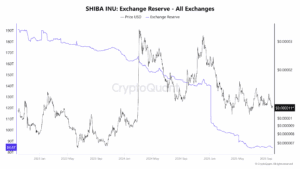

Shiba Inu (SHIB) exchange holdings have dropped to their lowest level since 2023, pointing to accumulation by investors. With fewer tokens on exchanges, the question now is whether or not this setup will lead to a rally in coming days. Let’s examine.

Exchange Reserves at a Two-Year Low

Data from CryptoQuant shows SHIB exchange reserves have dropped sharply. At the start of 2025, reserves stood near 140 trillion tokens. That means holdings on exchanges have fallen by almost 40% in less than a year.

Exchange reserves track how many tokens are available on trading platforms. When reserves fall, it usually means that holders are moving their tokens into private wallets or staking platforms instead of leaving them on exchanges. This shift often reduces the immediate supply available for selling. Historically, similar declines in reserves have preceded periods of accumulation, where investors hold rather than sell, creating conditions for price stability or even upward momentum

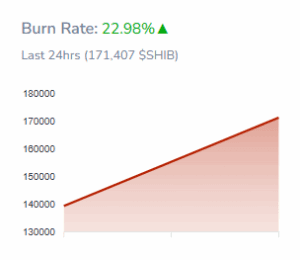

At the same time, Shiba Inu’s burn mechanism continues to chip away at supply. According to Shibburn data, more than 171,000 SHIB tokens were burned in the past 24 hours, marking a 22.98% increase in the daily burn rate.

Although the burned amounts are small compared to SHIB’s massive circulating supply of over 584 trillion tokens, the consistent reduction plays into the broader theme of tightening supply.

The combination of lower exchange reserves and ongoing token burns suggests that fewer SHIB tokens are available for immediate trading, which could reduce sell-side pressure if demand picks up.

SHIB Faces Strong Resistance

Despite these positive signals on the supply side, SHIB’s price remains locked in a downtrend. The daily chart shows a descending resistance line that has capped rallies since early 2023. Currently, SHIB is testing support near $0.000011, a level that has held multiple times in recent months.

Currently, SHIB is testing support near $0.000011. This is a level that has held multiple times in recent months. The Relative Strength Index (RSI) is around 38, close to oversold territory, which shows sellers have dominated but also hints that buyers may soon step back in. At the same time, the 50-day and 200-day exponential moving averages (EMAs) remain above the price, keeping the overall trend under pressure. For bulls, a move above $0.00001364 would be needed to confirm any reversal.

Can Lower Reserves Trigger an ‘Uptober’ Rally?

Analysts believe that SHIB’s reduced exchange supply places the token in an accumulation zone. With fewer tokens available on exchanges, even modest increases in demand could fuel price moves higher. Some traders see October—often called “Uptober” in crypto circles—as a potential turning point if SHIB price manages to break out of its descending trendline.

However, risks remain. If SHIB fails to hold the $0.000011 support, further downside could open toward the $0.000010 level.