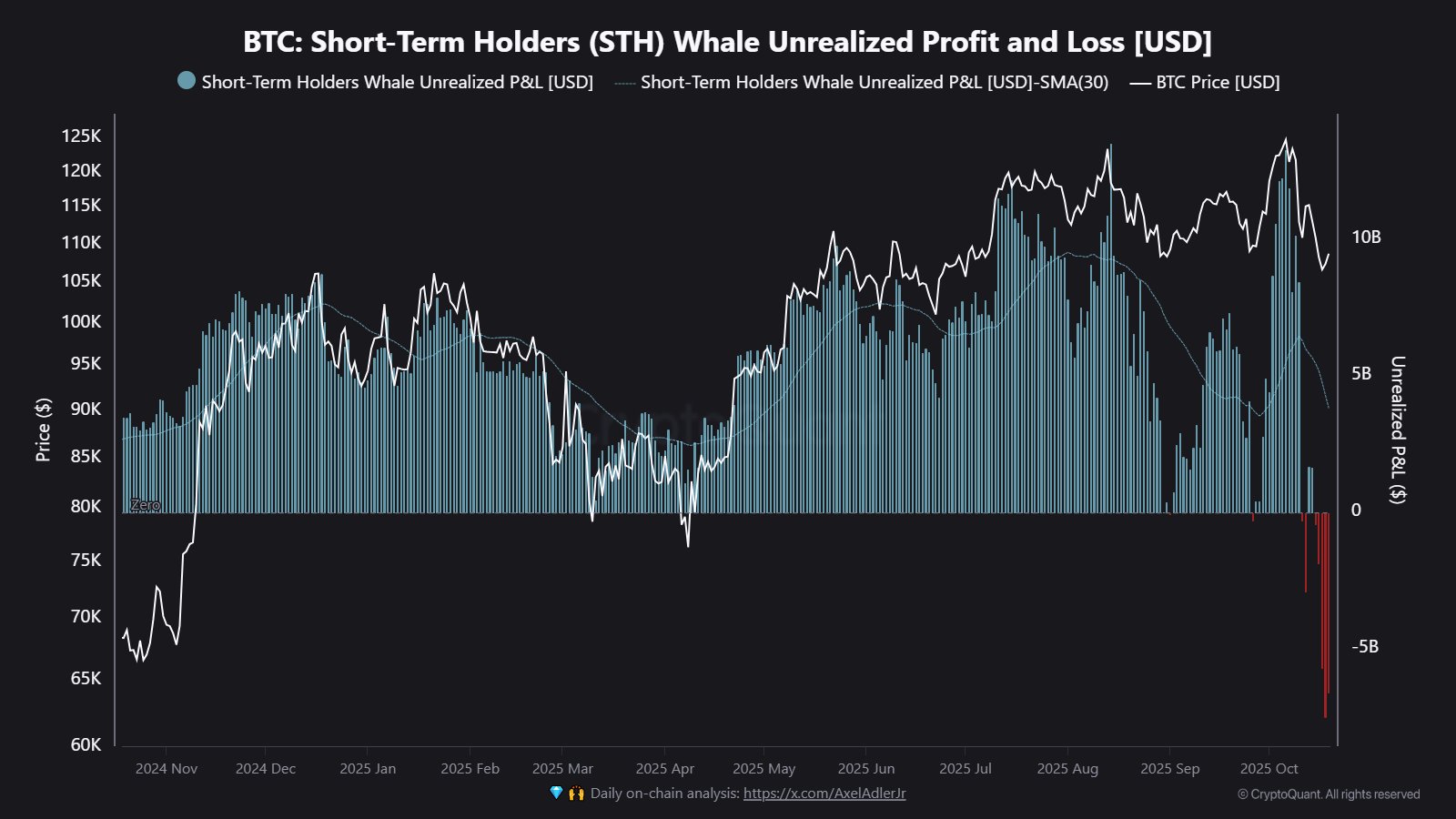

On-chain data indicates that new Bitcoin whales are now facing nearly $7 billion in losses, the largest since October 2023.

Notably, Bitcoin is still struggling to recover from the sharp drop it suffered on Oct. 10. Despite climbing back to retest the $110,000 mark, the world’s largest crypto asset remains about 13% below its all-time high of over $126,000, reached earlier this month.

The recent slide has put pressure on large investors, as new data shows that a growing number of large whales are sitting on heavy unrealized losses.

New Bitcoin Whales Seeing Losses

Specifically, on-chain analytics firm CryptoQuant reported that newly formed whale wallets are now underwater. These wallets, which accumulated Bitcoin around recent highs, hold the asset at an average price of roughly $113,000.

With Bitcoin currently trading at around $110,000, this group faces nearly $6.95 billion in unrealized losses, the largest seen since October 2023. Data from an accompanying chart confirms that this is the first time these short-term whales are seeing unrealized losses since November 2024.

