A fresh round of scam allegations hit Pump.fun’s fast-growing “streamer” meta over the past 24 hours. Community posts and dashboards tracked creator activity alongside sudden drawdowns in several high-profile tokens, reviving claims of pump-and-dump behavior. Commentary centered on how rapid launches and short holding periods can leave late buyers exposed.

Bagwork, a streamer cohort that drew heavy traffic this week, faced scrutiny after an NFT link appeared and was later removed. The group’s BAGWORK token reached an all-time high near $52 million before dropping about 90%, according to recaps that aggregated on-chain charts and creator-fee data. The sequence intensified accusations across social channels.

At the same time, creator payouts accelerated under Pump.fun’s “Project Ascend.” Recent tallies show weekly creator claims in the mid-eight figures and millions over a single day as dynamic fees channeled more revenue to streamers. The payout cadence remained a key backdrop to the surge in new launches drawing scam chatter.

Influencer launches intensify scrutiny

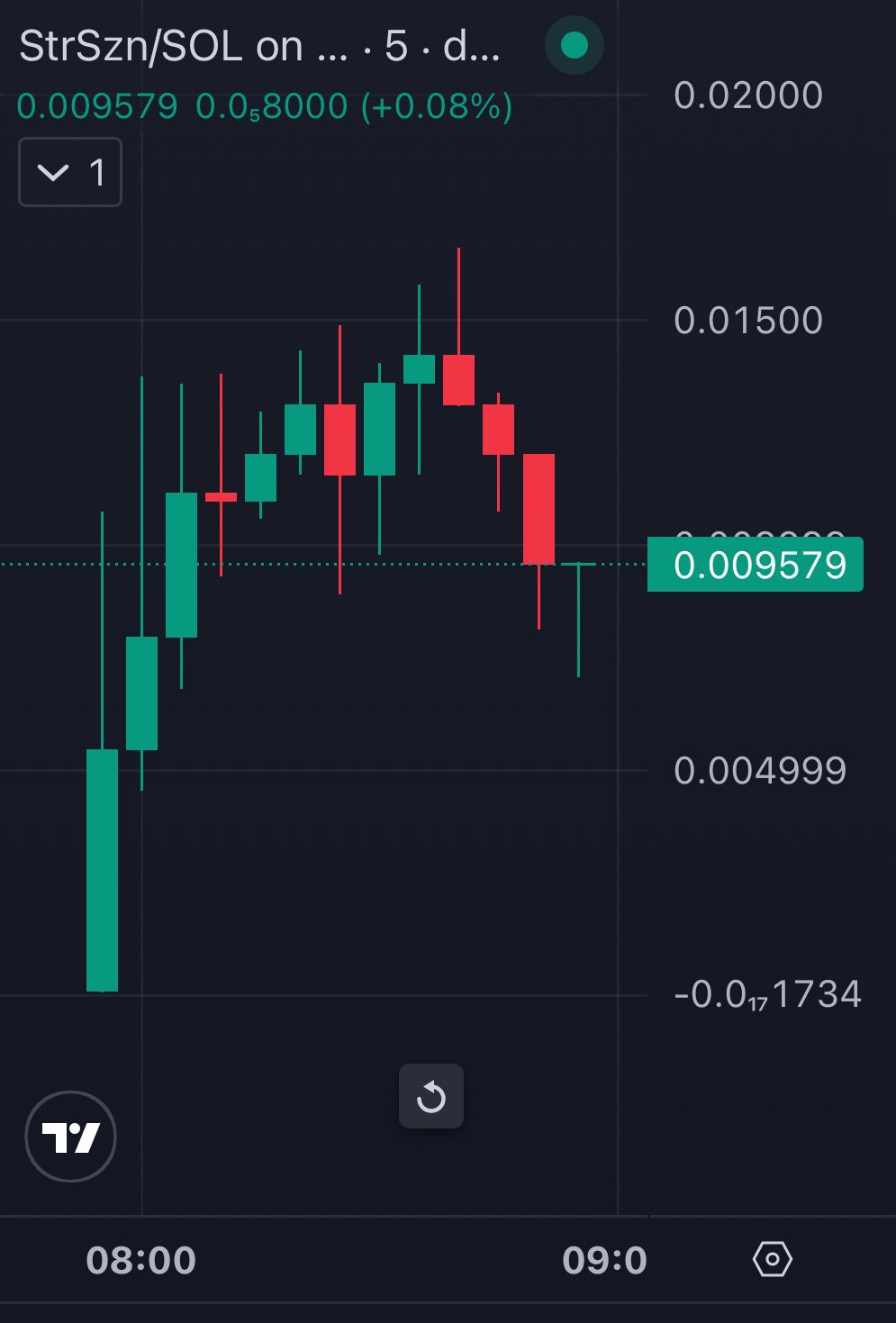

Meanwhile, influencer coins amplified the pressure. On Sept. 15, Alex Becker’s Stream SZN token spiked to a reported ~$19 million market cap within an hour before trading turned choppy, according to launch-day recaps. The outsized opening and quick reversal fed comparisons to classic pump-and-dump patterns voiced by traders.

