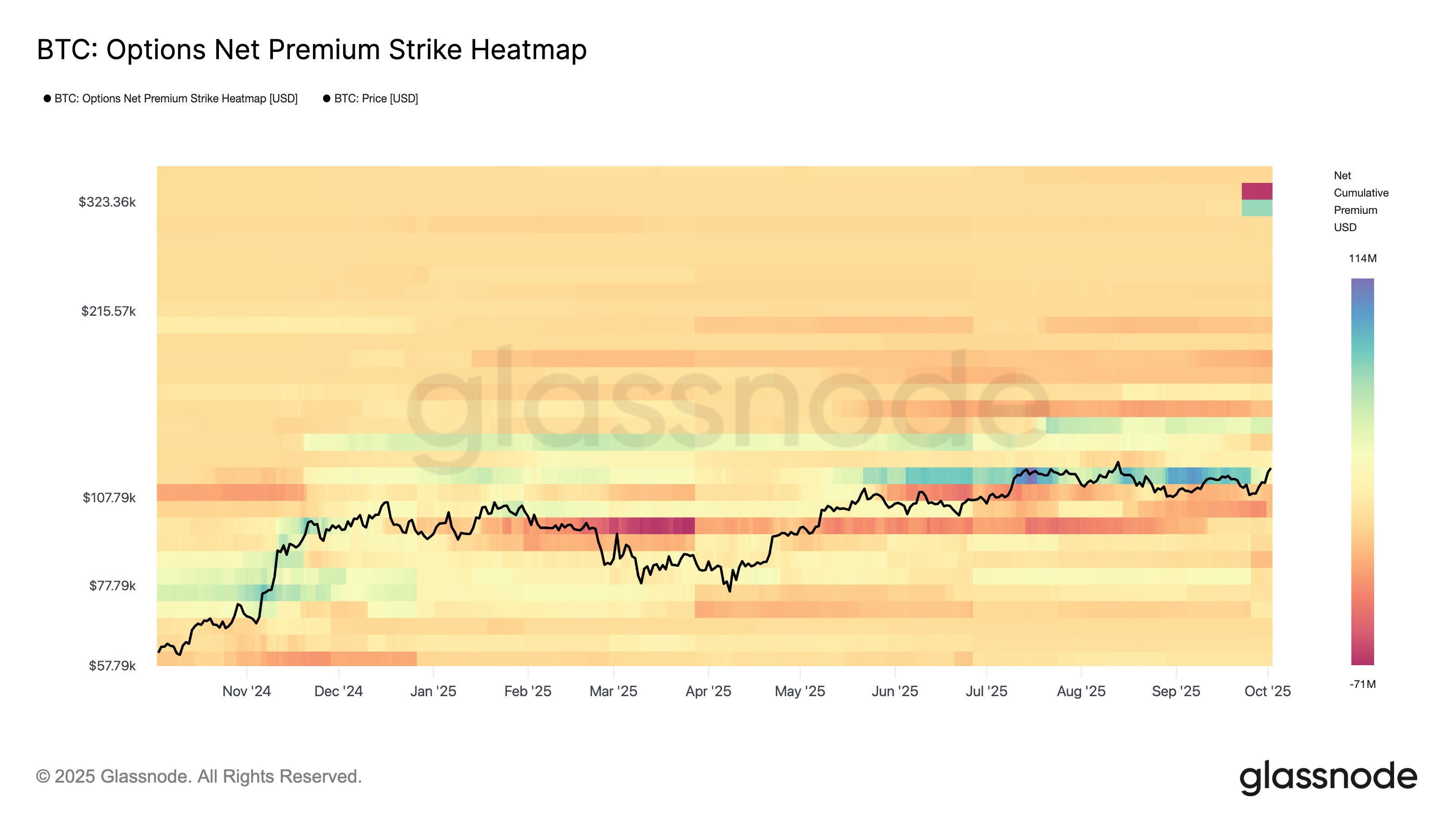

Market analytical platform Glassnode has identified a recent important event that reset Bitcoin Open Interest and set the stage for Q4.

