- SUI price coiling to recoup its bearish momentum and breach the immediate support of $0.88.

- Derivative market data shows 46% decline in SUI’s open interest since early January, suggesting the market is losing speculative force.

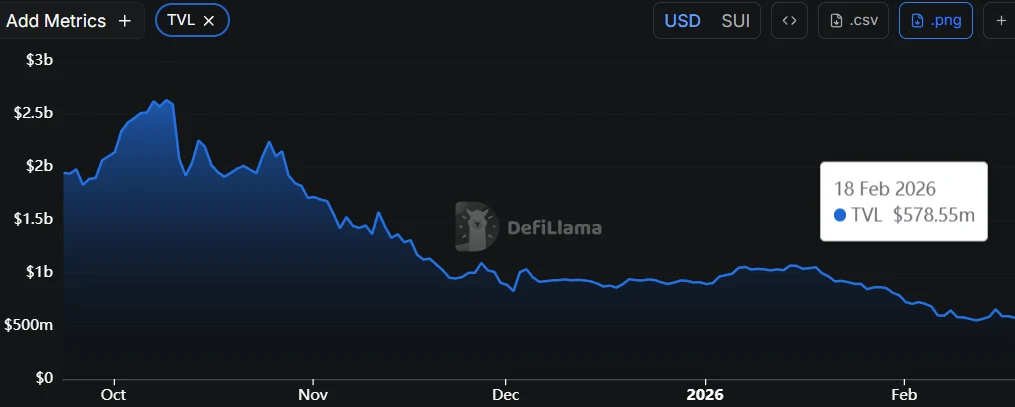

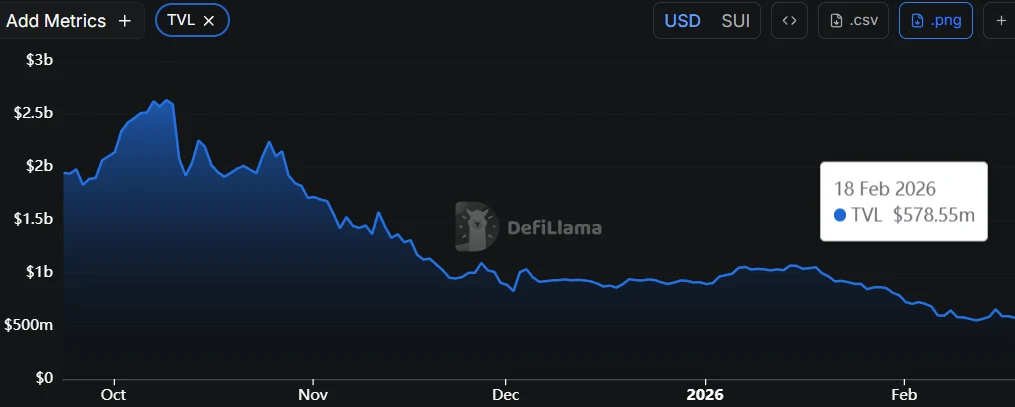

- SUI’s TVL plunged from approximately $2.6 billion to nearly $560–$580 million by early 2026.

SUI, the native cryptocurrency of the SUI blockchain, showed low volatility trading during Tuesday’s U.S. market hour to waver around $0.96. The coin price has been wavering around the $1 level for the past two weeks now, indicating weak confidence from buyers to sellers to drive a sustained recovery. However, a constant decline in SUI’s futures contracts and total volume locked signals that market participants are leaning out of this asset in a cautious approach.

SUI Struggles Near $1 After 78% TVL Crash and 46% Futures Decline

From early January, the SUI price has witnessed significant correction from the $2 to current trading value of $0.97, registering a loss of 52%. As a result, the asset’s market cap also plunged from $3.73 billion.

Recently, Sui’s token has moved from a long decline to consolidation, with its value fluctuating around the $1 value amidst the ongoing caution in the markets.

The overall cryptocurrency ecosystem is also quiet, and the Sui network’s total value locked is on a significant downward trend. Following a severe flash crash on October 10, 2025, there was a sharp decline in TVL from a peak of about $2.6 billion to about $560-$580 million in early 2026, representing a decline of about 78-79% of locked assets. This means massive outflows from DeFi protocols and low ecosystem participation in the wake of widespread liquidations and the lack of trader confidence.

In the derivatives space, there has been a similar story of contraction in open interest in Sui perpetual futures. CoinGlass figures show a slide from approximately $955 million in early January to between $510 – $513 million recently, a decrease of approximately 46%.

This initial strong decline was associated with mass liquidation of bullish positions, however the prolonged decrease is associated with traders progressively lowering leverage to cope with persistent price movements and lower confidence. Lower participation on-chain and in futures markets may prevent any sustained recovery in the token’s valuation.

SUI Price Poised for 11% Drop If Buyers Loss this Support

For the past two weeks, the SUI price has been wavering around the $1 mark, following the uncertainty in the broader crypto market. The consolidation showed notable swing on either side but failed to sustain as traders display lack of conviction.

However, as the price entered a lateral trend after a prolonged correction, the sellers are likely taking a breather to recoup their bearish momentum. The declining slope of 20, 50, 100, and 200 exponential moving averages in daily charts shows the path to least resistance is down as broader market sentiment remains bearish.

If the bearish momentum persists, the SUI price could plunge below the $0.88 support, accelerating the selling pressure in the market. The post-breakdown fall could plunge the price another 16.3% down to hit the $0.73 support.

Also Read: Italy’s Intesa Sanpaolo Bank Discloses $96M Bitcoin ETF Holdings