The U.S. Securities and Exchange Commission approved Grayscale’s Digital Large Cap Fund to list and trade as a multi crypto asset ETP, giving investors one ticker for exposure to Bitcoin, Ether, XRP, Solana and Cardano. The decision arrived on Sept. 17, 2025, and marks the first U.S. approval for a multi asset crypto ETP.

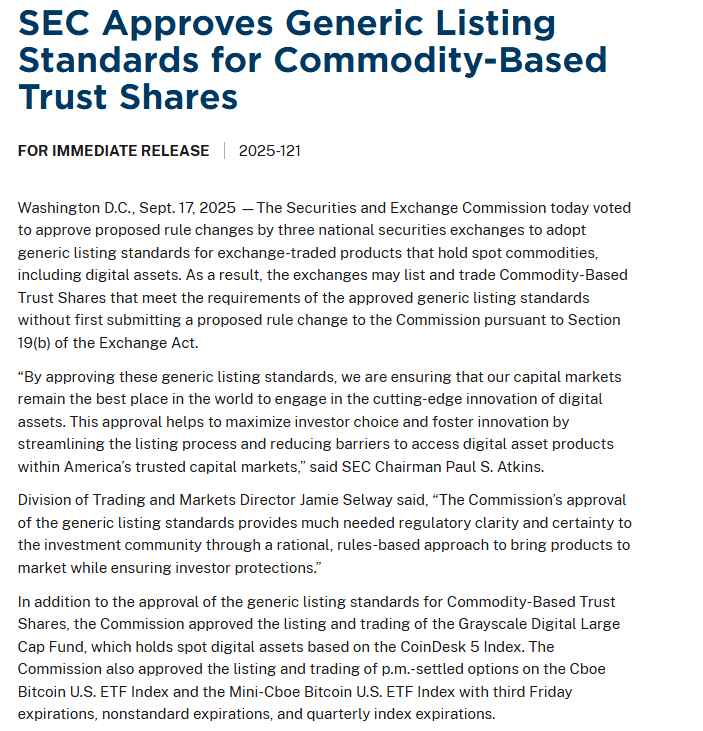

At the same meeting, the Commission adopted generic listing standards for spot commodity ETPs that include digital assets. Exchanges can now list qualifying products that meet the new criteria without filing a separate rule change each time.

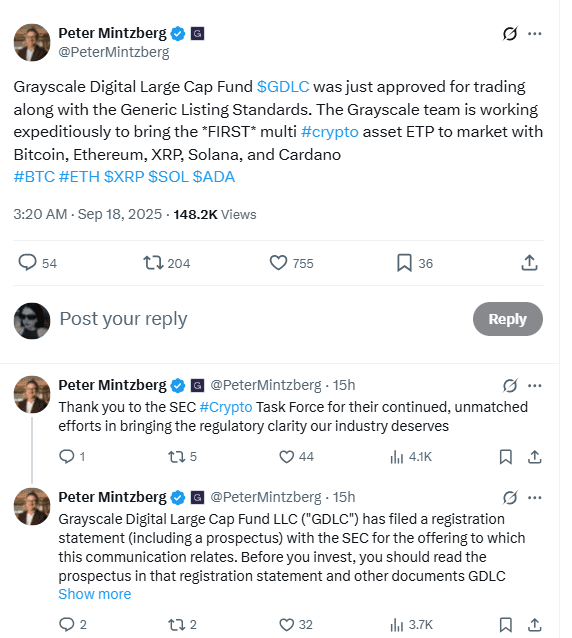

Grayscale CEO Peter Mintzberg announced the approval on X and said the firm would move quickly to bring the fund to market. The product tracks the CoinDesk 5 Index and packages the five largest eligible assets in one portfolio.

