Ripple completed its $1.25 billion acquisition of global prime broker Hidden Road and rebranded the business as Ripple Prime. The company says the unit’s business has tripled since the April announcement, and it now serves more than 300 institutional customers across markets that clear over $3 trillion annually. Ripple frames the unit as a one-stop desk for trading, financing, and clearing.

With the deal closed, Ripple becomes the first crypto company to own and operate a global, multi-asset prime broker. That positioning matters for institutions that want integrated credit, clearing, and access to both digital and traditional markets under one umbrella. The company also highlights operational scale as a differentiator.

Moreover, Ripple links the prime brokerage to its product stack. The firm notes that its dollar stablecoin, RLUSD, will increasingly be used as collateral inside Ripple Prime as more institutional users onboard. This connects the acquisition to Ripple’s broader push to embed settlement assets directly into institutional workflows.

Corporate-treasury push advances with $1B GTreasury deal

Separately, Ripple moved into the corporate-treasury software market by agreeing to acquire GTreasury for $1 billion. The target brings cash, risk, and payments tooling used by large enterprises, which Ripple says will help CFOs manage stablecoins, tokenized deposits, and liquidity in real time. The companies describe the deal as a direct bridge between digital-asset rails and day-to-day treasury operations.

The acquisition remains subject to customary approvals. However, both sides are already outlining integration themes, emphasizing how treasury users could interact with Ripple’s infrastructure and assets from familiar enterprise interfaces. That narrative keeps the focus on utility rather than market activity.

Context from industry coverage also underlines the scale of Ripple’s 2025 dealmaking: Hidden Road in prime brokerage and GTreasury in software, alongside earlier transactions this year. Together, they sketch a strategy aimed at institutional adoption across trading, settlement, and corporate finance.

On-chain: XRPL “Batch” amendment remains in voting

On the XRP Ledger, the Batch (XLS-56) amendment remains under active validator voting. The change would allow multiple transactions to execute together, enabling atomic workflows and improving complex operations for apps and institutions. Public trackers show the proposal in the voting phase rather than enabled on mainnet.

Developers and ecosystem voices continue to discuss use cases and implementation details, noting that the amendment shipped in rippled v2.5.0 but still needs supermajority support to activate. The emphasis stays on documentation, tooling, and clear patterns that make Batch straightforward to adopt.

Additionally, the official amendments registry and third-party dashboards align on status: Batch is visible, measurable, and short of the activation threshold at the time of writing. That means functionality has not changed yet on mainnet, even as testing and advocacy proceed.

Why it matters for XRP utility (not price)

First, the Hidden Road close turns Ripple Prime into an operating unit rather than a pending plan. As a result, institutions now have an owned channel from Ripple for prime services that can incorporate RLUSD and, where relevant, XRP-based rails. This creates a concrete venue for non-price usage narratives.

Second, the GTreasury deal targets corporate workflows. If completed, it would bring Ripple’s assets and payment rails closer to treasury teams that manage cash, liquidity, and settlements daily. That proximity often determines whether crypto tools move from pilots to routine use.

Third, protocol work like Batch lays groundwork for more complex app logic on XRPL. When atomic sequences become easier to execute, services that require multi-step commitments—such as bundled payouts or coordinated swaps—can operate with fewer failure modes. That kind of reliability typically precedes broader enterprise uptake.

