- Robinhood Chain logs 4M testnet transactions as developers test new tools on the L2 network

- Activity grows while tokenized assets surge, and on-chain finance gains wider market traction

- Early tests shape expectations ahead of the upcoming Robinhood Chain mainnet launch later

Robinhood Chain closed its first full week of public testing with four million transactions, a figure CEO Vlad Tenev highlighted early Thursday as evidence of quick developer engagement. The network, introduced on February 11 after months of closed trials, is emerging as Robinhood’s most direct step toward a broader on-chain financial ecosystem.

Four million transactions in the first week of Robinhood Chain testnet.

Developers are already building on our L2, designed for tokenized real world assets and onchain financial services.

The next chapter of finance runs onchain.

— Vlad Tenev (@vladtenev) February 19, 2026

Tenev said developers were already experimenting with tools and applications on the layer-2 system, which was built on Ethereum using Arbitrum’s technology stack. The milestone landed at a moment when several trading platforms are exploring tokenized assets, but Robinhood’s approach ties the work directly to its existing retail footprint.

Robinhood Chain: L2 Framework Focused on Tokenized Markets

Robinhood Chain operates as a permissionless Ethereum layer-2 designed to shoulder higher volumes than the base chain can comfortably manage. It batches transactions off mainnet, settles them back on Ethereum, and, in theory, provides the throughput needed for financial applications that behave more like traditional markets.

Company materials indicate that the network is structured to handle tokenized equities, exchange-traded funds, and additional financial instruments. Partners such as Alchemy, LayerZero, and Chainlink are supplying infrastructure ranging from node access to cross-chain messaging. Developers using the testnet are also trialing smart-contract logic and tokenized representations of assets in preparation for a mainnet release expected later in the year.

However, the network’s early traffic does not reveal how many of the four million transactions came from internal stress testing versus external builders. Yet, the volume suggests a degree of interest that extends beyond basic connectivity checks.

Expanding a Broader RWA Strategy

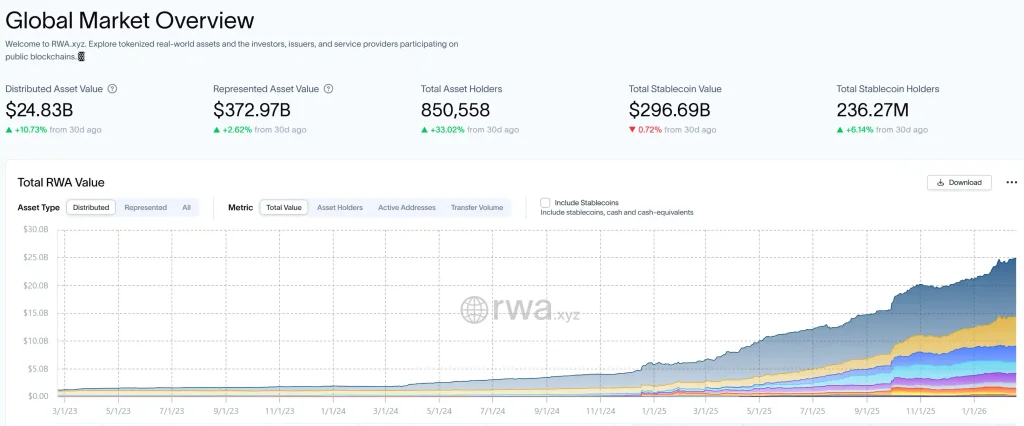

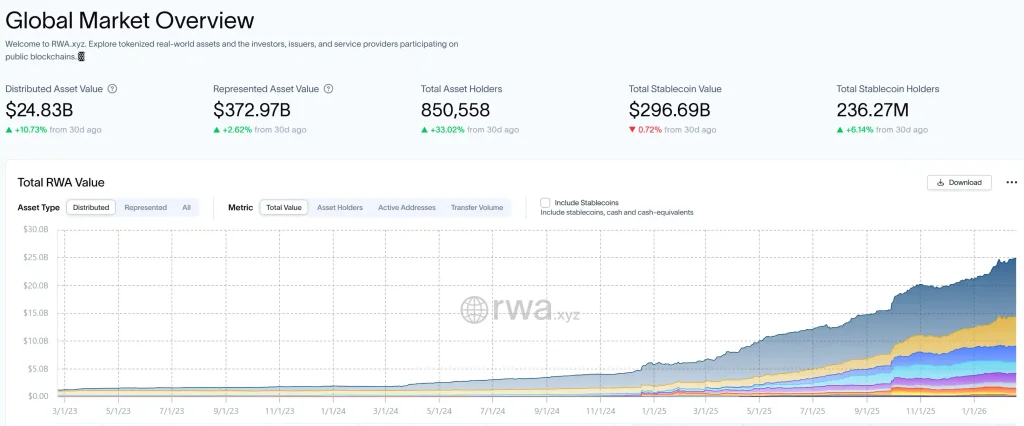

Robinhood Chain arrives as the market for tokenized real-world assets continues to expand. Data from RWA.xyz shows roughly $24.83 billion in tokenized assets issued directly on-chain, a monthly gain of about 10%. When combining that with other digitally represented instruments, the overall category now approaches $372.97 billion.

Real World Asset Market Overview (Source: RWA.xyz)

Real World Asset Market Overview (Source: RWA.xyz)

Wallet adoption is rising as well. Addresses holding tokenized financial products stand at roughly 850,558, up more than one-third in 30 days. Stablecoins, which remain the backbone of many of these systems, hold about $296.69 billion in value spread across 236 million users.

The total value edged lower during the month, although user growth continued to move upward. For Robinhood, the timing is deliberate. The company has already tokenized close to 500 U.S. stocks and ETFs on Arbitrum and has made clear that it sees tokenized markets as a long-term expansion path.

Financial Picture and Market Reaction

The launch also follows a mixed earnings report. Robinhood posted $1.28 billion in net revenue for Q4 2025, a 27% increase from the prior year. Analysts had expected more, and the shortfall came partly from a sharp drop in crypto trading revenue, which fell 38% to $221 million after the October downturn.

Moreover, net income slid to $605 million, down 34% year-over-year, though per-share results came in slightly above forecasts. Meanwhile, reactions to Tenev’s announcement varied across X. Some observers called the testnet volume “interesting but inconclusive,” noting that such numbers often blur the line between real use and automated testing.

4M transactions in week one is seriously impressive. If mainnet holds up under that load, this could be a real on-ramp for retail crypto.

— jobis.eth (@ZorbaLee2) February 19, 2026

Others argued the early traction, if replicated on mainnet, could give Robinhood a meaningful entry point into retail-driven blockchain activity. Critics also questioned whether launching new chains fragments liquidity at a time when developers already concentrate heavily on Ethereum.

For now, Robinhood Chain’s testnet remains the proving ground. With four million transactions logged in week one, the company’s layer-2 experiment is underway, leaving the coming months to show whether developers stay long enough to turn activity into durable applications.