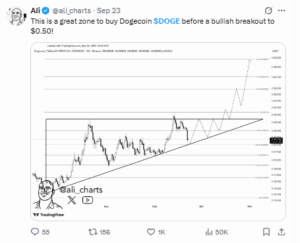

Dogecoin (DOGE) may be entering a buy zone, according to market analyst Ali Martinez. Martinez wrote on X that “this is a great zone to buy Dogecoin,” highlighting an ascending triangle pattern. The formation, where higher lows meet a flat resistance ceiling, is often linked to bullish breakouts.

Martinez projected the token could rally toward $0.50 as a bullish chart pattern forms alongside fresh institutional and corporate adoption. He suggested the setup could lift Dogecoin to $0.50 if resistance gives way.

Dogecoin traded at $0.234 today on Sept.25, down almost 3% on the day. The token has retreated from highs of $0.30 earlier in September but, according to Martinez, still sits inside a favorable technical structure.

ETF Launch and Corporate Treasuries Boost DOGE

The call follows the debut of the first U.S.-listed Dogecoin exchange-traded fund. Issued by Rex-Osprey, the ETF launched on Sept. 18, under the ticker DOJE. It holds about 60% in Dogecoin and 38% in 21Shares’ Dogecoin ETP, giving regulated market access to the asset for the first time.

Companies have also begun to add Dogecoin to their balance sheets. On Sept. 18, Thumzup Media Corporation disclosed it had purchased 7.5 million DOGE at an average price of $0.2665. The firm also announced a $10 million stock buyback program through 2026 and plans to acquire DogeHash Technologies, a mining firm with 2,500 rigs in operation.

Another U.S. company, CleanCore Solutions recently expanded its holdings by 100 million DOGE, lifting its total reserves above 600 million tokens. The firm also named Elon Musk’s attorney, Alex Spiro, as chairman of its board.

Filings have further linked Bit Origin to Dogecoin reserves, with reports indicating the firm raised $500 million in DOGE-related financing earlier this year.

Key Support Levels Could Decide Next Move

Dogecoin’s price structure shows a short-term retracement inside a wider consolidation phase. After rallying to $0.30 in early September, the token pulled back to $0.234, testing support at the 50-day exponential moving average (EMA) around $0.238. The 200-day EMA at $0.219 represents the next line of long-term support if selling pressure builds.

Momentum has cooled since the rally. The 14-day relative strength index (RSI), which tracks the strength of buying and selling, stands at 43.9, down from overbought conditions above 70 earlier this month. This places Dogecoin in a neutral zone, leaving room for a move in either direction depending on demand.

Analysts identify the immediate trading band between $0.23 and $0.25. A recovery above $0.25 would likely prompt a retest of resistance around $0.28–$0.30, where the September rally stalled. Breaking through that ceiling would validate the ascending triangle Martinez flagged and bring his $0.50 target into view.

The downside risk is that if Dogecoin price loses support at $0.23, it could fall toward $0.20, erasing most of its September gains.