Singapore’s FOMO Pay enabled Ripple’s USD-backed stablecoin RLUSD for merchant and cross-border transactions today. The firm is a licensed Major Payment Institution under the Monetary Authority of Singapore. It framed RLUSD as enterprise-grade and suitable for settlement.

The rollout adds a fiat-stablecoin rail in a region where stablecoin use in trade and treasury is rising. FOMO Pay already offers multi-currency collection and payout services across Asia, so RLUSD plugs into existing merchant flows.

Additionally, third-party trackers and crypto outlets flagged the integration across industry feeds this morning, underscoring near-term merchant availability rather than a future pilot.

i-payout switches on Ripple rails in US and Canada

Global disbursements company i-payout said its cross-border payout stack now uses Ripple in the United States and Canada. The company targets merchant settlements, freelancer earnings, and treasury payouts across platforms.

The firm also outlined next steps: add RLUSD stablecoin payouts as it expands beyond North America. That plan positions RLUSD alongside existing fiat routes for faster settlement and reconciliation.

Because i-payout already operates at platform scale, the integration moves Ripple usage from proof-of-concept to live production for mainstream payout scenarios.

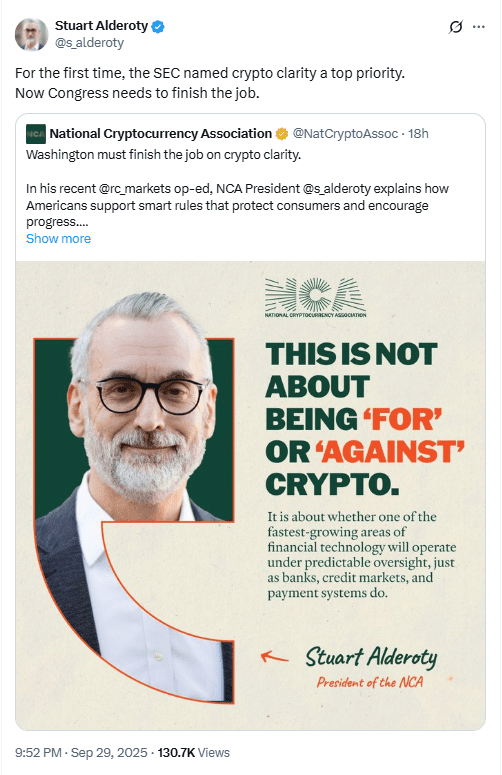

Ripple’s legal chief presses Congress for clear rules

Ripple CLO Stuart Alderoty urged US lawmakers today to “finish the job” on comprehensive crypto legislation. He cited polling that Americans both use crypto and want stronger protections, and he warned about talent flight without clarity.

He framed clarity as consistent with the SEC’s investor-protection mandate rather than at odds with it. In his remarks, he placed the debate in a mainstream policy context, not a niche industry ask.

Multiple outlets carried the comments, keeping the policy push in the daily news cycle as Congress weighs broader digital-asset packages.

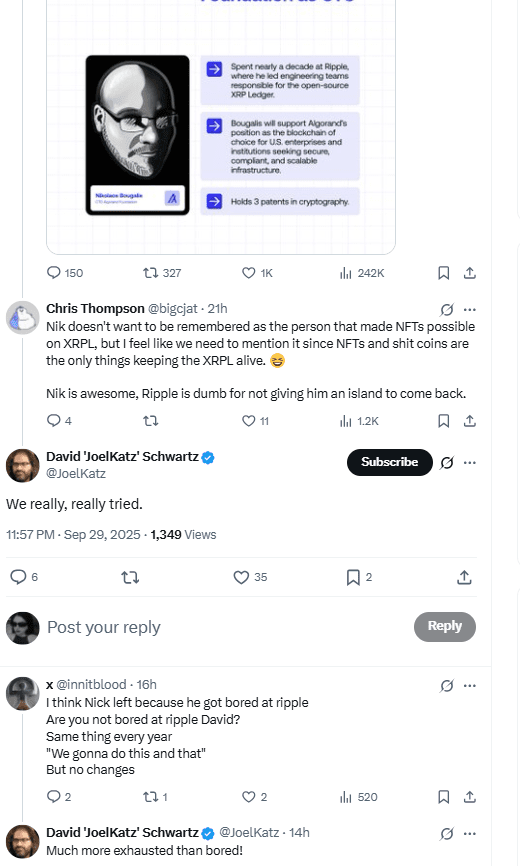

Talent move: ex-XRPL lead joins Algorand; CTO responds

Former XRP Ledger lead engineer Nik Bougalis joined Algorand. His move drew quick attention across XRPL and broader Layer-1 circles.

