Uniswap enabled direct Solana trading on its web app, letting users connect Solana wallets and swap Solana tokens alongside Ethereum and other networks. The move removes the need to leave Uniswap to access Solana markets.

In its announcement, Uniswap positioned the update as part of a broader effort to reduce fragmentation across chains. It emphasized an architecture built to support multiple networks without bespoke rebuilds for each.

Jupiter ships Ultra v3 across its stack

Jupiter launched Ultra v3, a major upgrade to its Solana aggregation engine focused on execution quality, MEV protection, and slippage control. The team highlighted gasless trading where available and routing improvements through a new “Iris” meta-aggregator. ForkLog

Independent write-ups echoed the technical claims, pointing to stronger sandwich-attack defenses and materially lower effective fees in common paths. They dated the go-live to October 18–19 with production endpoints already serving Ultra v3 traffic.

Additional summaries noted faster routing and predictive execution under Ultra v3. Together, the releases frame this as a performance and protection release rather than a token event.

Forward launches a zero-fee Solana validator

Forward Industries introduced a Solana validator operating at 0% commission, allowing delegators to receive full staking rewards from the node. The company said its own stake is directed to the validator and future nodes will follow the same setup.

The validator runs on DoubleZero infrastructure and references work around Jump Crypto’s Firedancer client developed with Galaxy. Forward framed the launch as an institutional-grade contribution to validator diversity and performance.

Reports explained how commission settings affect delegator yield and why a zero-fee posture can attract stake during network-level client diversification. Coverage placed the launch in the second week of October.

Core software and public remarks: Agave guidance and Disrupt stage

Messari’s Solana portal lists Agave v2.3.13 as the current recommended mainnet-beta validator release dated Oct. 10, 2025. Operators on older Ubuntu versions are reminded that new binaries target Ubuntu 22.04.

Agave documentation reiterates that the Anza team maintains the validator client formerly under Solana Labs, with ongoing development toward multi-client resilience. Release threads also note compatibility changes tied to operating system baselines.

Separately, TechCrunch confirmed Solana Labs CEO Anatoly Yakovenko for a Disrupt 2025 main-stage session in San Francisco on Oct. 27–29, with a program focused on scaling, developer adoption, and real-world finance use cases. This fixes the near-term window for public remarks from the project’s lead.\

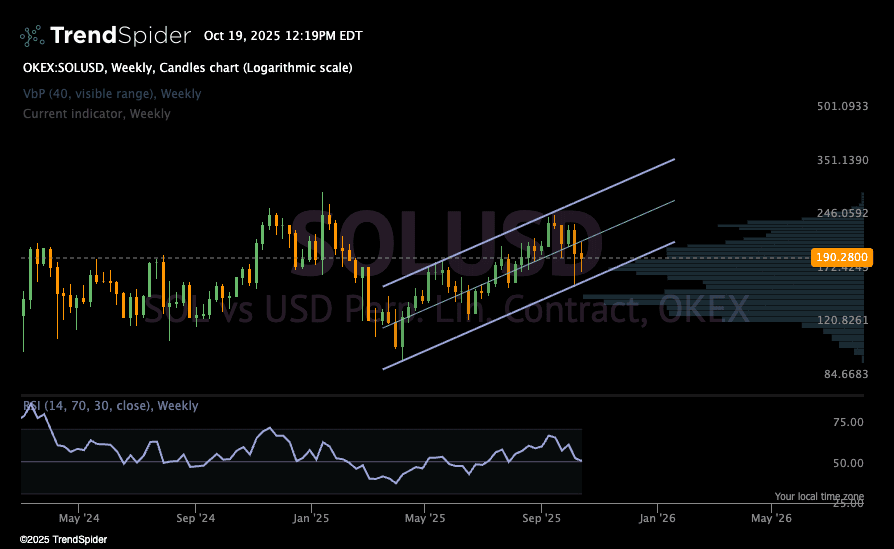

Analyst cites ascending channel and faster dip buys on Solana

An independent analyst, Yimin X, said Solana is coiling inside a tight ascending channel and absorbing supply near $190. He argued that buyers stepped in quickly on each retest of the lower trendline. As a result, he framed the structure as potential accumulation on the weekly chart.

He noted that reactions at support have accelerated rather than slowed, which often signals demand building under price. In addition, the visible range profile on his chart clusters volume around the $190 area. That zone, he said, continues to attract bids as the channel holds.

He added a conditional target, stating that if the pattern resolves higher, the next leg could extend roughly 50%. However, he positioned the view as a technical setup while most attention remains on Bitcoin. Therefore, he presented Solana as a parallel breakout candidate based on structure rather than sentiment.

Analyst outlines breakout structure and 124% Solana target

Analyst JamesEastonUK highlighted a long-term ascending structure on Solana’s weekly SOL/USDT chart and projected a breakout target near $415. He pointed to a multi-year horizontal resistance zone that has capped every rally since 2021. According to his view, Solana is now pressing that ceiling once again while respecting a steady series of higher lows.

In the chart, the analyst illustrated a rising trendline that has guided Solana’s advance since late 2022. He argued that this structure reflects persistent demand and a tightening coil beneath major resistance. As a result, he framed the consolidation as a potential launch point rather than a reversal setup.

He added that a confirmed breakout could imply a 124% move from current levels. The chart shows a measured move projection that aligns with the height of the multi-year range. Therefore, he plans to reassess beyond $415 only if the resistance is cleared with conviction. The post positions the pattern as a technical inflection point while broader market attention remains centered on Bitcoin.