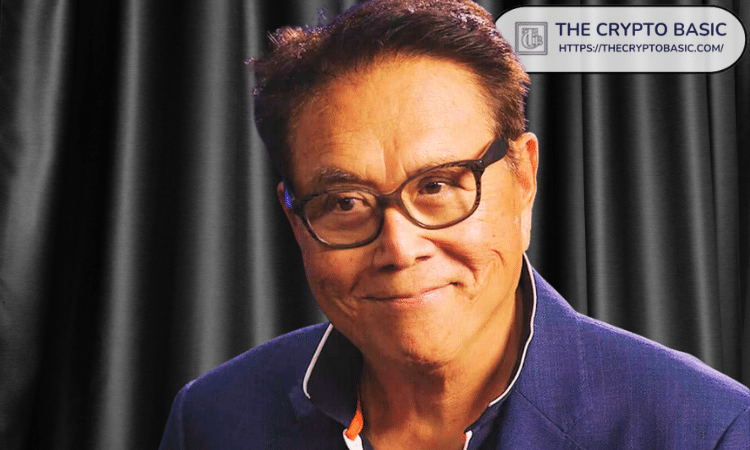

Financial author Robert Kiyosaki has warned that a major stock market collapse is imminent, urging investors to prepare by holding scarce assets like Bitcoin, Ethereum, gold, and silver.

He also revealed plans to continue buying Bitcoin as prices fall.

Key Points

- Robert Kiyosaki warned that a major stock market crash is imminent.

- He urges investors to prepare by holding scarce assets like Bitcoin, Ethereum, gold, and silver.

- Kiyosaki said he plans to keep buying Bitcoin if prices decline further.

- He argues that Bitcoin’s fixed 21 million supply gives it an advantage during periods of monetary instability.

Historic Market Collapse Warning

In a post on X, Kiyosaki references his 2013 book Rich Dad’s Prophecy to highlight a looming financial crisis. He emphasized that investors who are adequately prepared stand to realize substantial gains. Conversely, those who disregard the warning could incur significant losses.

This cautionary outlook sets the stage for his recommended investment strategy, emphasizing preparation as the key to weathering market turbulence.

To that end, Kiyosaki advises acquiring tangible, limited assets during crises. He specifically mentions Bitcoin, Ethereum, gold, and silver, noting he only holds verified, authentic forms.

In particular, he argues that Bitcoin’s fixed supply of 21 million coins gives it a structural advantage in periods of monetary instability. Given that most of that supply has already been mined, Kiyosaki believes scarcity will drive long-term value.

Rather than fearing falling prices, he says he plans to continue buying Bitcoin if the market declines further, viewing panic-driven selloffs as opportunities.

Ultimately, for Kiyosaki, market crashes are not disasters but discounts — moments when, as he puts it, “priceless assets go on sale.”

Contrasting Bitcoin Outlook

However, not everyone shares Kiyosaki’s optimism. Mike McGlone, a strategist at Bloomberg Intelligence, has cautioned that the cryptocurrency market may face deeper losses. Specifically, McGlone suggests that the ongoing unwinding of the crypto bubble could push Bitcoin down as much as 85% from its highs, potentially revisiting the $10,000 level.

Meanwhile, recent market performance highlights that uncertainty. Bitcoin is currently trading around $68,075, down 25.3% over the past three months. While some investors interpret the pullback as a warning sign, Kiyosaki sees it as validation of his long-term approach: volatility, he argues, creates opportunity.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.