Specifically, on Sept. 26, the crypto market faced one of its biggest derivatives events of the year as $17 to $18 billion worth of Bitcoin options expired. Notably, Deribit carried most of this load with about $17 billion, while OKX and CME also saw significant expiries.

The timing was especially tough for Bitcoin, which was in the middle of a steep downturn that began on Sept. 18. For context, BTC dropped from $117,000 to $109,000 by the time of the expiry. However, once the contracts rolled off, Bitcoin quickly found its footing again. The coin now trades at $120,995.

Options Expiry Reset Bitcoin OI

Speaking on the event, Glassnode explained today that this expiry reset the options market and cleared out excess hedging positions. As open interest has dropped, traders now have room to place more intentional bets on price direction and volatility rather than just rolling positions tied to expiry.

Moreover, volatility data also shows how the market changed. According to Glassnode, short-dated implied volatility dropped. One-week at-the-money implied volatility fell about three points from the peak a week earlier, while the two-week measure eased by roughly two points.

Meanwhile, longer-term contracts held between 40% and 43%. The firm said this caused the volatility curve to steepen, showing reduced short-term pressure but caution further out.

In addition, the options skew also flipped. Notably, Glassnode said the one-week 25-delta risk reversal swung from an 18.5-volatility put premium to a 4-point call premium.

Skew shifted sharply. 1W 25Δ RR moved from an 18.5 vol put premium to a 4 vol call premium. That’s a major swing away from downside hedging. Longer maturities flattened too, pointing to a more balanced risk outlook. pic.twitter.com/dKFwQHqToD

— glassnode (@glassnode) October 3, 2025

This move signals that traders stopped heavily protecting against downside and started leaning toward the upside instead. Even longer-dated contracts flattened out, which points to a more balanced view of risk overall.

Hedging Flows Won’t Return Until Next Major Expiry

According to Glassnode, buyers lifted upside calls with premiums clustering between $136,000 and $145,000 strikes. However, at higher levels, traders sold calls, which shows they want exposure to potential gains but don’t expect extreme prices anytime soon.

Dealer positioning also changed after expiry. Specifically, Gamma exposure turned slightly long on both sides, which helps stabilize the market, though only to a limited extent. Glassnode noted that meaningful hedging flows won’t return until the next major expiry later in the quarter.

Meanwhile, in a separate report, the firm highlighted signs of fresh demand. Its Trend Accumulation Score showed that mid-sized holders are buying strongly, whale selling has slowed, and smaller investors remain neutral. It concluded that this behavior points to new structural demand building.

The Trend Accumulation Score highlights a shift in recent days. Mid-sized $BTC holders are accumulating strongly, whale distribution has moderated, and smaller entities remain neutral. This points to fresh structural demand emerging despite continued large holder selling. pic.twitter.com/KnqpCdN9qx

