Ripple said it will donate $25 million of its Ripple USD (RLUSD) stablecoin to two U.S. nonprofits, Accion Opportunity Fund and Hire Heroes USA. The firms will receive the funds via The Giving Block. Ripple framed the move as a way to push digital-asset rails into mainstream philanthropy.

The company added that the transfer will occur in RLUSD rather than cash. Therefore, the nonprofits will interact with wallets and exchange infrastructure as part of the grant flow. Ripple said this design gives the recipients operational experience with crypto while moving funds quickly. Ripple

Coverage from financial media reiterated the figures and counterparts and noted the gift’s focus on small-business lending and veteran employment programs. The company put the announcement out on Sept. 15–16.

XRPL’s on-chain identity “Credentials” goes live

The XRP Ledger activated the “Credentials” amendment on Sept. 4 after reaching validator supermajority. The upgrade adds a native, standards-aligned identity layer intended to support KYC/AML-aware workflows on-chain. Time of activation was reported as roughly 03:51:21 UTC.

XRPL’s developer materials describe Credentials as a framework for issuing, holding and verifying attestations that map to W3C Verifiable Credentials, adapted for XRPL accounts. RippleX previously detailed how Credentials can pair with “Permissioned Domains” to enable compliance-driven use cases.

XRPL.org’s release notes list Credentials among recent amendments shipped with core server updates. The amendment then proceeded through the standard voting and activation process before turning on this month.

XRPL EVM adoption advances as Rabby adds support

Rabby Wallet integrated the XRPL EVM chain in mid-September, enabling users to connect to XRPL’s Ethereum-compatible environment from within Rabby. The integration was built with Peersyst, the team behind the XRPL EVM sidechain.

The wallet addition arrives after XRPL EVM launched on mainnet this summer. The sidechain brings full EVM smart-contract support to the XRPL ecosystem while maintaining bridges to the main ledger. Project materials date the mainnet debut to June 30.

Peersyst and community posts have since highlighted growing developer activity around the EVM environment. The Rabby step therefore expands end-user access while the ecosystem onboards tools and dapps.

Swell 2025 set for New York on Nov. 4–5

Ripple’s annual Swell conference returns to New York City on Nov. 4–5, 2025. The public agenda lists a welcome reception on Nov. 3 followed by two days of programming. The company positions Swell as its flagship policy-and-payments forum.

Registration windows and session blocks are published on Ripple’s event site. The schedule shows full-day programming across both dates, with networking events in the evenings.

The timing puts Swell on the calendar after the fall spate of crypto industry events, giving Ripple a platform to outline roadmap updates following the September XRPL changes.

Accelerator program targets builders with grants up to $200K

Ripple and Swiss accelerator Tenity announced an XRPL Accelerator cohort centered in Singapore, running on a 12-week cadence starting September 2025. Program materials state that selected teams can receive up to $200,000 in non-equity funding tied to milestones.

XRPL community pages and Tenity’s site describe the accelerator’s structure, with mentorship and investor access alongside the grants. Prior demo days and cohorts in Singapore set the template for this year’s run.

Ripple and partners say the cohort focuses on real-world asset tokenization, institutional DeFi and AI-blockchain intersections. Applications for the fall window closed in August, with the program spanning September through November.