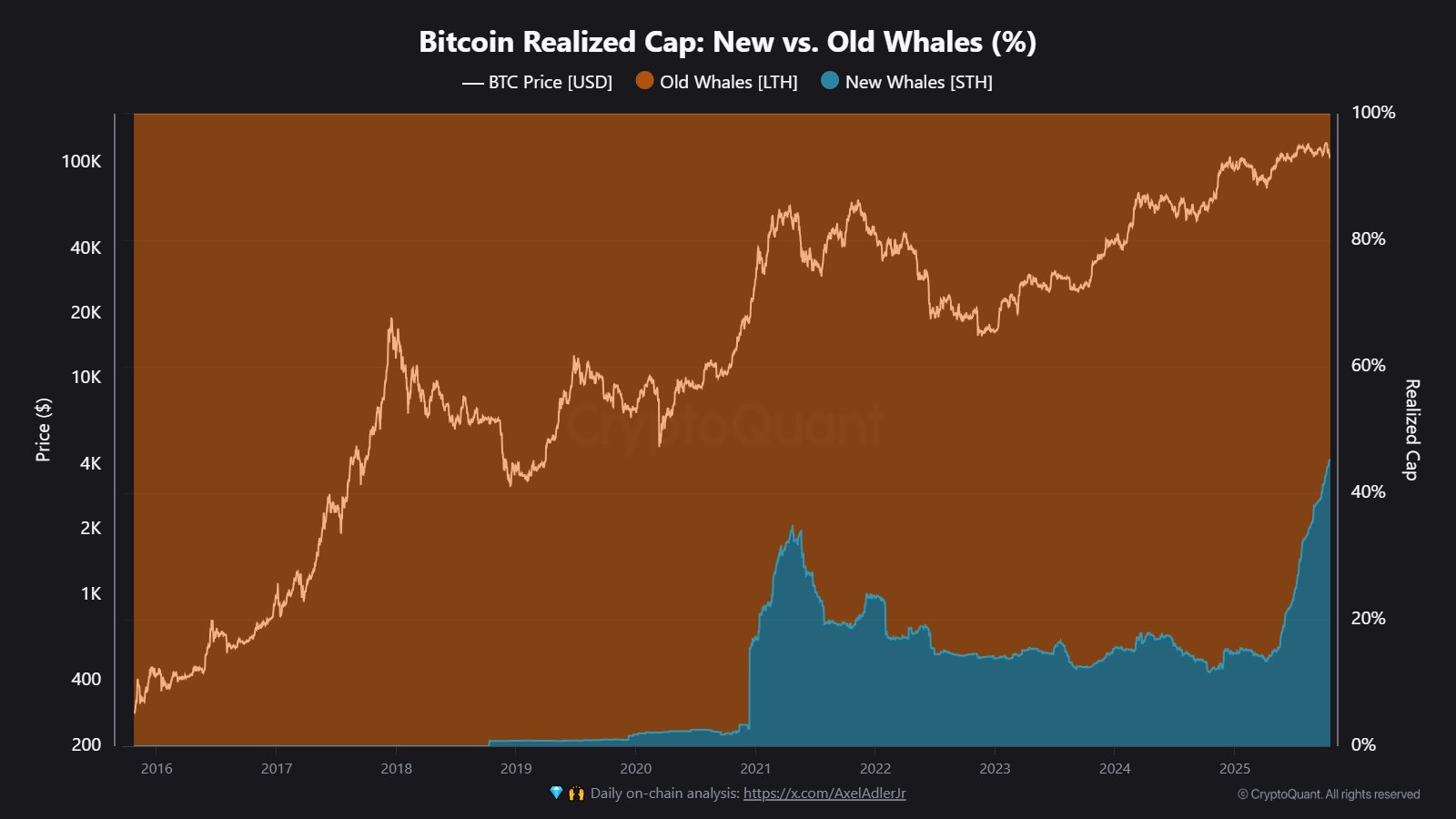

CryptoQuant added that these newer whales now hold about 45% of Bitcoin’s total whale realized cap, showing how much of the big-money market lies in this category. Interestingly, the chart confirms that earlier in the year, they held below 20%.

Still, many of these whales continue to buy more Bitcoin despite their paper losses. Notably, market analyst Crypto Patel noted that over 26,500 BTC recently moved into whale accumulation wallets.

🐳 Whales are loading up.

Over 26,500 #BTC just flowed into whale accumulation wallets, that’s not traders, that’s big money moving off exchanges.

Historically, every spike like this has happened when fear is high… and whales are quietly buying. pic.twitter.com/JiXWlBfJrZ

— Crypto Patel (@CryptoPatel) October 19, 2025

He explained that these transfers typically occur when fear dominates the market, a pattern that has often marked the early stages of accumulation before major rallies. Patel said this shows large investors are quietly adding to their holdings while most traders stay cautious.