— glassnode (@glassnode) October 3, 2025

Bitcoin in a Favorable Position

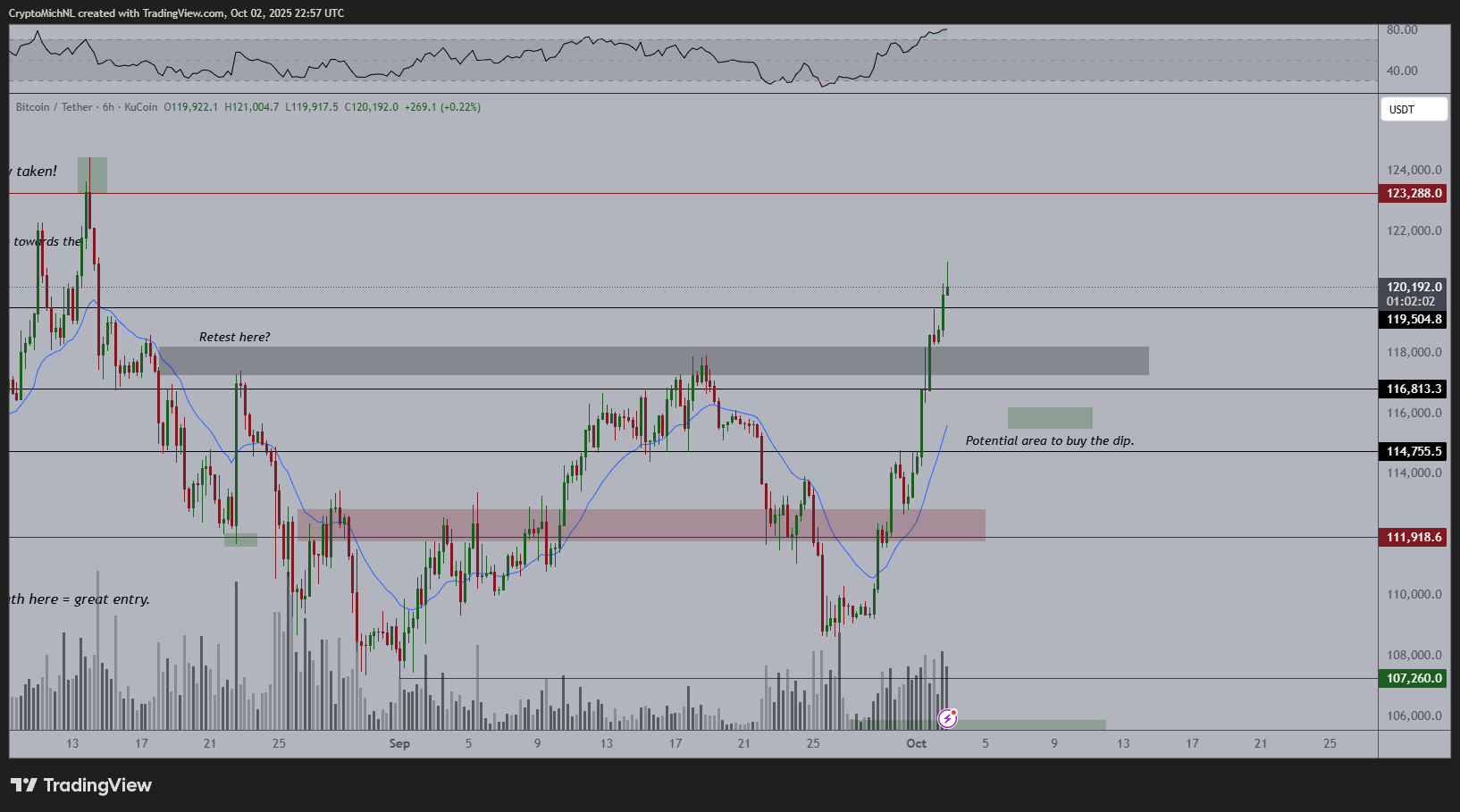

Interestingly, market analysts have shared their views amid Bitcoin’s recent recovery push. For instance, Ted Pillows said the latest rally stalled at $121,000. If Bitcoin breaks through this resistance, he believes a new all-time high could follow. If not, he expects a pullback to $117,000.

$BTC got rejected from the $121,000 resistance level.

If Bitcoin reclaims this level soon, a new ATH could happen.

Otherwise, BTC could drop towards $117,000 in the coming days. pic.twitter.com/BVVQJbejgU

— Ted (@TedPillows) October 3, 2025

In another note, he pointed out that Bitcoin often bottoms in September, pointing out it has done so seven times since 2016. He said the recent $107,000 dip, followed by a 12% rebound, could mean the bottom is already in.

Also, Veteran trader Michaël van de Poppe said Bitcoin has already taken out previous highs and now sits within reach of a fresh record. He expects a new all-time high within weeks once Bitcoin consolidates, calling this the signal for the next breakout phase.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.