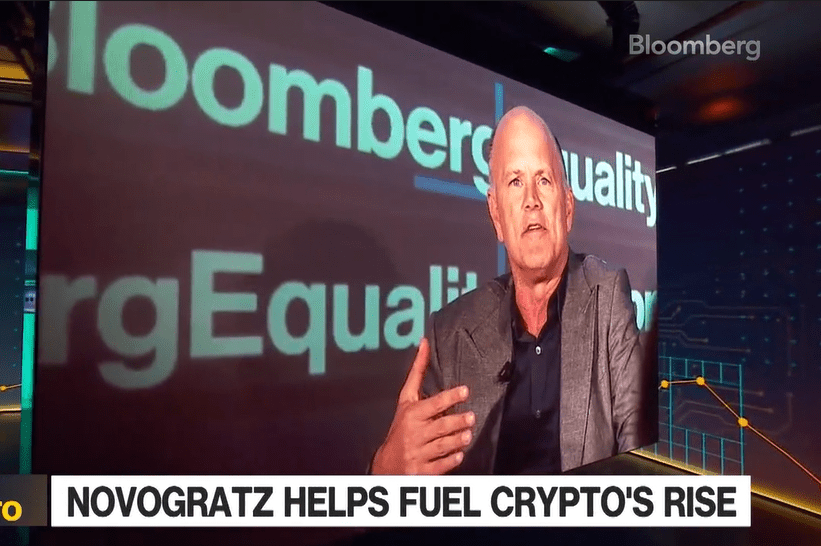

Mike Novogratz said new US crypto legislation could invite fresh participation and disrupt the four-year cycle. He pointed to the GENIUS Act on stablecoins and the CLARITY Act on market structure in remarks on Bloomberg.

US Crypto Legislation: GENIUS Act and CLARITY Act Set the Stage

Mike Novogratz, the Galaxy Digital chief executive, tied the shift to two US bills. He cited the GENIUS Act, signed in July, which regulates stablecoins under clear rules. He also highlighted the CLARITY Act, which sets agency roles for digital assets.

“It’s a big deal. With those two bookends of legislation, it’s going to unleash a tremendous amount of new participation in crypto,”

said Novogratz. He framed the GENIUS Act and the CLARITY Act as the core drivers of the next phase. His comments placed policy clarity at the center of market structure.

Brian Armstrong supported that view on September 17. The Coinbase chief said he was certain Congress would pass the CLARITY Act. He called it “a freight train leaving the station,” pointing to strong momentum in US crypto legislation.

Stablecoins in Everyday Apps: GENIUS Act Opens New Channels

Novogratz said people could not use stablecoins on iPhones or in social apps before. He noted those features lacked clear legal ground. He then added, “but now they are,” referring to the GENIUS Act.

Clear stablecoin rules reduce compliance risk for consumer apps. Therefore, payment gateways and fintechs can integrate stablecoin rails with fewer hurdles. As a result, stablecoins can reach users who avoided on-chain tools due to legal uncertainty.

Banks and brokers can also plan around defined obligations. With GENIUS Act standards in place, firms can design custody and reporting workflows. This structure can widen access to stablecoins under US crypto legislation.

Four-Year Cycle Questioned: Bitcoin Halving Meets New Demand

Many investors track the Bitcoin halving and a four-year cycle. The last halving occurred in April 2024. Some therefore see a possible late-year peak and reversal.

Novogratz argued that policy-driven inflows could change that pattern. He said investors may act differently than in 2017 and 2021. New participants under the GENIUS Act and CLARITY Act could offset cycle-based selling.

At the time, BTC traded near $112,703. That print set context for the discussion of demand. Yet the focus stayed on US crypto legislation and stablecoins, not on short-term price moves.

Legislative Timing and Party Dynamics: CLARITY Act in Focus

Timing remains central. Representative French Hill said the House Financial Services Committee targets action on the CLARITY Act in October or November. That window places the bill on the fall calendar.

Novogratz addressed concerns about the Trump family’s involvement in crypto. He said the Securities and Exchange Commission would handle any conflicts that arise. His comments kept the spotlight on process rather than personalities.

He also pointed to growing Democratic support for US crypto legislation. He said enough Democrats now see value in crypto to pass a market-structure bill. The remarks suggested a path forward for the CLARITY Act.

Market Slump Context: Chinese Miners, Hyperliquid HYPE, and $200B Wipeout

Novogratz discussed this week’s deleveraging. He said almost $200 billion was erased from spot crypto markets. He linked part of the drop to “big Chinese mining selling,” which can weigh on bids.

Novogratz also cited Arthur Hayes and Hyperliquid sentiment. He said HYPE “got hit the hardest,” which hurt broader tone. Data showed HYPE down more than 23% from its recent high.

Hayes said he sold his entire HYPE stake to fund a Ferrari deposit. That disclosure became a focal point during the move. Novogratz called the action a pullback while keeping attention on US crypto legislation and CLARITY Act progress.