Pi Network introduced a decentralized exchange (DEX) and automated market maker (AMM) on its testnet this week. The features allow users to create liquidity pools and test token swaps in a controlled environment. Developers can mint test tokens to experiment with trading, but real token creation on mainnet remains restricted.

The Core Team confirmed the update on September 30. They noted that any future mainnet token issuance would follow strict rules. The move highlights Pi’s effort to test decentralized finance tools without risking the live network.

The DEX and AMM also connect with Pi App Studio, giving developers a wider toolkit. This step adds momentum to the platform’s push for broader utility, beyond its mining app.

Chengdiao Fan Speaks at TOKEN2049 Singapore

Pi Network co-founder Dr. Chengdiao Fan delivered a keynote at TOKEN2049 Singapore on October 1. Her session, titled “Crypto’s Future: From Liquidity to Utility – Web3 Pathways to Innovation,” focused on shifting from speculation toward real-world use.

The official conference agenda listed her among the main speakers. Live coverage and community posts confirmed her participation and highlighted her remarks. She framed utility as the next stage for blockchain adoption.

Her appearance comes at a time when Pi Network is adding DeFi tools on testnet. The timing ties the project’s message of utility directly to ongoing product updates.

Pi Hackathon 2025 Nears Final Deadline

Pi Network’s Hackathon 2025 continues, with the final deadline for submissions set on October 15. Participants must provide demo videos and upload their apps to the Pi Developer Portal. Midpoint updates showed progress across several projects.

Community forums and social channels echoed the October 15 cutoff. Teams are expected to showcase apps focused on practical use cases, aligning with the network’s wider narrative on utility.

The hackathon plays a central role in Pi’s ecosystem growth. It encourages developers to build apps that can later integrate into the Pi Browser and broader network.

Roadmap Keeps Focus on Apps and Integration

The Pi Network roadmap lists ongoing plans to expand its ecosystem. It includes closer alignment between the PiNet site and the main website, giving users a unified entry point. The roadmap also points to including community-built apps in the Pi Browser.

These updates are still marked as “In Progress,” signaling active development. The Core Team continues to prioritize app discovery and integration across its platforms.

Together, the testnet DeFi launch, conference presence, and hackathon deadline form the latest developments around Pi Network. The updates reflect a strong focus on building tools and ecosystems rather than price action.

