with price near 2.35 at 05:12 UTC. The chart was created using a channel pattern to track a sequence of higher highs and higher lows, then extended to mark a projected objective. Price pushed through the upper boundary around 2.10 and held above the 50-period EMA near 2.02, which keeps the breakout intact.

A rising channel is a structure defined by two upward-sloping parallel lines that contain price swings, and a decisive move above the top line signals accelerating trend strength. In this case, candles closed outside the channel and volume expanded, which indicates demand stepping in after weeks of orderly climbs. The pattern therefore shifts from containment to continuation.

Price is already up from the pattern and continues to build on the breakout. Buyers defended the prior ceiling during brief intrabar checks, and momentum stayed positive as the market advanced along the new trajectory. As long as price holds above the former channel top, the setup remains valid and favors follow-through rather than mean reversion.

From the current level around 2.35, another 32% advance implies a target near 3.10 (2.35 × 1.32 ≈ 3.10). That mark aligns with the blue extension line on the chart and represents the next logical waypoint if the breakout persists. Should the trend pause, the former channel top around 2.10 to 2.12 and the 50-EMA zone near 2.02 remain the nearest areas to watch for strength during any pullback.

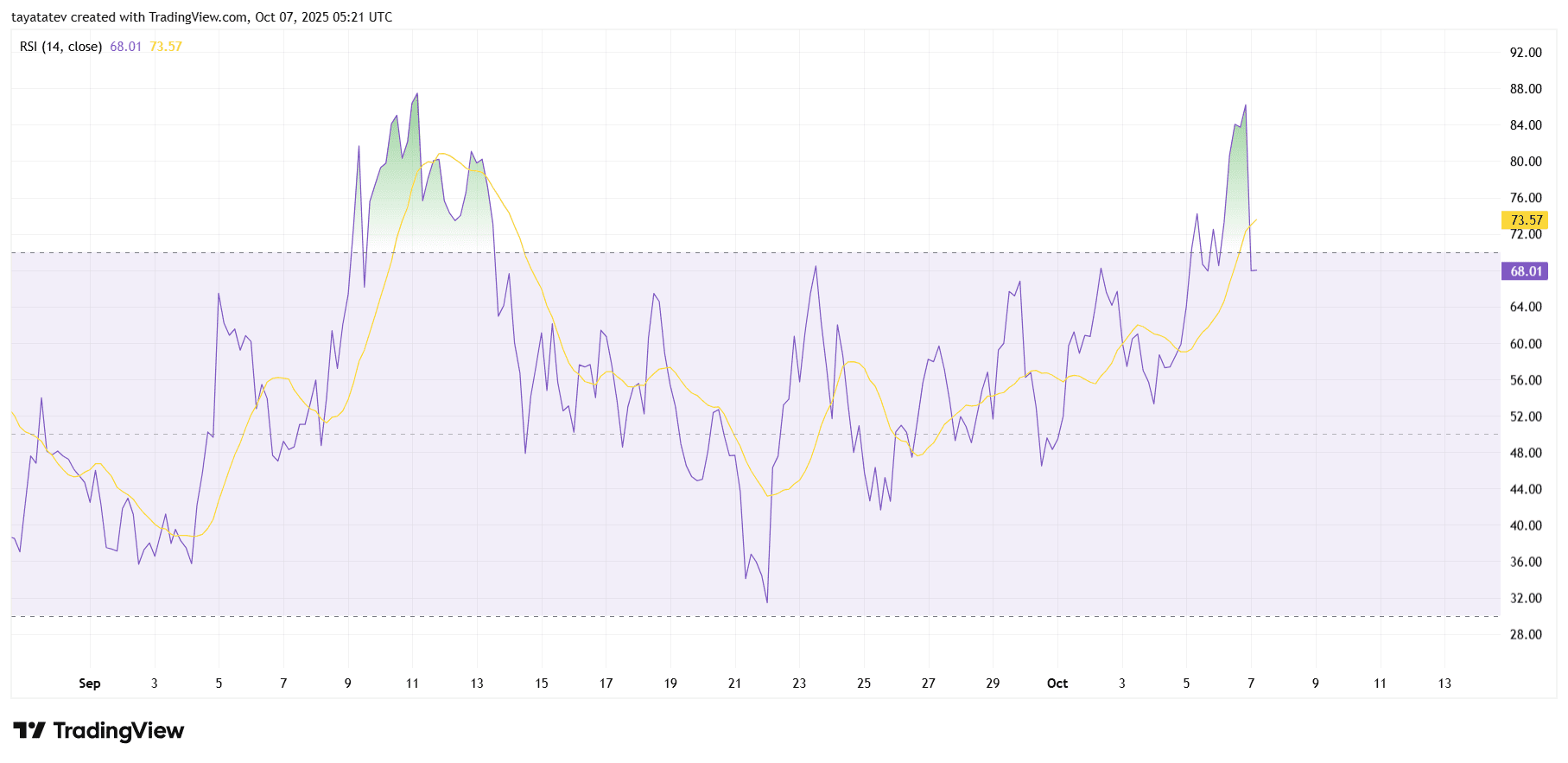

MNT momentum stays strong as RSI cools from overbought

On Oct. 7, 2025, the MNT/USDT 4-hour RSI prints around 68 after spiking into the 80s earlier in the session. The indicator remains in a bullish regime above the 60 line, which signals positive momentum even after the brief fade. The RSI moving average trails slightly higher, reflecting the recent acceleration before this pullback.

Momentum built through late September and early October, with multiple pushes above 70 that marked overbought conditions. Each dip toward the mid-50s met support and turned higher, which kept the trend intact. Today’s retreat from the high-80s brings the gauge back to a more sustainable level without breaking the uptrend structure.

Going forward, watch the 60 area on RSI as a near-term strength line. Holding above it would keep momentum constructive and consistent with the recent price breakout. A decisive drop below the 50–55 band would indicate cooling force and raise the odds of a deeper pause. The chart, created on TradingView at 05:21 UTC, shows no clear bearish divergence at this timeframe, so the momentum context remains favorable while the RSI stays above 60.