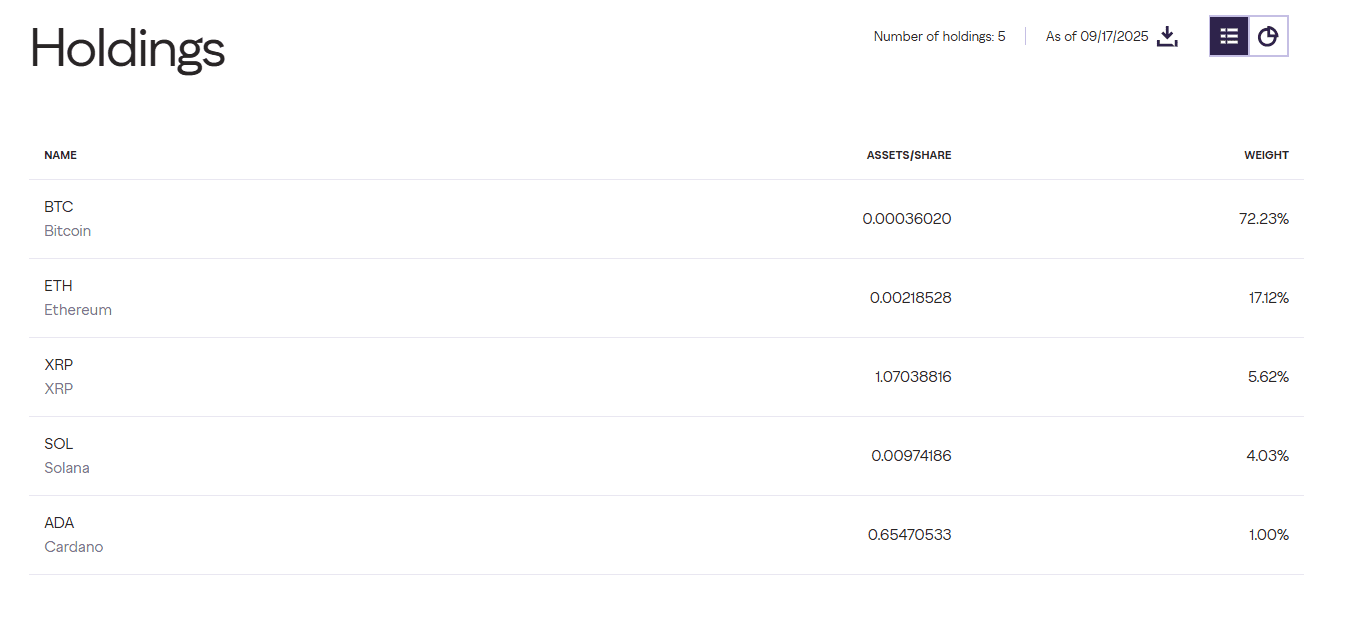

What the “Top 5” fund holds

The Grayscale Digital Large Cap Fund follows the CoinDesk 5 Index methodology. That index selects large cap digital assets that meet liquidity and custody requirements, and it rebalances over time. The fund’s current components are Bitcoin, Ether, XRP, Solana and Cardano.

As of Sept. 17, 2025, Grayscale shows five holdings with published weights on its product page. Bitcoin and ether carry the largest shares, while XRP, solana and cardano make up the rest of the basket. The index provider is CoinDesk Indices.

Grayscale also reports a net asset value of 57.70 dollars per share and about 915.6 million dollars in assets under management on the same date. Those figures update with market conditions and appear alongside the product’s reporting and documents.

New listing standards cut approval time

The SEC’s vote approved generic listing standards that apply to spot commodity ETPs, including those holding digital assets. Under these standards, NYSE, Nasdaq and Cboe can list products that meet defined criteria without a full Commission rule filing each time.

Reuters reports the change reduces the maximum timeline from roughly 240 days to about 75 days. The shift replaces the prior case by case process and opens a clearer path for products beyond bitcoin and ether.

SEC Chair Paul S. Atkins said the decision would maximize investor choice and streamline access to digital asset products in U.S. markets. The agency also cleared p.m. settled options on Cboe bitcoin indexes during the same action.

From a July pause to a final green light

Earlier in the summer, the SEC’s Division of Trading and Markets approved NYSE Arca’s plan to list GDLC under delegated authority. The Commission then stayed that order and set the matter for review, delaying the uplisting while it evaluated comments.

The Sept. 17 Commission vote ends that review and approves both the generic standards and the listing and trading of the Grayscale fund. The action appears in the agency’s press release and associated orders.

Regulatory filings and notices point to NYSE Arca as the listing venue for GDLC under the amended Trust Units rule. That rule update allows Trust Units to reference an index or portfolio of eligible assets.

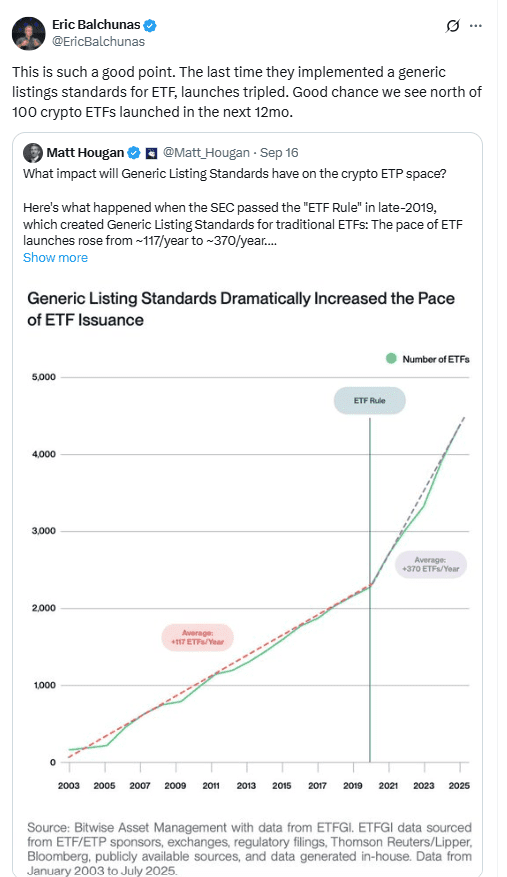

Analysts expect a wave of new filings and launches. Bloomberg’s Eric Balchunas said the last time generic standards arrived for ETFs, launches tripled, and he sees a chance for more than one hundred crypto ETFs within a year.