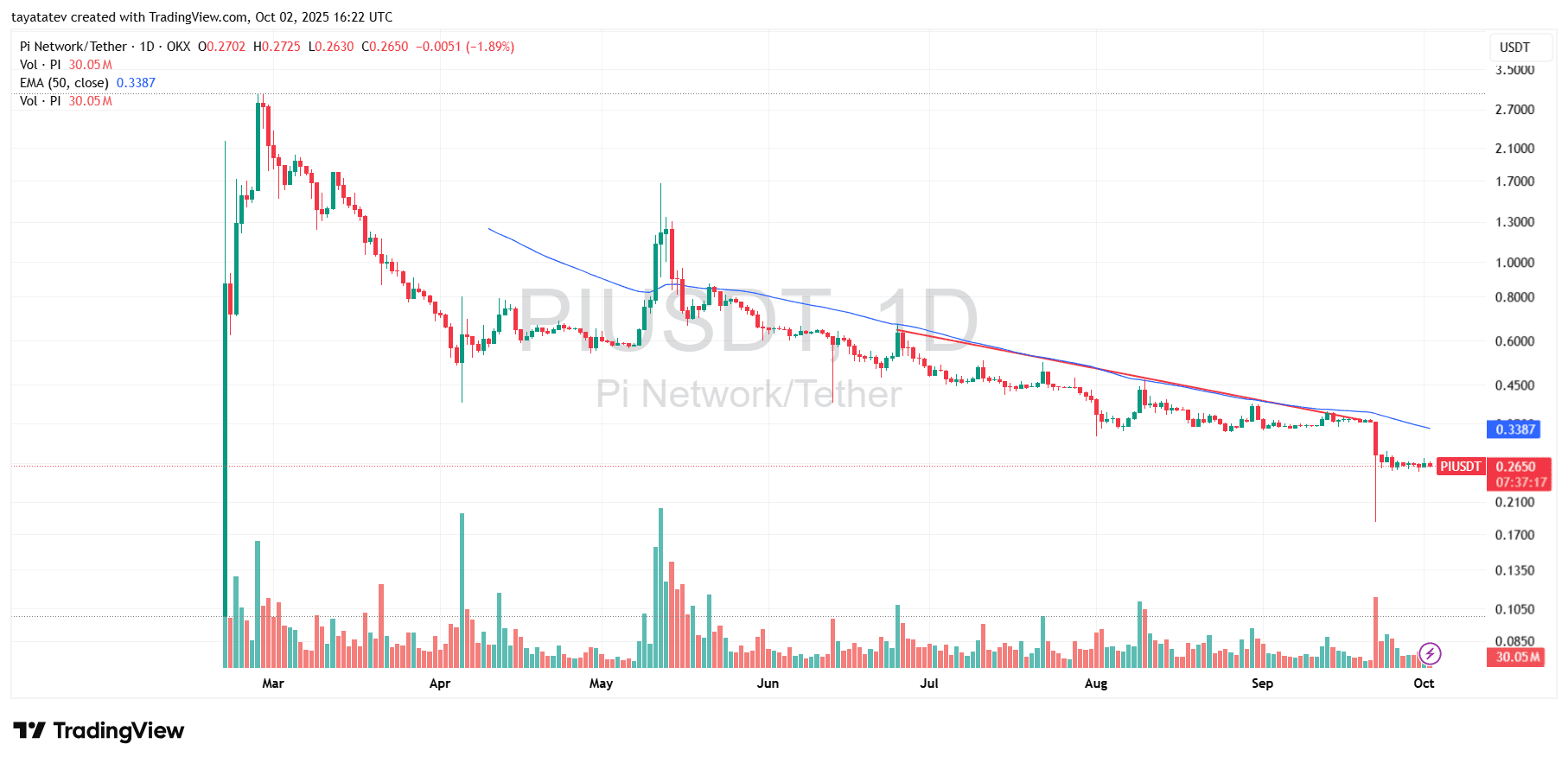

PIUSDT extends downtrend as 50-day Exponential Moving Average caps price

Pi Network’s PIUSDT pair stayed in a clear downtrend on the daily chart. Price trades near 0.26 while a descending trendline from May continues to reject bounces. The 50-day Exponential Moving Average, which smooths recent price action to show trend strength, sits around 0.34 and acts as dynamic resistance above the market.

The breakdown accelerated late September. A wide red candle pushed PIUSDT from the 0.30 area toward 0.21 intraday, then price closed higher but remained below the trendline. Volume expanded on the selloff and then cooled, which signals strong supply on the break and limited follow-through demand afterward. As a result, the market is consolidating under former support turned resistance around 0.27–0.29.

Technically, sellers keep control while price holds below both the descending trendline and the 50-day Exponential Moving Average. Momentum reflects that pressure: successive lower highs since June show failed rallies, and the rebound attempts in August and September faded beneath the moving average. Until buyers reclaim the 0.29–0.30 band, the path of least resistance remains lower.

Going forward, the near-term pivot sits at 0.29–0.30. If bulls close daily candles back above that zone and then challenge the 50-day Exponential Moving Average near 0.34, a relief move toward the mid-0.30s becomes possible, especially if volume expands on green candles. However, if the market loses 0.24–0.23 on a closing basis, sellers could attempt a retest of the late-September spike low near 0.21. In short, the trend stays bearish below the moving average and the descending trendline, and it turns neutral only after a decisive reclaim of 0.30 with sustained volume.

