Ondo enabled access to 100+ tokenized U.S. stocks and ETFs for non-U.S. users inside the Blockchain.com self-custody wallet on October 20. The rollout places Ondo Global Markets in front of a large retail base without touching price claims. It focuses on distribution and compliant access.

The integration frames tokenized equities as a product you can hold in the same interface as crypto. It also keeps custody under the user’s control while routing trading through Ondo’s rails. Consequently, the move tests real user demand for tokenized TradFi assets in a familiar wallet.

Moreover, the launch advances Ondo’s strategy to link regulated securities tooling with mainstream crypto apps. The company has positioned Global Markets as a bridge between DeFi users and U.S. market exposure, using tokenization to manage access and settlement.

Policy push: Ondo asks SEC to delay Nasdaq’s tokenization rule

Earlier this week, Ondo urged the U.S. SEC to delay Nasdaq’s proposal for trading tokenized securities. The firm argued that the plan relies on undisclosed post-trade processes at the Depository Trust Company, which limits public scrutiny. Therefore, Ondo asked for transparency before any approval.

In anopen letter dated October 15, Ondo said the SEC and market participants need clear visibility into DTC’s settlement mechanics when tokenized assets are involved. The request centers on market structure, not token pricing. It aims to reduce operational blind spots.

As a result, the filing positions Ondo as an industry stakeholder pressing for disclosure standards. It also aligns with its broader effort to build compliant rails for tokenized securities, where predictable post-trade flows are necessary for institutional adoption.

Stablecoin rails: USDY tapped as collateral for USST mints

On October 10, stablecoin platform STBL selected Ondo’s USDY as primary collateral, enabling up to $50 million in USST mint capacity. The update speaks to utility and collateral quality rather than speculation. It expands places where USDY can work as a yield-bearing reserve.

USDY is designed to be backed by short-term U.S. Treasuries and bank demand deposits. Consequently, using it as collateral links tokenized T-bill exposure to a stablecoin-minting workflow. That connection is important for payments and treasury use cases across DeFi.

Furthermore, the STBL integration arrives alongside Ondo’s expansion of distribution for USDY across ecosystems, which the company has highlighted through recent product posts and partnerships. The emphasis remains on functionality and compliant collateralization.

As of October 22 (EDT), Ondo reports OUSG’s underlying assets near $787.5 million on its product page. The data point signals continued institutional-style demand for tokenized cash-equivalent exposure. It reflects product scale, not a price call.

Additionally, on October 6, Ondo closed the acquisition of Oasis Pro, adding a U.S. broker-dealer, ATS, and transfer-agent footprint. This stack enables regulated secondary trading and record-keeping for tokenized securities under one umbrella. It targets compliance and market plumbing.

Together, reported OUSG scale and the new licenses frame how Ondo wants to operate end-to-end markets: issuance, trading, settlement, and transfer agency. The company continues to pair distribution deals with policy engagement to grow on-chain capital markets.

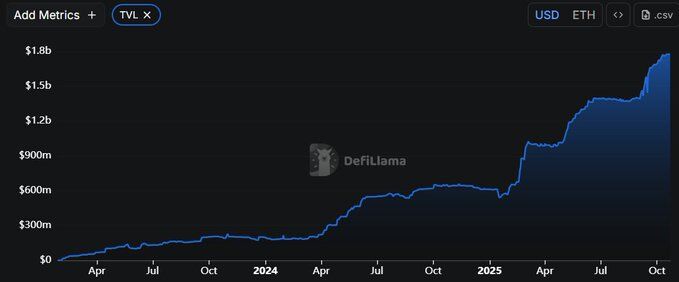

Ondo TVL nears $1.8B as distribution widens

Ondo’s total value locked continues to climb, approaching $1.78 billion on DeFiLlama. The curve shows steady build through 2024, then sharper step-ups in 2025, with only brief pullbacks before new highs. This path signals growing deposits into Ondo products rather than a one-off spike.

Drivers look operational, not speculative. USDY gained more venues and use cases, which typically attracts treasury flows seeking short-duration yield on-chain. Meanwhile, OUSG’s scale and accessibility help institutions park larger tickets, reinforcing the base TVL. As integrations expand, users can hold tokenized cash equivalents alongside other assets, which reduces friction and supports stickier balances.

Momentum also ties to market plumbing. With a licensed stack for securities and new distribution like wallet integrations, onboarding gets simpler for non-crypto natives. Consequently, inflows arrive in waves as access turns on in new channels. If these pipelines stay open and redemptions remain orderly, TVL should remain elevated even through routine volatility.

ONDO compresses under $0.75 as $0.51 base defines risk

ONDO trades in a bearish structure on the daily chart, yet buyers still defend the $0.51–$0.55 support band. The latest candles show compression beneath $0.75 after a sharp drawdown, which often precedes a decisive move. Momentum has stopped deteriorating, so the tape now waits for a catalyst rather than printing fresh lows.

If buyers reclaim and close above $0.75, the market likely squeezes into the $0.82–$0.86 supply area next. That zone capped rallies in recent weeks and will test whether momentum can actually flip trend. A clean daily close through $0.86 would invalidate the immediate bearish bias and open a fuller repair toward the prior cluster near $0.95.

