Solana’s (SOL) price cooled to $233 on Sept. 15 after briefly touching $244 the same day. The token has held a steady uptrend since early Aug. 2025, climbing from near $150 and setting higher lows along the way. Daily momentum showed traders defending gains despite intraday pullbacks, keeping the rally intact. Now, a key technical indicator that has preceded past rallies has flipped bullish.

The shift has also lifted social sentiment, strengthening calls for Solana to extend its move toward higher liquidity zones.

Technical Indicator Flips Bullish, Analysts Line Up to Agree

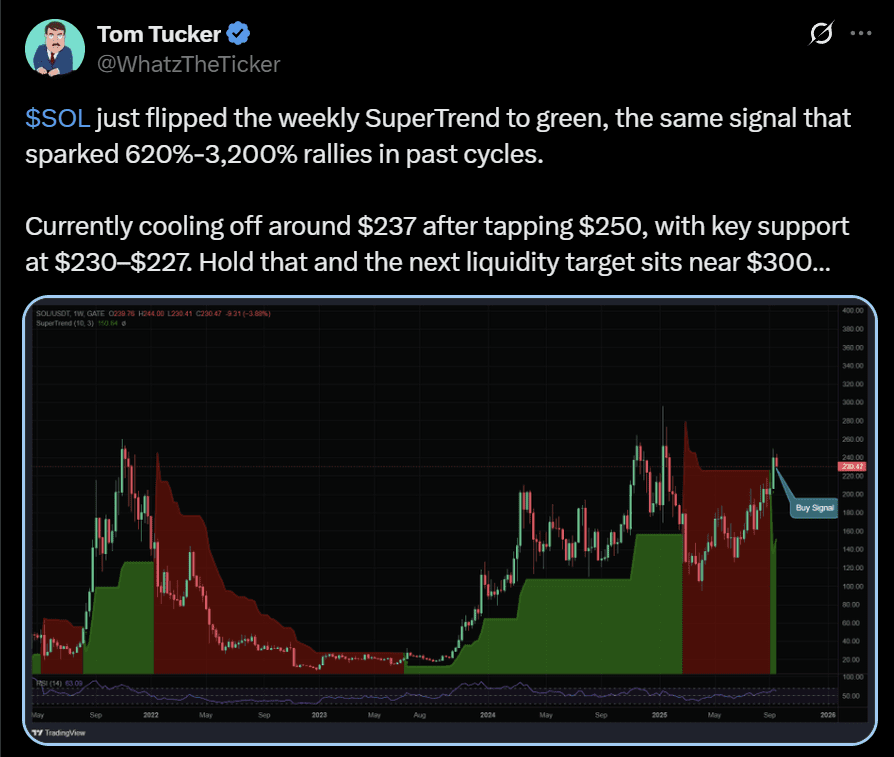

The bullish case strengthened after Solana’s weekly SuperTrend flipped green. Independent analyst Tom Tucker highlighted the indicator’s bullish flip, which previously aligned with rallies of 620% to 3,200%.

Tucker noted the indicator turned positive as the SOL USD pair traded near $237 after testing $250. Tucker identified the $230–227 zone as immediate support, stressing that holding this region would be crucial for keeping momentum intact. He argued that the shift placed $300 as the next liquidity magnet if buyers maintained control.

The SuperTrend flip also aligned with shorter-term momentum signals.

Another analyst, with the X username Cipher X, pointed to a bullish crossover between the EMA 9 and EMA 15, which confirmed strength on the daily chart. The analyst stressed that strong structural supports around $160 and $120 underpinned the broader trend, even if near-term pullbacks emerged. The chart showed that the crossover followed a period of compressed volatility, suggesting momentum could accelerate if accompanied by higher trading volume.

