Morgan Stanley will let all clients access crypto funds starting October 15, per CNBC. The change applies across its wealth management network.

Previously, access required $1.5 million in assets and an aggressive profile. Now clients with IRAs and 401k plans can use approved Bitcoin funds under the same platform controls.

The firm will start with allocation caps and automated checks. Advisers will follow risk settings that align with the firm’s internal guardrails.

Bitcoin Funds From BlackRock And Fidelity: Narrow Shelf, Clear Rails

Advisers can initially offer Bitcoin funds from BlackRock and Fidelity. Morgan Stanley will monitor markets for other crypto funds, according to CNBC.

This approach keeps crypto funds inside existing custody and reporting. Clients hold fund shares, not self-custodied coins, which simplifies audits and statements.

Therefore, Morgan Stanley adds crypto funds without changing client operations. Advisers continue to use existing order, compliance, and review flows.

IRAs, 401k, And Retirement Assets: Where Crypto Funds Fit

The policy includes IRAs and 401k accounts. That matters because these accounts have strict tax and compliance rules.

As of June 30, U.S. retirement assets totaled $45.8 trillion, per the Investment Company Institute. IRAs held about $18 trillion and 401k plans about $9.3 trillion.

Morgan Stanley Wealth Management employs about 16,000 advisers, oversees roughly $6.2 trillion, and serves more than 19 million relationships, per the 2025 Annual Shareholder Letter.

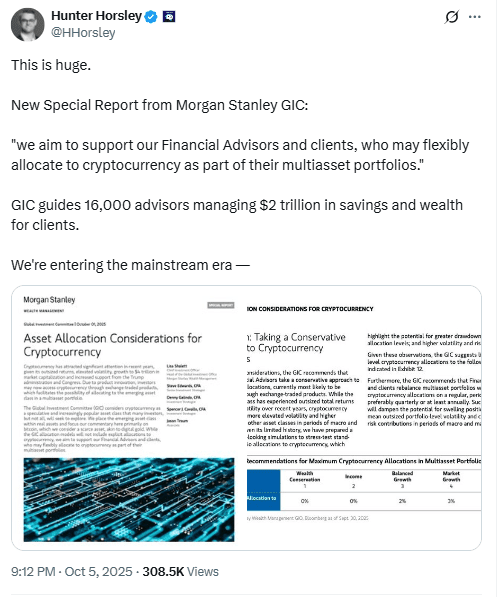

In October, the Global Investment Committee advised limited crypto exposure. It outlined up to 4% for Opportunistic Growth and 2% for Balanced Growth.

It set 0% for income and preservation strategies. These ranges guide allocation caps and help advisers structure positions.

Thus, crypto funds access and allocation caps move together. The policy opens the door while the ranges frame portfolio sizing.

Wealth Management Context: Fidelity, JPMorgan, And BlackRock Moves

In April, Fidelity launched retirement accounts that enable Bitcoin buying and selling with near-zero-fee access. The suite includes a traditional IRA and two Roth IRA options.

In June, JPMorgan allowed clients to use crypto ETFs as collateral for loans, per Bloomberg. It also began including crypto holdings in net-worth assessments.

BlackRock’s spot Bitcoin ETF generated about $245 million in fees over the past year. On September 11, Bloomberg reported BlackRock is exploring tokenization of ETFs for around-the-clock trading and potential DeFi collateral use.

How Morgan Stanley’s Crypto Funds Access Works Day One

Advisers begin with Bitcoin funds only from BlackRock and Fidelity. There is no direct wallet setup and no private key handling for clients.

Automated systems help keep allocation caps within Global Investment Committee ranges. The controls align trades with a client’s profile and the firm’s risk settings.

Over time, the firm may add more crypto funds. For launch, Morgan Stanley centers on Bitcoin funds that already fit its wealth management workflows.

Morgan Stanley reaches 19 million relationships through 16,000 advisers. Even small crypto funds allocations scale across $6.2 trillion in assets.

The broader backdrop is $45.8 trillion in U.S. retirement assets. The policy does not imply flows; it creates access within regulated channels.

Key details remain the same: October 15 start, Bitcoin funds only, BlackRock and Fidelity as managers, and allocation caps guided by the Global Investment Committee.