Whale cohort trims holdings; 70M XRP moved in 48 hours

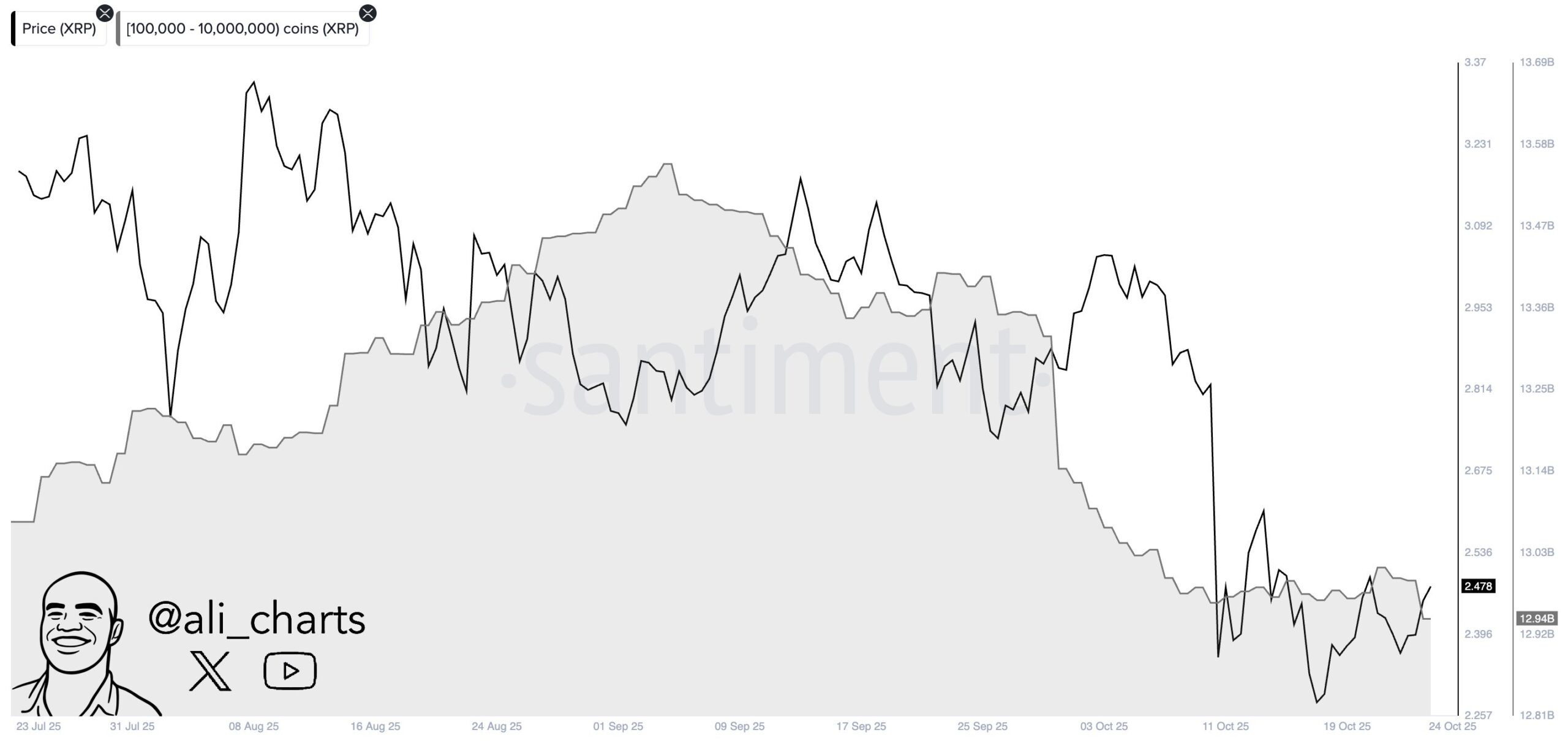

Santiment data cited by @ali_charts shows addresses holding between 100,000 and 10,000,000 XRP reduced their balances by roughly 70 million XRP over two days. This cohort often signals distribution phases because it controls sizable, tradable supply. The chart’s shaded area slopes lower through mid-October, while price action stays choppy, indicating sellers had the upper hand during that window.

However, on-chain balance drops do not always equal spot selling. Large holders can shift coins to different wallets, collateralize them, or route them through exchanges without immediate liquidation. Exchange inflow data would confirm actual sales, while outflows or wallet clustering could imply internal reshuffles. In any case, a 70 million XRP move equals about 0.07% of the 100 billion total supply, so the headline size needs context even if the activity pressured intraday liquidity.

Going forward, watch the same 100k–10M cohort to see if distribution continues or stalls. At the same time, track known exchange wallets for net inflows, which would validate sell pressure, and compare that with funding, open interest, and XRPL transfer volume. If balances stabilize and exchange inflows fade, the signal weakens; if not, the data supports a sustained supply overhang.

XRP weekly setup: range, 55-EMA support, and breakout trigger

The chart frames XRP in a rising “accumulation” box since January 2025, with resistance clustered around $2.60 and a parallel support trendline beneath. Candles continue to respect the range while the January highs cap advances. The visual also marks a brief downside wick that recovered back inside the box, keeping the structure intact for now.

The weekly 55-EMA (blue) acts as dynamic support in this read. A clean weekly close above $2.60–$2.70 would confirm a range break and shift focus to prior highs. Conversely, a decisive weekly close back below the 55-EMA and the lower trendline would invalidate the breakout thesis and return the market to range maintenance. Because the screenshot lacks momentum panels, confirmation should include volume expansion and improving market breadth.

For targets, the author cites a 1.618 Fibonacci extension projecting $5–$6 once resistance gives way. That path requires sequential steps: reclaim and hold the $2.60 area, clear January 2025 highs, and then sustain higher lows on retests. The extension provides a roadmap, not a guarantee; it remains contingent on higher-timeframe closes and continued support from the 55-EMA.