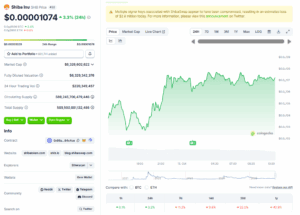

Shiba Inu (SHIB) is trading near $0.00001079, down roughly 40% year-over-year, leaving long-term holders deep in the red. Despite short rebounds from the recent crash, analysts say the token’s technical and structural outlook points to further weakness, making the current dip one of the riskiest entry points in months. So, How much more this token dive further? Let’s take closer look.

SHIB Struggles to Reclaim Lost Support

The SHIB/USDT daily chart shows the token recently broke below a key support zone near $0.0000102–$0.0000110 before rebounding modestly. The level now acts as resistance, capping any immediate upside.

SHIB price action remains trapped beneath a descending trendline drawn from the March 2025 highs, reinforcing a broader downtrend that has lasted most of the year. Multiple exponential moving averages (20-, 50-, 100-, and 200-day) slope downward above current price, creating layered resistance between $0.0000115 and $0.0000133.

Momentum indicators confirm the weakness. The 14-day Relative Strength Index (RSI) hovers around 40 — a zone that shows limited buying pressure. Without a strong catalyst, the chart implies potential continuation toward the $0.0000095 region.

With SHIB trading below every major EMA and unable to reclaim former support, it’s near-term setup is bearish. Unless the token breaks decisively above $0.0000125, the path of least resistance remains downward.

You May Also Like: Is There Any Chance of Shiba Inu (SHIB) Reaching $1?

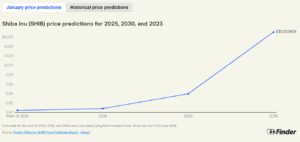

In February 2025, Finder.com’s panel of 26 crypto specialists, including Gracy Chen, CEO of Bitget, projected SHIB price would average $0.0000399 by year-end. Nearly half the panel already considered the token overvalued, while 57% recommended holding rather than buying.

Eight months later, that forecast appears overly optimistic. SHIB trades at barely a quarter of that projection, with analysts pointing to the same problems identified earlier this year — oversupply, weak burn rates, and limited real-world use — but under far heavier technical pressure.

Tokenomics Still the Main Obstacle

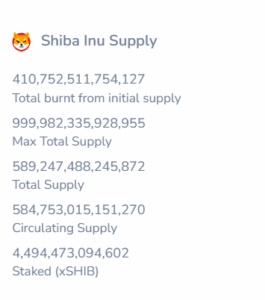

SHIB’s circulating supply remains huge. This limits price appreciation. Over 410 trillion SHIB—about 41% of the original supply—has been permanently removed, yet more than 584 trillion remain in circulation. At that scale, burn campaigns—often measured in millions or hundreds of millions per day—barely alter overall supply dynamics. The current burn rate represents far less than 0.1% of circulating supply per month, leaving the tokenomics heavily inflationary by crypto-market standards.

SHIB utility also lags. The Shibarium Layer-2 network has processed billions of transactions, but faces declining on-chain activity following its September security breach. This drained several million dollars in assets. Although validators were rotated and refunds promised, the incident significantly dented investor confidence.

Further Reading: 5 Real Use Cases of Shiba Inu (SHIB) — And Whether They Can Boost Its Price

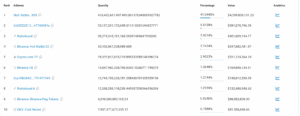

Roughly 60% of total SHIB supply sits in the top ten wallets, including burn and exchange addresses. Such concentration leaves the market vulnerable to abrupt swings whenever large holders move funds.

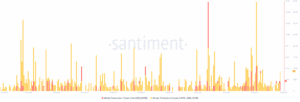

Recent on-chain data show declining average whale transaction size — a signal of reduced participation but also thinning liquidity, which can amplify volatility during sell-offs.