However, failure to lift through $0.75 keeps pressure on the range midline and then the $0.51 floor. A daily close below $0.51 confirms continuation, inviting follow-through into the mid-$0.40s before liquidity reloads. Until the break, expect choppy mean-reversion inside $0.51–$0.75, with intraday spikes fading quickly.

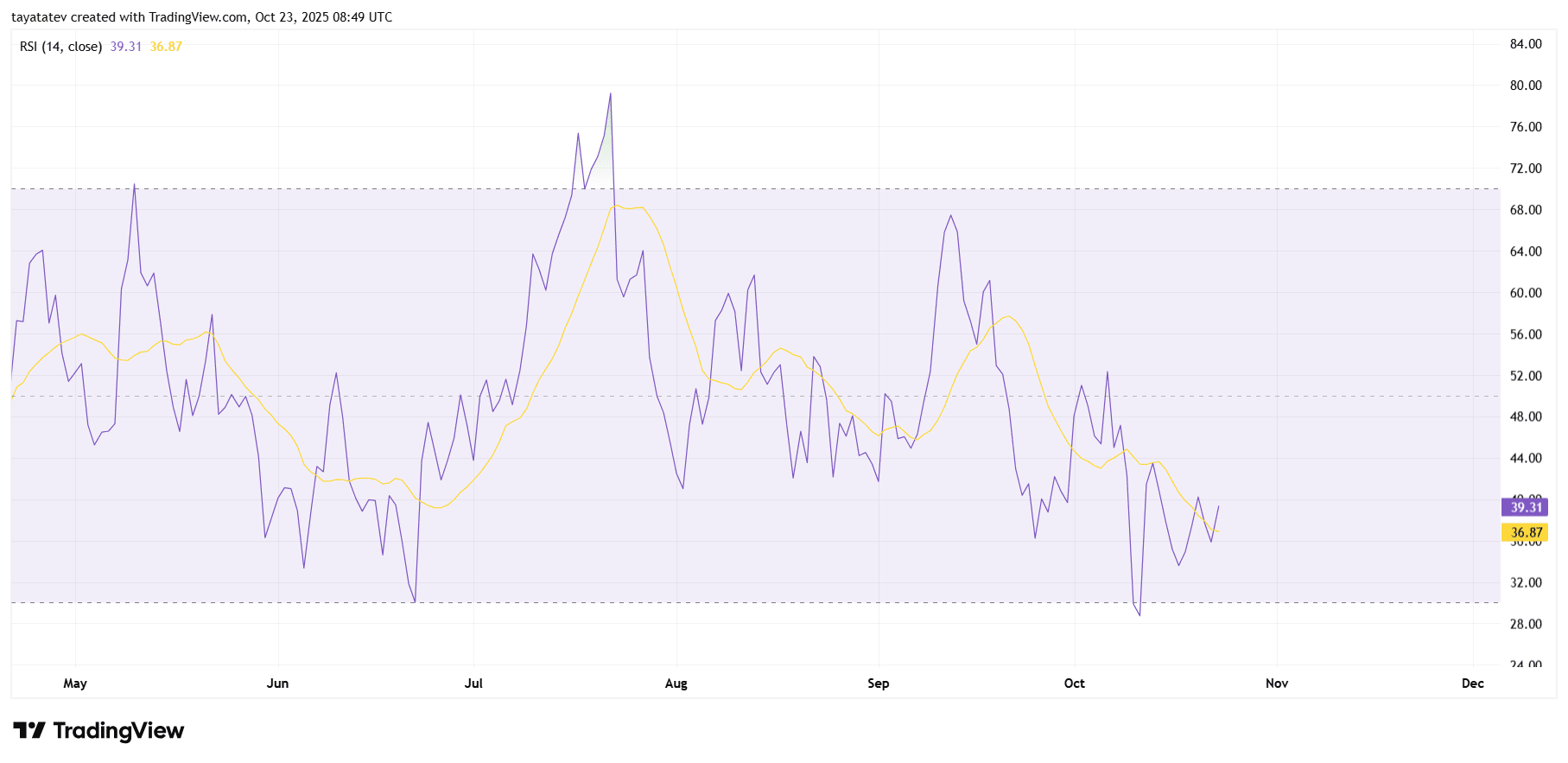

ONDO daily RSI steadies below 50 as momentum searches for a turn

The 14-day RSI sits in the high-30s and tracks below its signal line, which keeps momentum bearish. However, it no longer bleeds lower. After early-October oversold prints, RSI formed a higher low and then based around 35–40. That behavior often signals exhaustion rather than fresh downside, especially when sellers fail to push RSI back under 30.

Even so, bulls must reclaim the RSI midline to flip tone. A sustained move above 50—ideally with the RSI crossing and holding over its moving average—would confirm improving momentum. If that happens, price typically follows with a grind into prior supply, and pullbacks find buyers faster.

Conversely, a rollover from 40–45 would revive pressure. If RSI slips beneath 30 again, expect another capitulation attempt before repair resumes. Until a clear break, momentum argues for range-bound action: weak bounces fade near the midline, while dips stabilize above the recent RSI troughs.