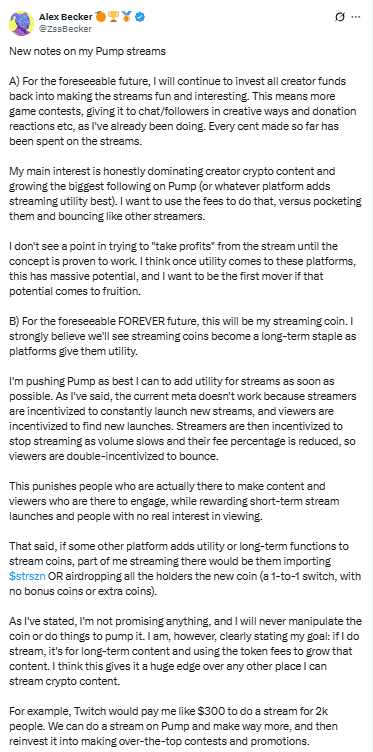

Becker posted that he funneled streaming proceeds back to smaller creators and cautioned followers about risk, while the token’s public page showed heated debate over holdings and early “sniper” activity. The exchange of claims and counter-claims kept attention on streamer coins’ mechanics rather than long-term plans.

Despite the turbulence, fee data and platform metrics show continued throughput from creator coins launched during the streamer rush. That throughput—measured in creator claims and session volume—remained elevated even as allegations of coordinated dumps resurfaced.

Phishing and impersonation scams ride the trend

Separately, security teams flagged fresh waves of impersonation sites and a bogus “$PUMP airdrop” designed to connect users to wallet-draining contracts. Removal guides published in late August and earlier this summer described active lure pages and advised against granting approvals on copycat domains.

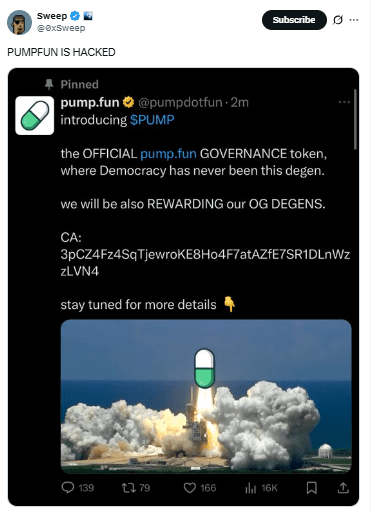

Earlier in 2025, Pump.fun’s official X account was briefly hijacked to push a fake “governance token,” prompting industry-wide warnings not to click links from the compromised handle. That compromise remains relevant as scammers piggyback on streamer-related spikes in attention.

Other incidents underscored the broader threat surface around the ecosystem, including a January supply-chain attack on a third-party tool used by some Solana traders that enabled wallet drainers. Advisories linked the malware to Windows builds and urged users to rotate keys.

Prior research underlines elevated risk

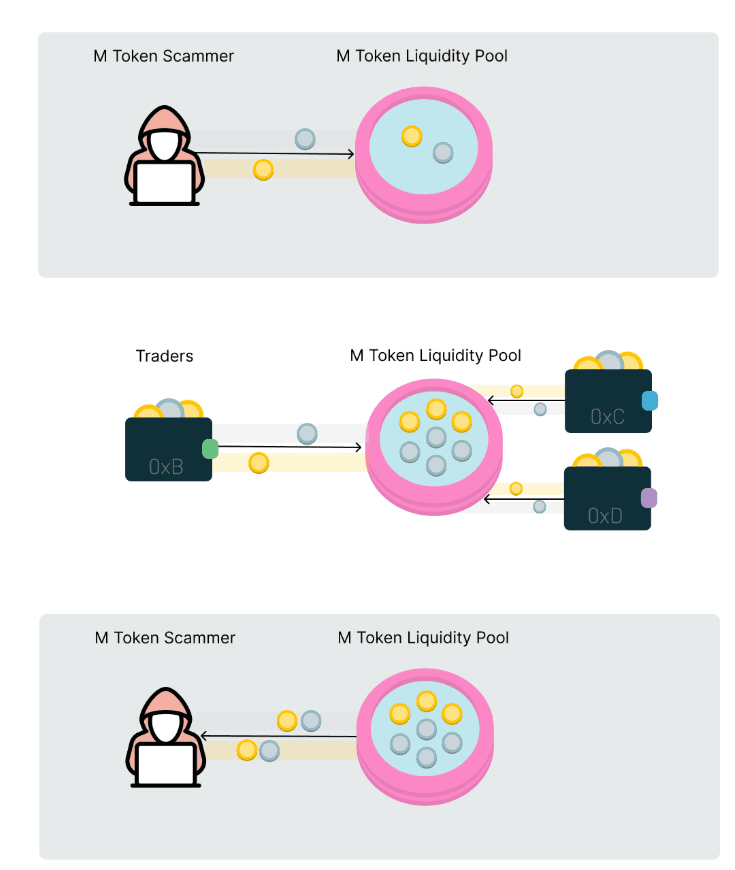

Risk-monitoring research published this year found that the vast majority of tokens launched via Pump.fun showed fraud or soft-rug traits during the study period, with only a small fraction retaining minimal liquidity. Coverage of the findings placed the share at roughly 98.6% across millions of launches.

The same analyses flagged similar manipulation signals in a large share of liquidity pools on Solana’s Raydium, framing Solana-based meme-coin activity as especially vulnerable to exploitative patterns. Compliance briefings positioned those metrics as a case for stronger surveillance.

While platform backers argue most meme coins trend toward zero over time regardless of venue, the current streamer surge has renewed focus on safeguards, disclosures, and the speed with which retail flows concentrate in creator-driven launches. As September’s streamer cohort expands, those questions remain central to non-price coverage.