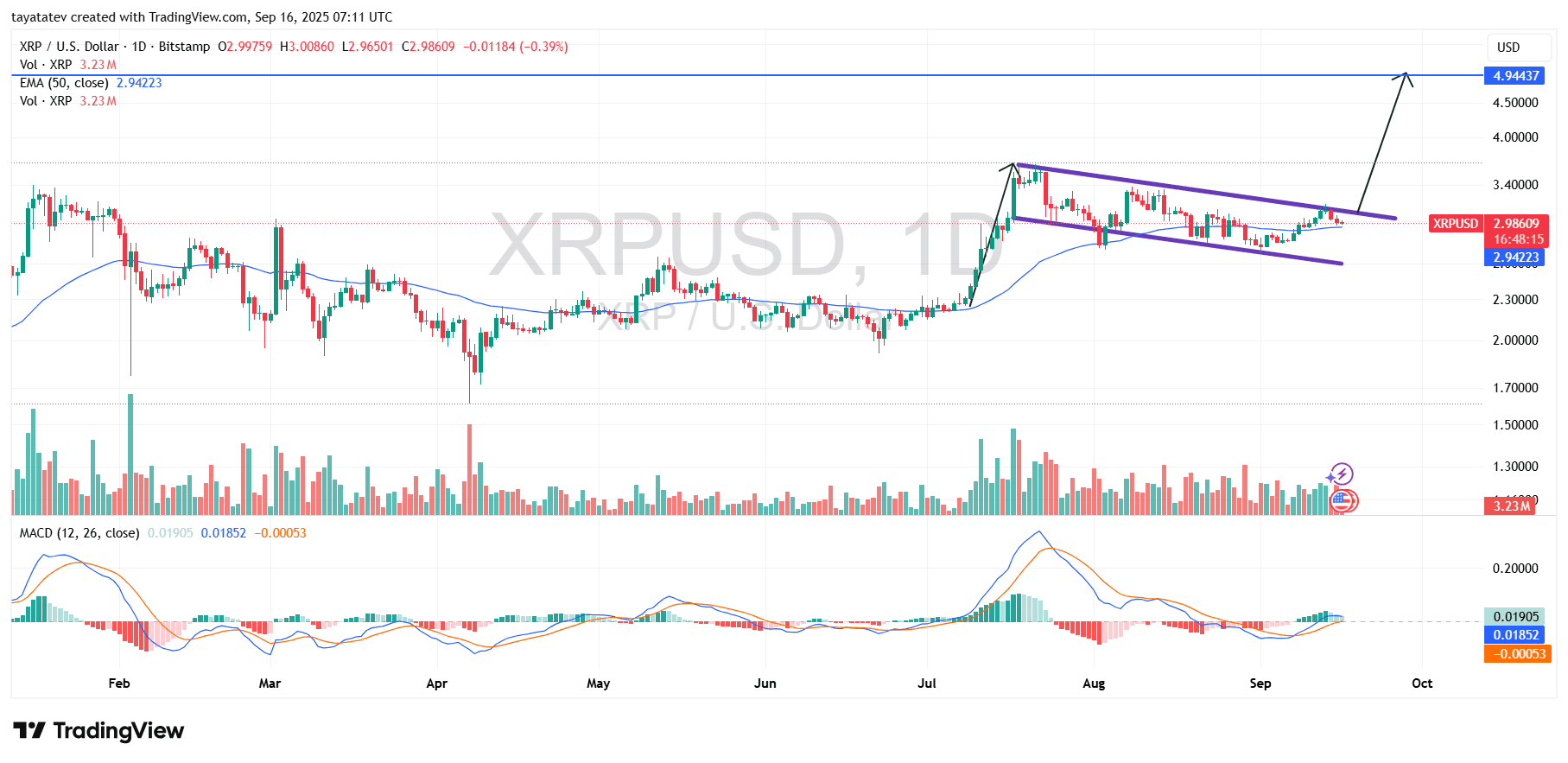

XRP forms bullish flag; 65% breakout path points to $4.93

On September 16, 2025, the XRP/USD daily chart shows a bullish flag. A bullish flag is a pattern where price surges in a sharp “flagpole,” then consolidates inside a gentle, downward-sloping channel before attempting a continuation breakout. If XRP confirms with a daily close above the flag’s upper trendline near $3.35 on rising volume, the setup signals continuation.

The chart aligns with that script. Price rides just above the 50-day EMA around $2.94, while the consolidation channel narrows and volume fades, which often precedes resolution. The MACD lines have turned up and crossed with a positive histogram, indicating momentum rebuild as price presses the upper boundary.

Confirmation would open the measured-move path. From the current price around $2.99, a 65% continuation implies a target near $4.93. Traders often validate the move with expanding volume and a strong daily close through resistance; failing that, immediate support sits at the 50-day EMA, with the lower flag line as the invalidation zone.

