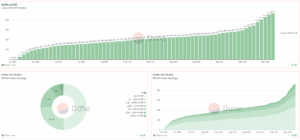

Pump.fun has crossed the $100 million mark in token buybacks in just 65 days. Data from Dune Analytics shows the platform has spent $103.68 million to repurchase more than 24.42 billion PUMP tokens since mid-July, reducing circulating supply by nearly 7%. The scale of these repurchases has placed Pump.fun among the most aggressive token buyback programs in the crypto market.

Platform Redirects All Revenue Into Daily Token Buybacks

Pump.fun launched in January 2024 as a platform on Solana that allows users to create and trade memecoins. It collects revenue through token creation fees and a 1% fee on trades.

In July 2025, the project introduced a policy to use 100% of platform revenue for buying back its native token, PUMP. The aim is to create scarcity and tie token value directly to platform activity. Every time a token is launched or traded on Pump.fun, part of the fees go back into the market to reduce PUMP’s supply.

Since the program began, Pump.fun has consistently spent between $2 million and $3 million per day on buybacks. On September 16, the program reached a daily high of $3.33 million. The cumulative total crossed the $100 million mark on September 17, just 65 days after the initiative started.

At current prices, this equals more than 24 billion tokens removed from circulation at an average buyback cost of $0.004246.

Wallet Count Nearly Doubles as Holders Top 93,000

The number of wallets holding PUMP token has also grown sharply. There are now nearly 94,000 unique holders, up from fewer than 50,000 in mid-July. Most wallets hold small amounts, often under 10,000 tokens. But whales — wallets holding more than 100 million PUMP — still account for about 6.6% of supply.

This shows that while retail adoption is expanding, large holders remain a risk because their selling could offset the impact of buybacks.

Pump.fun has generated nearly $800 million in total revenue since launch. But revenue is not stable. In late July and early August, daily income fell to about $1.7 million. It later recovered to $2–3 million per day, but the fluctuations raise questions about how sustainable the buyback program will be in the long term.

Because all repurchases depend on fees from trading and launches, any slowdown in Solana memecoin activity could reduce buyback power.

Pump.fun Buybacks Outpace Binance and Shiba Inu Burn Models

Other platforms and tokens also use supply-reduction strategies. Binance uses quarterly burns for BNB, while Shiba Inu relies on community-driven burns. But Pump.fun’s program stands out because it spends all of its daily revenue on repurchases, rather than a fraction.

Competition has also emerged. LetsBonk.fun briefly challenged Pump.fun in user activity but has since lost ground. Pump.fun currently holds more than 90% of Solana memecoin listings, which secures its revenue base for now.

PUMP Rally Faces Profit-Taking Risk as Momentum Stretches

The PUMP token has rallied strongly since the buyback program began. After dropping below $0.003 in late July, it has risen to trade around $0.00804. It briefly tested highs near $0.009 but failed to break through.

Charts show resistance at $0.009. If bulls can close above this level with strong trading volume, the next target could be $0.0105. On the downside, support lies near $0.008, with stronger zones at $0.0074 and $0.0063.

The Relative Strength Index (RSI) is above 70, placing PUMP in the overbought zone. This suggests the token may face short-term profit-taking before another attempt higher.

Pump.fun’s buyback strategy has removed nearly 7% of supply in just over two months. The program has restored confidence, increased the number of holders, and lifted PUMP price from its summer lows.

But risks remain. Daily buybacks depend on volatile revenue, whales hold a sizable share of tokens, and regulators are paying close attention. Whether PUMP can surge beyond $0.009 will depend on continued user activity and the ability of buybacks to outweigh profit-taking and external pressures.