The crypto market continues to evolve as investors search for the best crypto to buy now, but not all top coins are showing strong momentum. Ripple (XRP), once a dominant player in the payments sector, is now facing stiff competition from new decentralized finance (DeFi) projects offering more flexible opportunities and higher potential returns. Among these, Mutuum Finance (MUTM) — a new crypto coin — is catching attention for its yield-generating protocol and rapid growth.

Ripple (XRP)

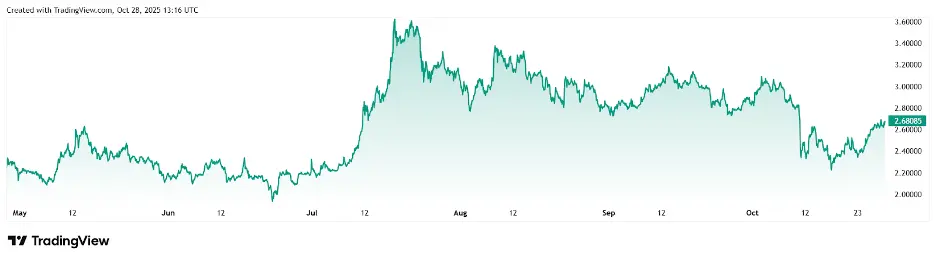

Ripple (XRP) currently trades around $2.67, maintaining a market cap near $150 billion. Despite being one of the most established cryptocurrencies, XRP’s price has been consolidating for weeks under key resistance zones at $2.80 and $3.00. While it remains a top choice for cross-border transactions, analysts note that its upside potential is limited in the short term.

The primary issue with XRP’s growth lies in its massive market cap. For a token already valued in the hundreds of billions, achieving double or triple-digit gains becomes difficult. Investors seeking higher upside are increasingly turning toward new crypto projects priced under $1 — where early-stage entry can multiply returns several times over.

Even though Ripple continues to make progress with partnerships and institutional integrations, its ecosystem lacks the dynamic yield and decentralized innovation that newer projects like Mutuum Finance bring to the market.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is an emerging DeFi crypto project developing a decentralized lending and borrowing protocol designed to maximize transparency and yield efficiency. Unlike traditional platforms, it uses two core systems that define its functionality.

Its Peer-to-Contract (P2C) system enables users to deposit major tokens such as ETH and USDT into liquidity pools, earning mtTokens in return. These mtTokens act as yield-bearing receipts that automatically accrue interest over time. For example, a user depositing 1 ETH would receive 1 mtETH, which increases in value as lending activity grows — offering a transparent and self-sustaining yield model.

The Peer-to-Peer (P2P) side of the protocol allows users to negotiate direct lending agreements for niche or less-liquid assets. Borrowers can choose between variable or stable interest rates, with flexible Loan-to-Value (LTV) ratios based on asset volatility. Lower-risk assets like ETH and stablecoins can reach up to 75% LTV, while riskier tokens stay around 35–40%, ensuring safety through overcollateralization and automated liquidations.

This dual approach not only gives users more control but also strengthens the system’s liquidity and risk management — key pillars of Mutuum Finance’s long-term sustainability.

Presale Performance, Audit, and 24-Hour Leaderboard

Mutuum Finance’s presale has been one of the most successful in 2025. The project is currently in Phase 6, where each MUTM token is priced at $0.035. The team has already raised over $18 million, attracted more than 17,550 holders, and sold over 780 million tokens.

The launch price is confirmed at $0.06, meaning phase 1 investors could see a 500% MUTM value increase at listings. Beyond the presale, Mutuum passed a CertiK audit with a strong 90/100 token security score, signaling strong smart-contract reliability.

To further boost engagement, Mutuum Finance introduced a 24-hour leaderboard that rewards the top daily contributor with $500 worth of MUTM tokens. This not only maintains presale momentum but also reinforces transparency and community activity — two key factors analysts highlight as reasons for the project’s growing trust.

V1 Testnet Launch, Stablecoin Vision, and Phase 6 Selling Fast

The next milestone for Mutuum Finance is the V1 protocol launch, set for Q4 2025 on the Sepolia Testnet. This rollout will introduce the full ecosystem — including the Liquidity Pool, mtTokens, Debt Tokens, and Liquidator Bot. The testnet will initially support ETH and USDT for lending, borrowing, and collateral, with more assets planned later.

Another major development in the roadmap is the upcoming USD-pegged stablecoin, which will be overcollateralized by ecosystem loans. It will be minted and burned dynamically, ensuring balance between demand and supply while maintaining long-term stability. This addition not only enhances liquidity but also opens new earning opportunities for lenders and borrowers.

In addition, Mutuum Finance’s planned oracle integration — expected to rely on Chainlink feeds — will provide reliable, real-time price data for liquidation and interest calculations. Analysts say this emphasis on accuracy, transparency, and automation positions MUTM among the most promising DeFi cryptocurrencies to watch heading into 2026.

With Phase 6 selling out rapidly, investors are racing to secure early positions before the next stage raises the token price to $0.04. Whale activity has already been reported, with one notable on-chain purchase of $120,000 worth of MUTM, reinforcing confidence in the project’s growth outlook.

Analysts’ Outlook

Market analysts tracking early DeFi projects believe Mutuum Finance could mirror the early success patterns of Solana. With a well-defined roadmap, sustainable tokenomics, and a growing investor base, some forecasts suggest MUTM could reach between $0.45 and $0.55 in 2026 — representing roughly a 15x potential increase from current presale levels.

As XRP continues to hover below $2.70 with limited upside due to its size, Mutuum Finance offers a fresh, early-stage opportunity under $0.05 — with stronger utility, verified security, and organic demand drivers built into its model.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance