Solana (SOL) price traded near $211 on Oct. 1, with the token’s post-crash recovery calming down into a more horizontal movement. Despite recently nearing $215 on Sept. 29, the token slipped, keeping its momentum fragile as traders tracked ETF speculation and liquidation levels.

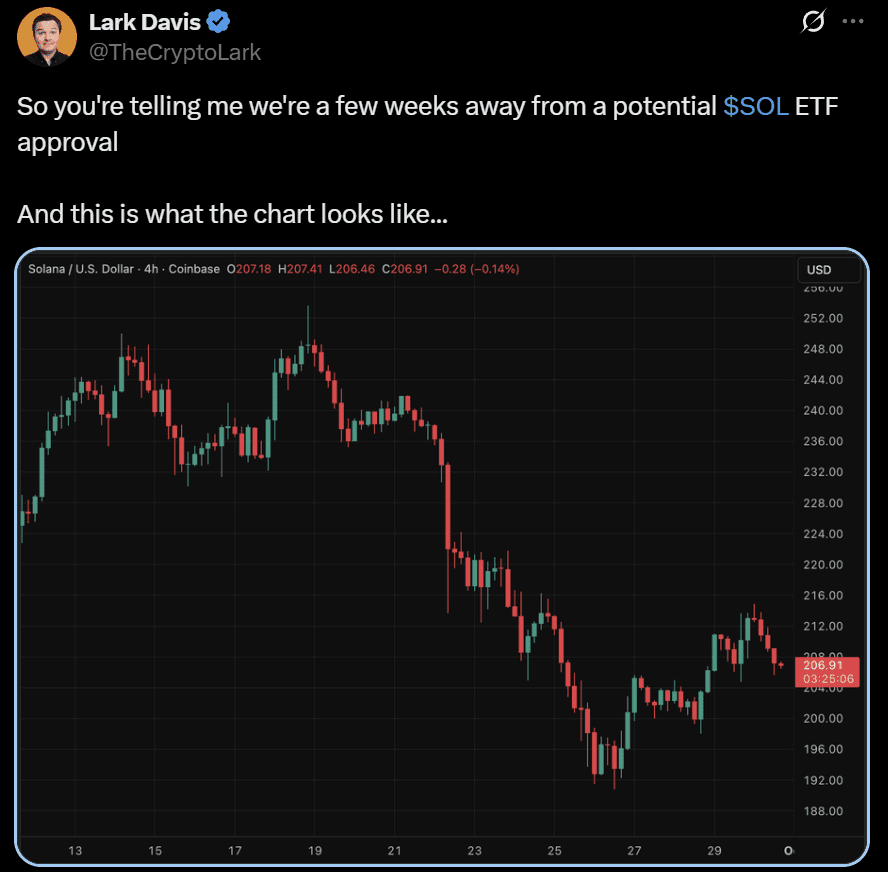

The long lower wick on recent candles suggests bulls are not backing down. With the ETF catalyst working in favor of the token, SOL prices could spike in the new month. Meanwhile, a resistance cluster between $218 and $221 has emerged vital for SOL, where short positions could force exits.

Analysts Eye Key Levels as Solana Approaches Resistance

The focus on Solana shifted from its immediate weakness to analyst predictions that centered around the $218–221 range. Independent analyst Crypto Monkey highlighted $221 as a take-profit level and warned that bulls needed to clear it before attempting another rally.

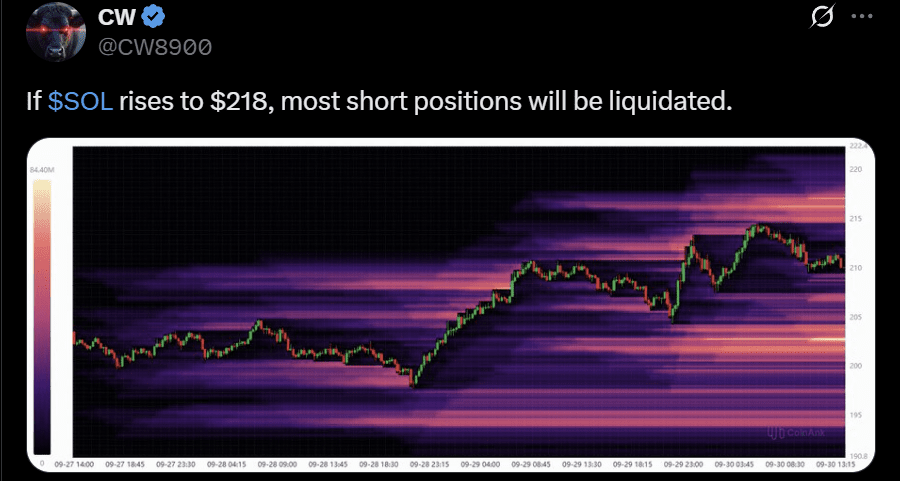

The analyst’s projection indicated a likely pause if the zone rejected price momentum, reflecting traders’ difficulty at clustered resistance levels. Moreover, market analyst CW added to the discussion by underlining the scale of liquidations resting just below that threshold.

CW said most short positions would be forced out if Solana pushed toward $218. CoinGlass data supported the claim, showing more than $552 million in cumulative short liquidations concentrated around that mark. While such a move risked a temporary squeeze, it also invited renewed selling pressure as liquidity thickened directly above.

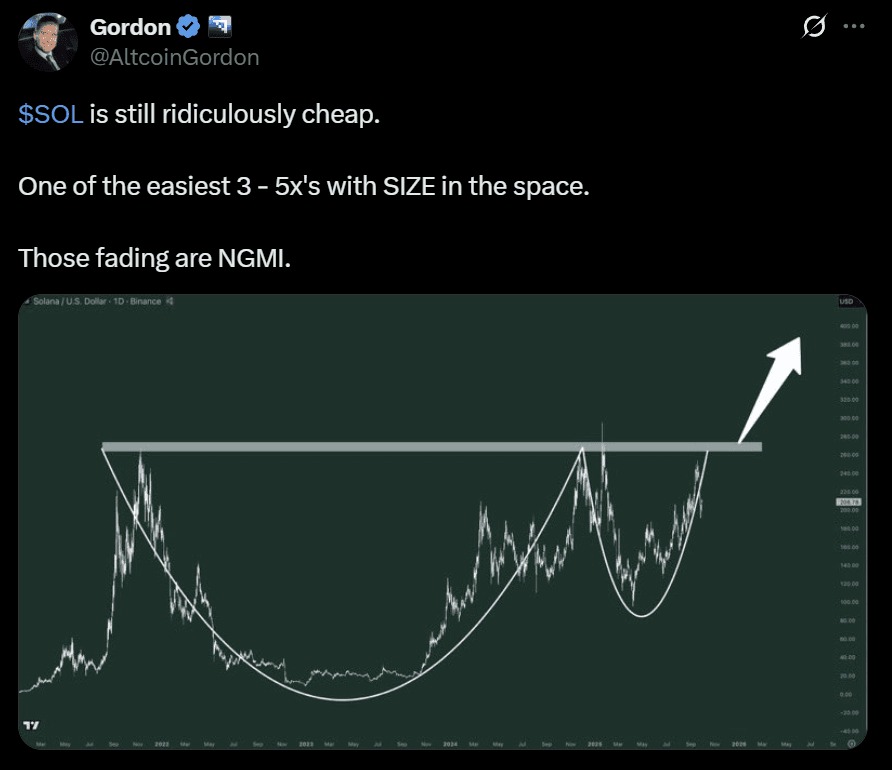

On longer timeframes, analyst Altcoin Gordon described the SOL USD pair as undervalued and highlighted a multi-year cup-and-handle formation.

Gordon argued the pattern suggested room for three to five times growth if Solana cleared the neckline near $280–290. However, that structure remained incomplete, as any rejection near $220 would delay confirmation.

Lark Davis framed the debate through the lens of ETF speculation. The analyst pointed to the chart he shared and questioned why Solana traded below resistance despite growing optimism over a potential approval. Solana’s near-term moves remained trapped by liquidation clusters, while long-term hopes hinged on a breakout above higher resistance.

ETF Hype and Network Upgrade Add to the Debate

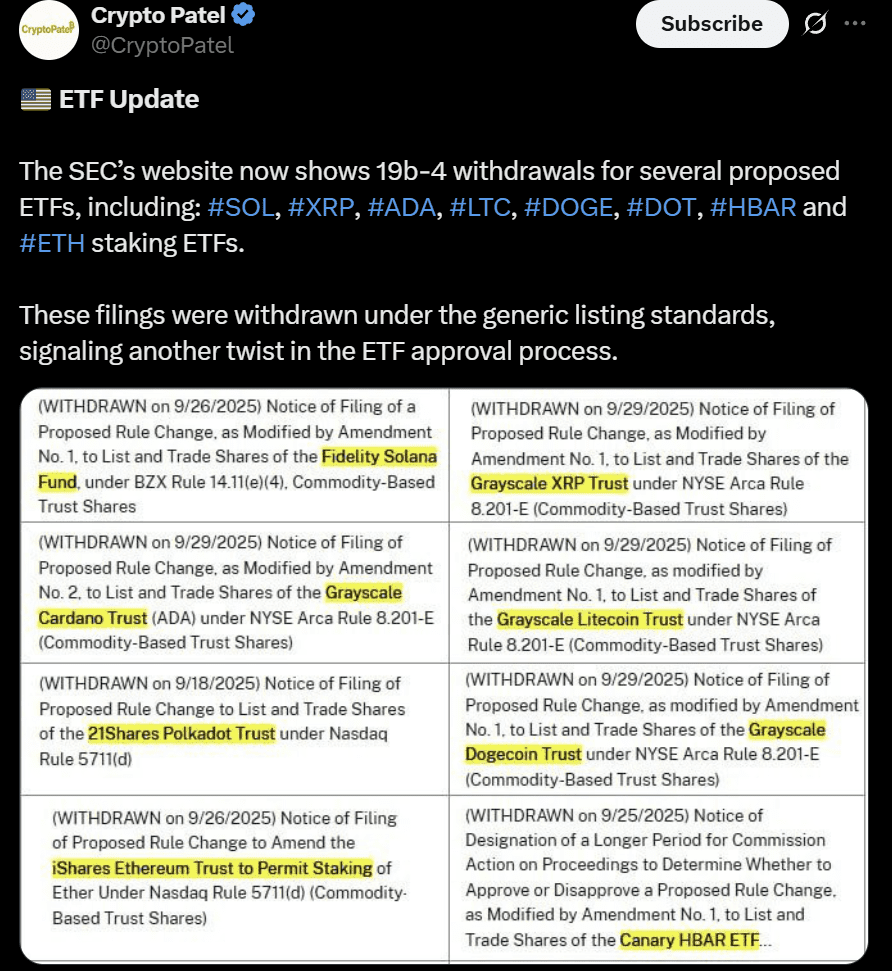

While analysts debated the technicals, the Solana token could also benefit from the recent ETF hype. X-based market commentator Crypto Patel highlighted that the SEC’s website showed withdrawals of several 19b-4 filings, including the Fidelity Solana Fund.

Patel noted the withdrawals occurred under generic listing standards, signaling a shift in how the process moved forward.

The change followed an earlier scoop by Eleanor Terrett, who reported amendment activity around several ETF applications, including Solana’s.

Eric Balchunas, a senior ETF analyst, argued the withdrawals carried little weight since generic listing standards applied, stressing that S-1 approvals were the only step left. The Bloomberg analyst said that approval odds had effectively reached one hundred percent once that clearance came through.

At the same time, Solana developers pushed ahead with network upgrades.

The upcoming Alpenglow release aimed to cut transaction finality from over twelve seconds to around 150 milliseconds by replacing vote transactions with offchain certificates. The update passed with strong validator support, offering a technical boost as the regulatory process advanced.

Together, the ETF speculation and the network upgrade added fuel to analyst claims of undervaluation. Yet, price still faced near-term resistance, leaving traders to weigh structural improvements against the heavy liquidation clusters that continued to cap rallies