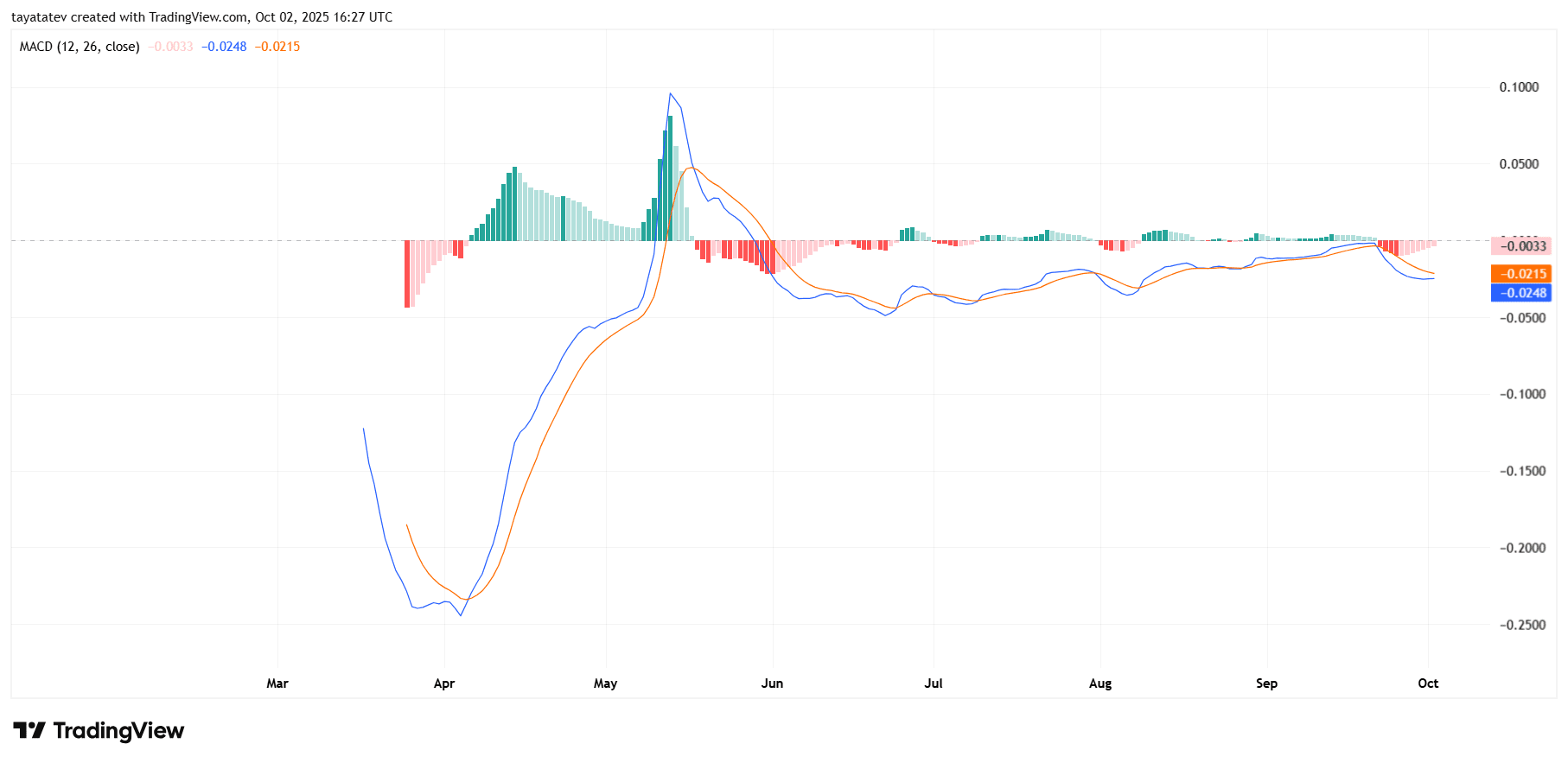

MACD turns negative as momentum slips below zero

Moving Average Convergence Divergence (MACD) on the daily chart flipped bearish again. The MACD line now sits around minus 0.0248, below the signal line near minus 0.0215, and the histogram shows small red bars under the zero axis. This setup signals negative momentum and confirms that sellers regained control after the late-September drop.

Moreover, the crossover happened below the zero line, which strengthens the bearish read. When MACD crosses down while already negative, rallies tend to fade quickly. The fading green bars through mid-September and the steady slide into red show momentum rolling over before price broke lower, which aligns with the recent downswing.

However, the histogram’s shallow depth indicates limited acceleration for now. Momentum is bearish, but not yet capitulatory. If the red bars expand and the MACD line pulls farther away from the signal line, downside pressure likely persists. Conversely, if the histogram contracts toward zero and the MACD line curls up to meet the signal line, a pause or relief bounce becomes more likely.

In context, bulls need a clear MACD signal-line cross back up, followed by a move above the zero axis, to argue for a trend shift. Until then, the indicator supports a defensive stance and favors sellers on rallies.