Bitcoin in a Favorable Position

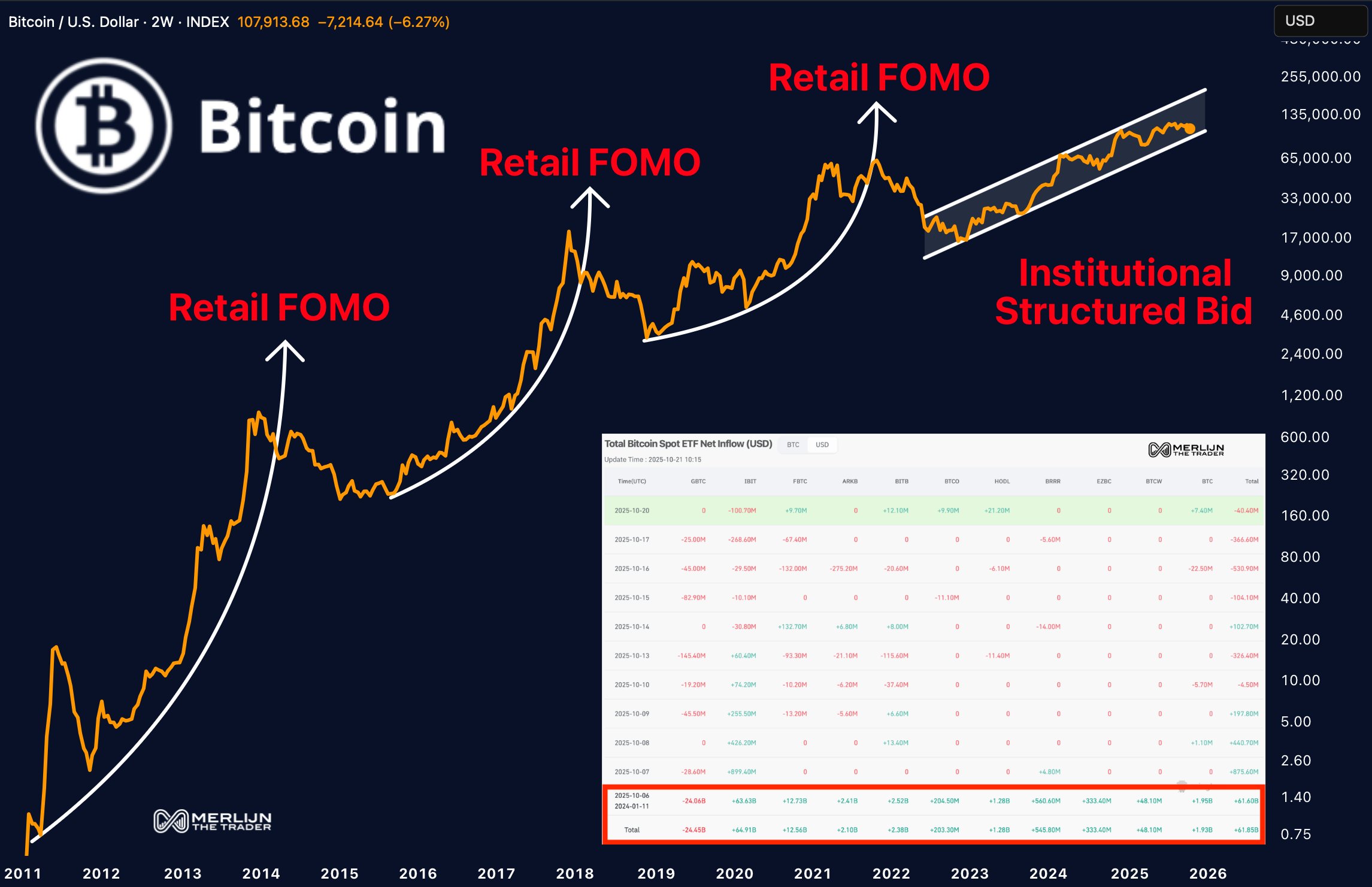

Meanwhile, amid the current market uncertainty, analyst Merlijn the Trader said this cycle looks very different from previous ones. In past bull runs, emotion and hype drove prices to new highs.

This time, structural factors, especially strong inflows from Bitcoin ETFs, are determining the market. Merlijn described the current phase as calm and deliberate, suggesting that big players are building positions early, as they prepare for what he called a major wave of institutional demand.

Also, data from Glassnode shows that leverage in the Bitcoin market has dropped sharply. The firm said open interest fell by about 30%, flushing out excess leveraged trades.

#Bitcoin open interest has dropped by ~30%, flushing excess leverage from the market. With funding now near neutral, the market is far less vulnerable to another liquidation cascade.

🔗https://t.co/4M02uALnGX pic.twitter.com/l4hkNnZdZX

— glassnode (@glassnode) October 21, 2025

With funding rates now close to neutral, the market looks more balanced and less exposed to another wave of forced liquidations. This reset could make the market healthier and less volatile in the short term.

Interestingly, market analyst Ted Pillows pointed out that Bitcoin is now testing a crucial support range between $107,000 and $108,000. He said that if this zone holds, the market could see a bounce. However, if Bitcoin falls below it, prices might slide toward $100,000 in the near term.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.