Ripple moved on multiple non-price fronts today. An engineering lead outlined a privacy roadmap for the XRP Ledger (XRPL). Meanwhile, banking and capital-markets moves advanced with DBS and Franklin Templeton listing a tokenized fund alongside Ripple’s RLUSD on XRPL. In parallel, XRPL’s EVM sidechain—live since June—continues to pull in developers seeking Ethereum compatibility.

XRPL sets a privacy track to court institutions

Ripple senior engineer J. Ayo Akinyele said the goal is to make XRPL “the first choice for institutions,” and the path runs through privacy and compliance at the protocol layer. He pointed to zero-knowledge proofs and confidential multipurpose tokens as the key instruments to enable private, auditable transactions. The plan targets sensitive use cases like tokenized funds and on-chain credit without exposing counterparties or strategies.

In practice, the design aims to provide verifiable math rather than trust in intermediaries. Zero-knowledge proofs can attest to balances or eligibility without revealing underlying data, while confidential tokens keep transaction details shielded yet compliant. That combination addresses persistent institutional blockers such as frontrunning and information leakage.

The roadmap frames a 12-month build window, with staged releases to harden privacy features alongside existing XRPL components like its native DEX and payments rails. For institutions, the sequencing matters: they can test limited scopes first, then expand usage as cryptographic assurances and operational tooling mature.

DBS pairs Franklin Templeton’s tokenized MMF with RLUSD on XRPL

DBS said it will list Franklin Templeton’s sgBENJI—tokens representing a U.S. dollar money-market fund—together with Ripple’s RLUSD on the DBS Digital Exchange. Eligible clients will be able to trade between the two, and DBS is exploring using sgBENJI as collateral for credit on its platform or third-party venues where the bank acts as collateral custodian. Franklin Templeton will issue the sgBENJI token on XRPL.

This setup gives institutional users a path to move between a dollar stablecoin and a tokenized fund inside the same settlement environment. In stressed markets, that ability to pivot quickly—while staying on XRPL—can reduce operational steps and preserve audit trails for risk teams. It also broadens RLUSD’s role beyond payments into portfolio rebalancing and secured financing.

Moreover, listing on a regulated venue like DDEx signals how tokenized securities and stablecoins may co-exist under bank oversight. The model could become a template for other banks evaluating tokenized funds and stablecoin pairs as inventory, collateral, or liquidity tools.

Ripple’s U.S. bank-charter bid seeks direct access to Fed rails

Ripple has applied for a U.S. national bank charter, according to filings confirmed in July. The company is also pursuing a Federal Reserve master account to hold RLUSD reserves directly and connect to Fed payment systems. If approved, those steps would place RLUSD squarely inside the U.S. banking perimeter and simplify reserve management and settlements.

A charter would centralize supervision under the Office of the Comptroller of the Currency, aligning Ripple with a path that a small set of crypto firms have taken. For counterparties, bank-level regulation can lower operational hurdles around due diligence, particularly for stablecoin usage in payments, custody, and collateral operations.

The master-account effort matters separately. Direct Fed access can shorten settlement chains and reduce reliance on correspondent banks, especially for high-frequency treasury operations tied to stablecoin minting and redemption. The decision ultimately sits with the Federal Reserve, which has historically approved few non-traditional applicants.

XRPL’s EVM sidechain broadens the developer funnel

XRPL’s EVM sidechain went live on mainnet on June 30, 2025, bringing Ethereum-compatible smart contracts to the XRP ecosystem. Developers can deploy Solidity dapps with bridges to the main XRPL, keeping XRP and XRPL assets portable across environments. The launch targets builders who want Ethereum tooling while tapping XRPL’s payments and throughput profile.

Since launch, the sidechain has focused on compatibility and low-friction onboarding: Metamask support, familiar dev tools, and documentation that mirrors EVM norms. This approach reduces switching costs and invites existing Ethereum projects to extend to XRPL without major rewrites.

For institutions watching tokenization and stablecoin rails, the sidechain provides optionality. They can keep business logic in Solidity while settling value on XRPL, or combine EVM contracts with XRPL’s DEX and payment features. That flexibility aligns with the broader privacy and banking efforts now unfolding around the ledger.