Ripple CTO David Schwartz publicly acknowledged the change and addressed speculation around internal departures. The exchange aimed to steady community narratives while highlighting ongoing XRPL development.

While individual moves are common across open-source ecosystems, today’s shift matters for teams that rely on Bougalis’s cryptography and protocol experience.

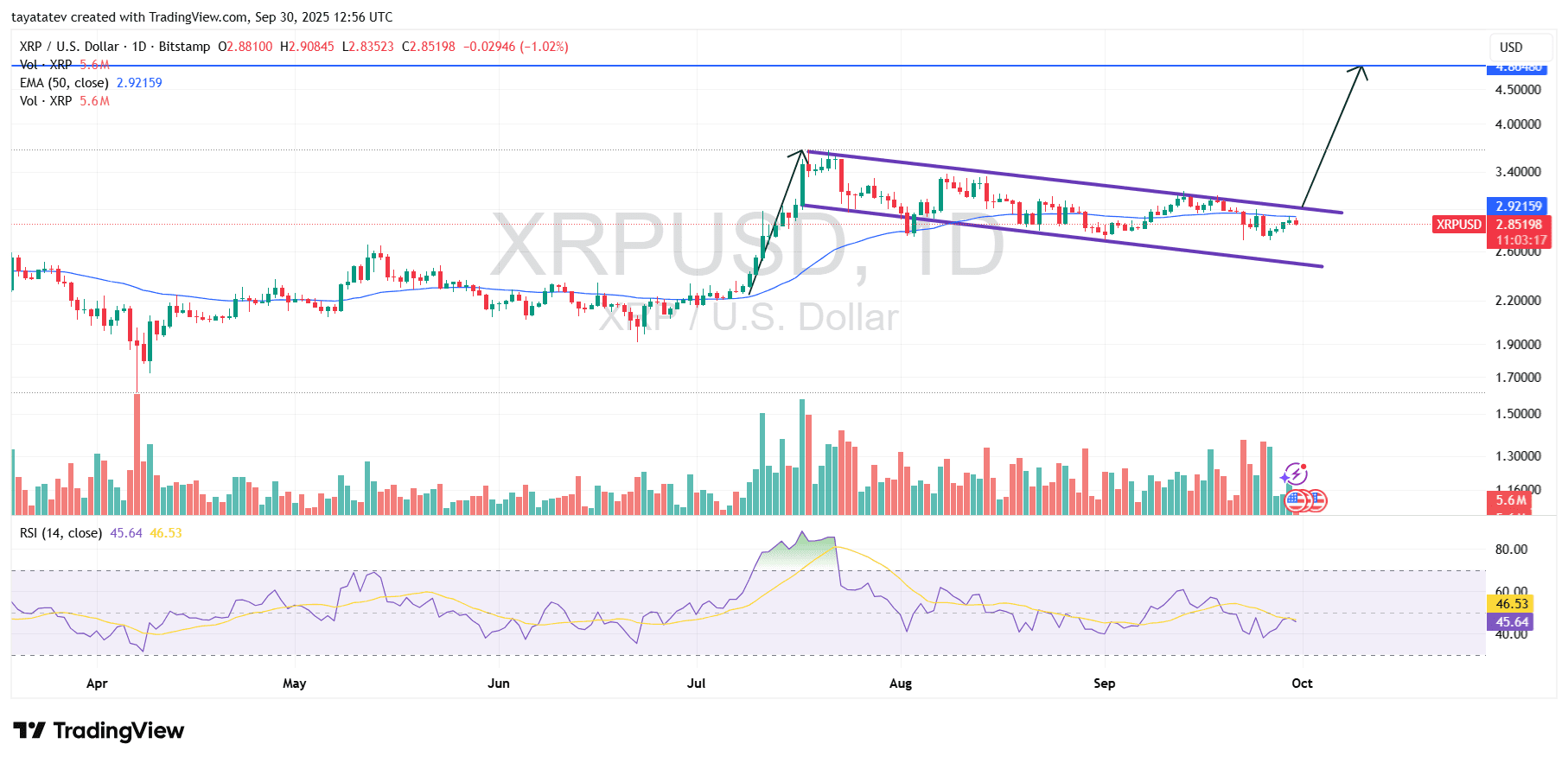

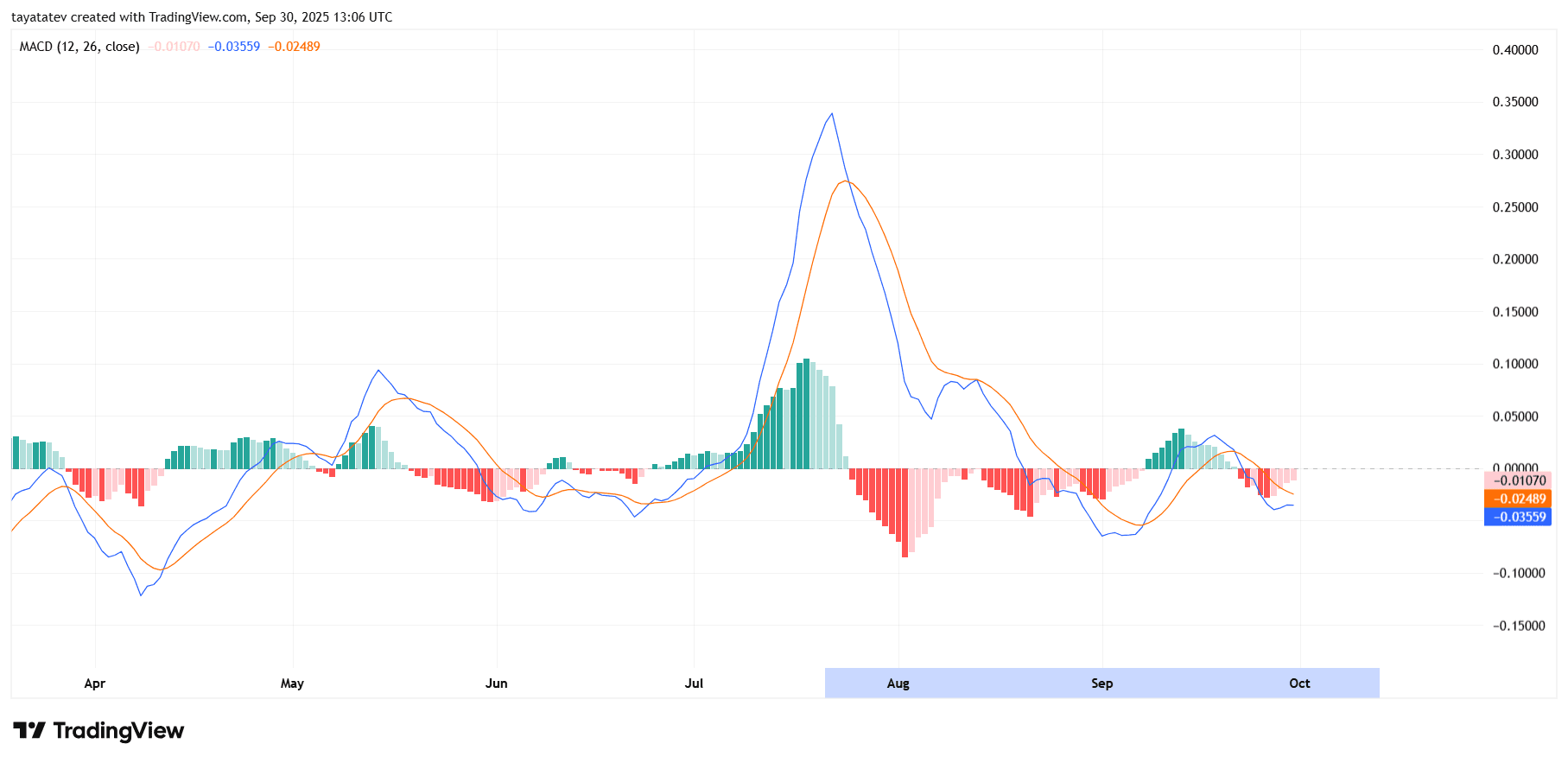

XRP chart signals bull flag pattern

The XRP chart on the three-day timeframe shows a sharp rally followed by a consolidation channel sloping downward. This structure matches the textbook definition of a bull flag, where price cools after a surge but stays within a controlled range.

In this case, XRP peaked near the $3 zone in late summer and has since moved between two parallel downward-tilting trend lines. The formation reflects selling pressure being absorbed while the broader uptrend remains intact. Analysts often see such patterns as pauses rather than reversals, with the prior rally acting as the flagpole and the narrowing channel forming the flag.

Confirmation depends on a breakout. If XRP breaks above the upper trend line with volume, it would validate the bull flag setup and point to continuation toward higher resistance zones. A failure to hold the lower boundary, however, could invalidate the pattern and return focus to earlier support levels.