Solana Demonstrates Sustained Strength

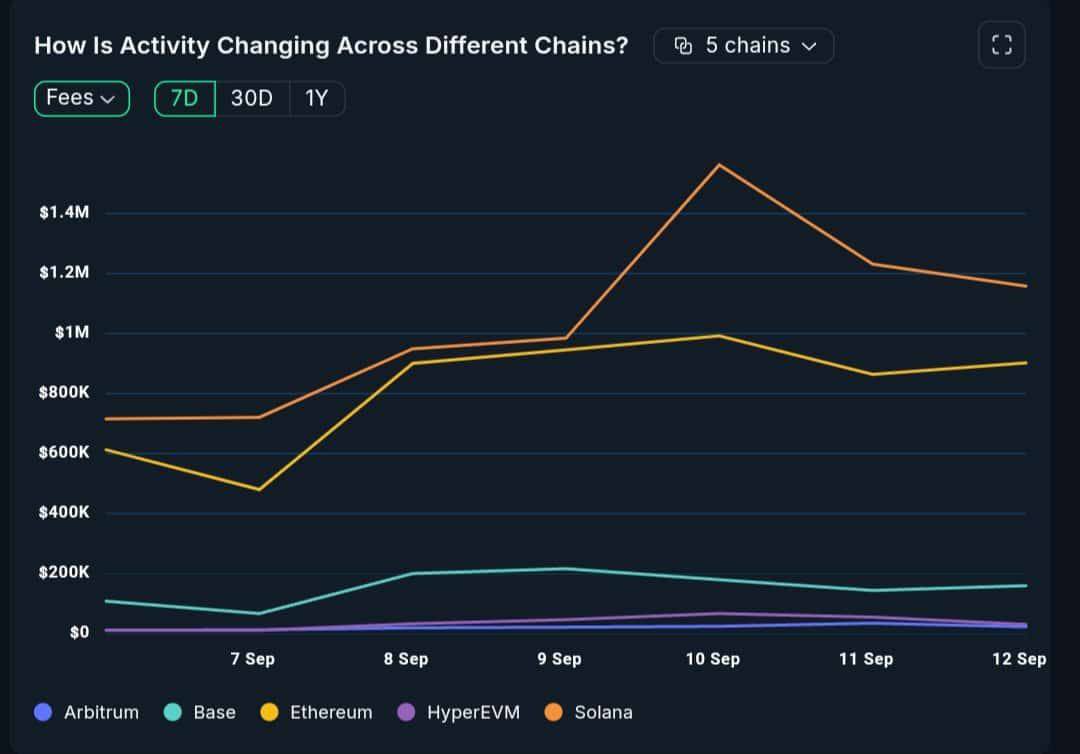

On-chain activity supported the case for sustained strength. Solana processed more than 65 million transactions in a week, dwarfing Base’s 10–12 million. Additionally, fees generated reached $1.2 million, surpassing Ethereum by about $200,000. Net inflows of $7.7 million in 24 hours reinforced the view that capital continued to rotate into SOL. The order book data also showed consistent bid depth around $230, adding credibility to the bullish setup.

Yet tactical voices urged caution. Crypto Bully recalled that bids around $205 were front-run as the token surged to $250. He suggested watching the $210–$215 zone for fresh entries, noting that buying interest from the DAT trend had cooled. SOL risked lagging majors in relative strength until ETF catalysts or new DAT structures emerged.

Forward Industries Buys $1.58B Tokens as SOL Becomes the Treasury Favorite

Forward Industries announced the launch of its Solana treasury with the acquisition of 6.82 million SOL, valued at about $1.58 billion. The purchase marked one of the largest single treasury moves in the crypto sector and placed Solana at the core of Forward’s reserve strategy.

The company confirmed that its initial tranche would be custodied across multiple providers, highlighting Fireblocks as a key partner. The raise totaled $1.65 billion, and Forward committed to building a balance-sheet model centered on Solana’s yield and liquidity profile.

The scale of the acquisition positioned Forward alongside Strategy’s (formerly MicroStrategy) Bitcoin play as a benchmark for corporate treasuries in crypto. Unlike staggered purchases in other cases, Forward’s decision involved a lump-sum acquisition, immediately securing nearly $1.6 billion worth of SOL tokens. The move underlined Solana’s emergence as an institutional-grade asset, capable of supporting treasury diversification at scale.

Galaxy Digital also bought 1.2 million SOL, worth about $306 million, in the 24 hours following the announcement. Its recent inflows totaled 6.5 million SOL, valued at $1.55 billion, though links to Forward’s plan remained unconfirmed. Helius Medical Technologies separately announced a $500 million Solana treasury, paired with $750 million in warrants, adding further weight to the institutional narrative.