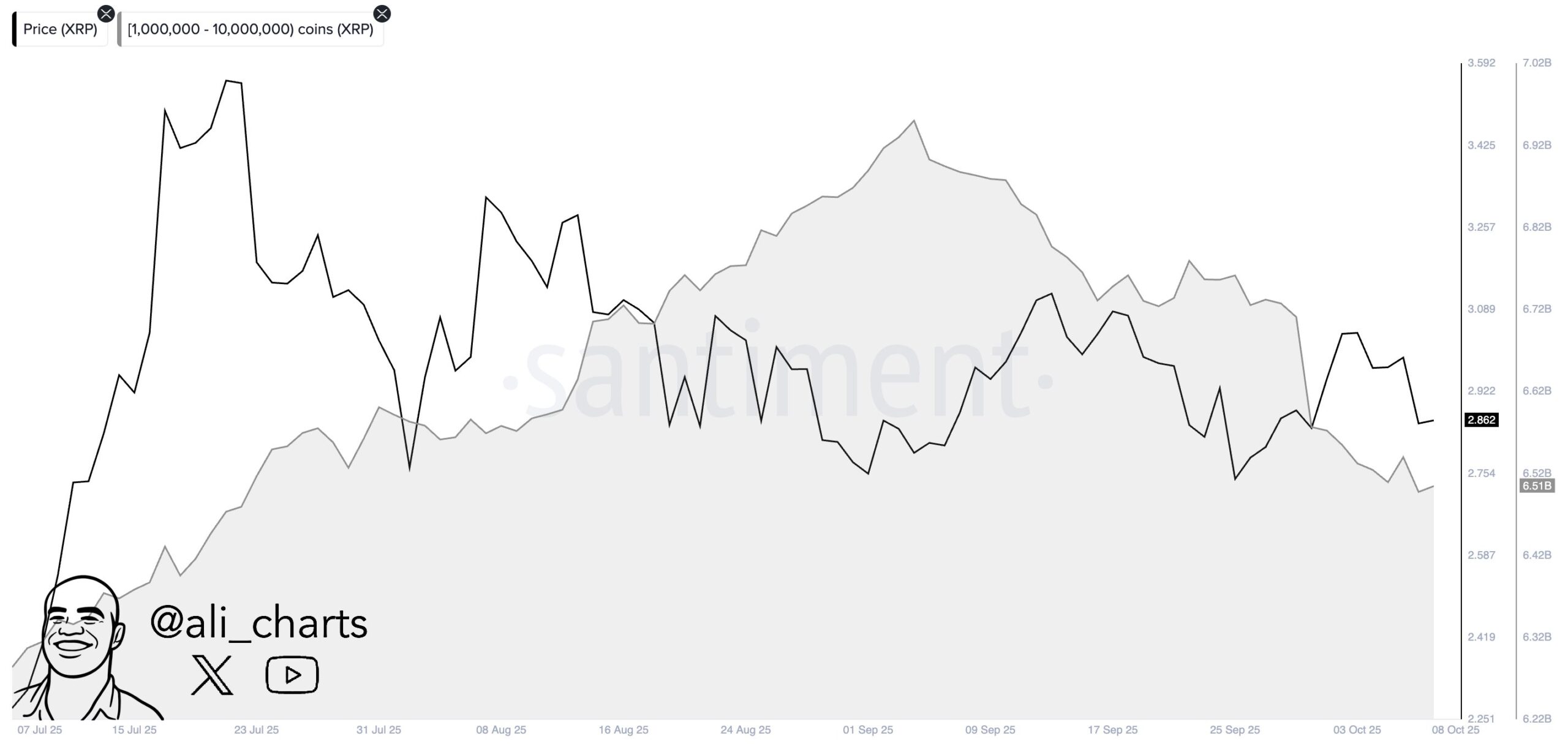

Whale wallets reduce holdings on XRP

Whale Distribution Shift on XRP. Source: Ali Charts, Santiment. The chart tracks the one to ten million XRP cohort over the last month. It shows a net decline of about 440 million XRP held by these addresses. The shaded area marks cohort supply, while the line traces its day to day path.

The data signals distribution by mid sized whales rather than accumulation. Holdings in this band trended lower through September into early October. Transfers likely moved to exchanges or OTC venues, since supply inside the cohort fell. The chart does not show smaller cohorts, so total network ownership may have shifted rather than exited entirely.

Context matters for interpreting intent. Reduced balances in this range can reflect profit taking, treasury rebalancing, or internal wallet reshuffles. However, the persistent decline across weeks points to steady distribution. Additional on chain markers such as exchange inflows and address migration would clarify whether the selling pressure continued beyond this snapshot.