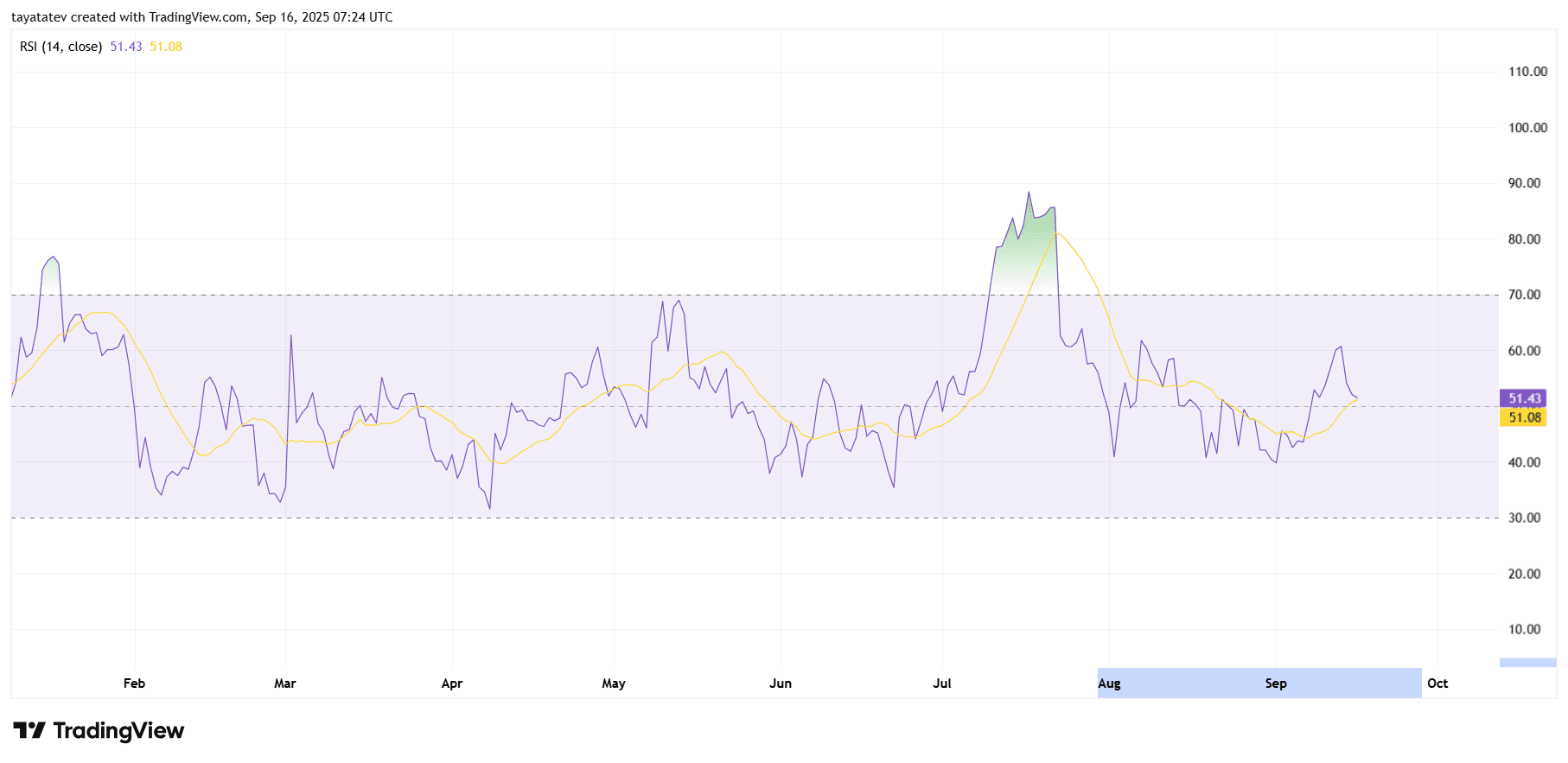

XRP RSI reclaims 50; momentum turns constructive

On September 16, 2025, XRP’s 14-day RSI reads 51.43 with its signal near 51.08. The oscillator has crossed back above the 50 line and above its signal. That shift marks a move from neutral to mildly bullish momentum on the daily timeframe.

The chart shows context. RSI surged into overbought in late July, then cooled through August and early September. However, it now prints higher lows and a clean upside cross of the signal. As a rule, holding above 50 supports trend continuation. Therefore, this reclaim favors follow-through if price strength persists.

Confirmation still matters. A steady rise toward the 60–65 zone would validate improving momentum. Volume and price closes should align with the RSI slope to sustain the regime. If RSI slips back under 50 and loses the signal line, momentum turns neutral again. In that case, support levels on price take priority over the single indicator.