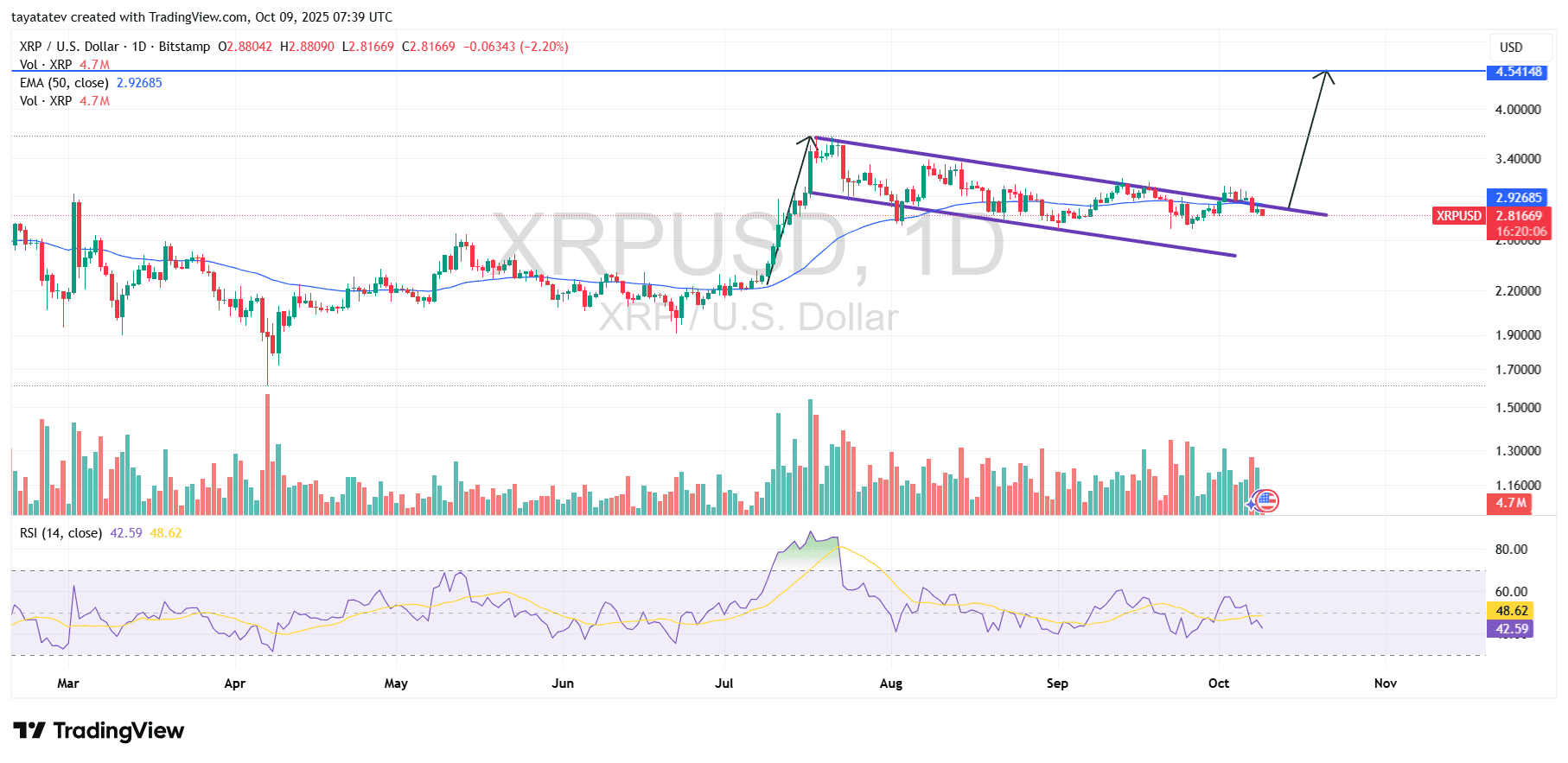

XRP daily chart shows bullish flag on October 9 2025, measured move points to 4.56 dollars

XRPUSD 1D on Bitstamp, TradingView timestamp 07:39 UTC on October 9 2025, shows a completed flag structure after the July surge. Price now sits near 2.82 dollars while the 50 day EMA prints 2.93 dollars. Meanwhile, RSI 14 reads 42.6, so momentum remains neutral to soft.

A bullish flag forms when a strong advance creates the flagpole and a downward sloping channel digests gains. The pattern reflects controlled pullbacks inside parallel lines as early buyers lock profits and new buyers rotate in. Therefore, a decisive breakout through the upper boundary typically signals continuation of the prior advance.

Here, the channel drawn from the late July peak tilts lower and compresses volatility into early October. Confirmation requires a daily close above the flag top around 2.95 to 3.00 dollars with rising volume and follow through back above the 50 day EMA. Consequently, a clean breakout and hold would validate the continuation setup.

If confirmed, the measured move implies about 62 percent upside from the stated price near 2.82 dollars. That projection places a target around 4.56 dollars, broadly consistent with the marked resistance band on the chart. Additionally, sustained acceptance above 3.00 dollars would keep the path open toward that objective while failure back inside the channel would defer the signal.