Turtle (TURTLE) launched and began trading on Binance on Oct. 22, marking its debut as a liquidity coordination protocol built around “sticky” deposits and yield distribution. The token’s listing followed months of hype tied to its ConsenSys and Linea-linked ecosystem narrative.

TURTLE token traded actively in its first 24 hours, showing sharp intraday swings before stabilizing near its opening range. The project earlier conducted a large airdrop to early network participants, followed by confirmation of a $5.5 million strategic round backed by Amber, FalconX, and GSR.

Airdrop Frenzy Meets Market Reality

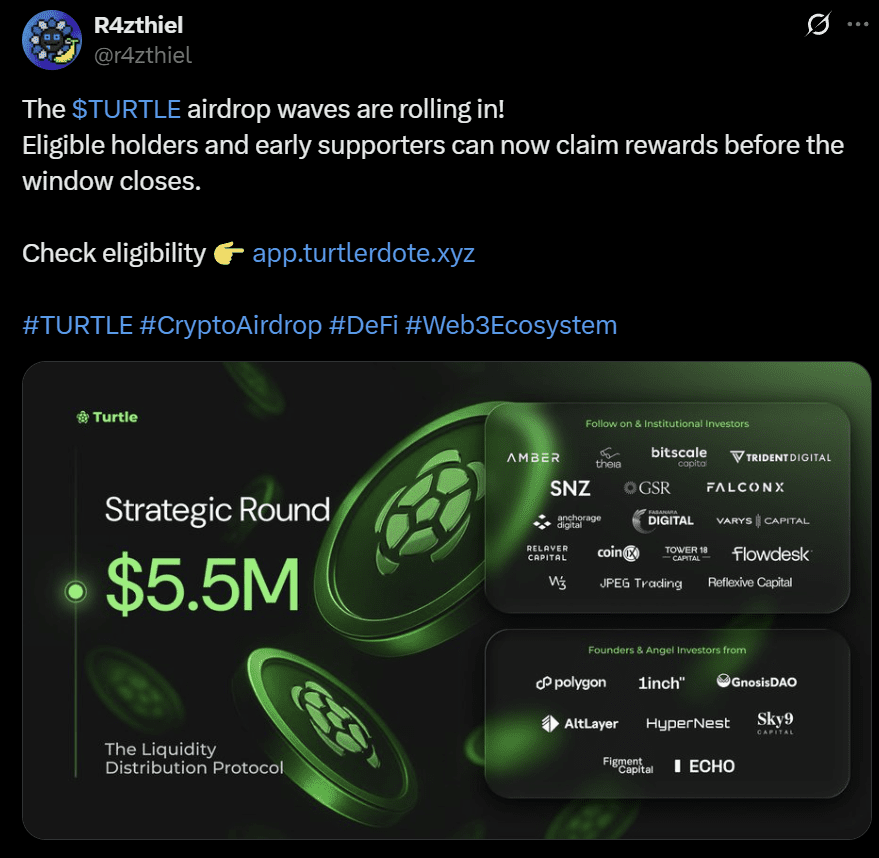

Turtle’s airdrop rollout became the project’s first major test after its Binance debut. The team distributed tokens to early network participants, with eligibility tied to liquidity activity and referral engagement.

The drop drew strong attention across X, where users like R4zthiel and Turtle’s official account shared snapshots of early allocations. The campaign briefly lifted social volume, but trading data suggested many recipients moved to secure profits soon after claiming. The early wave of selling likely contributed to the token’s sharp retracement following its opening surge.

Despite the volatility, market participation remained high. TURTLE logged over $125 million in early trading volume, underscoring speculative interest even as prices slipped. The project has positioned itself as a liquidity coordination protocol designed to stabilize DeFi yield flows across multiple ecosystems, including Linea and Ethereum. Its goal is to incentivize long-term liquidity instead of short-term farming, with mechanisms to reward consistent deposits and cross-chain activity.

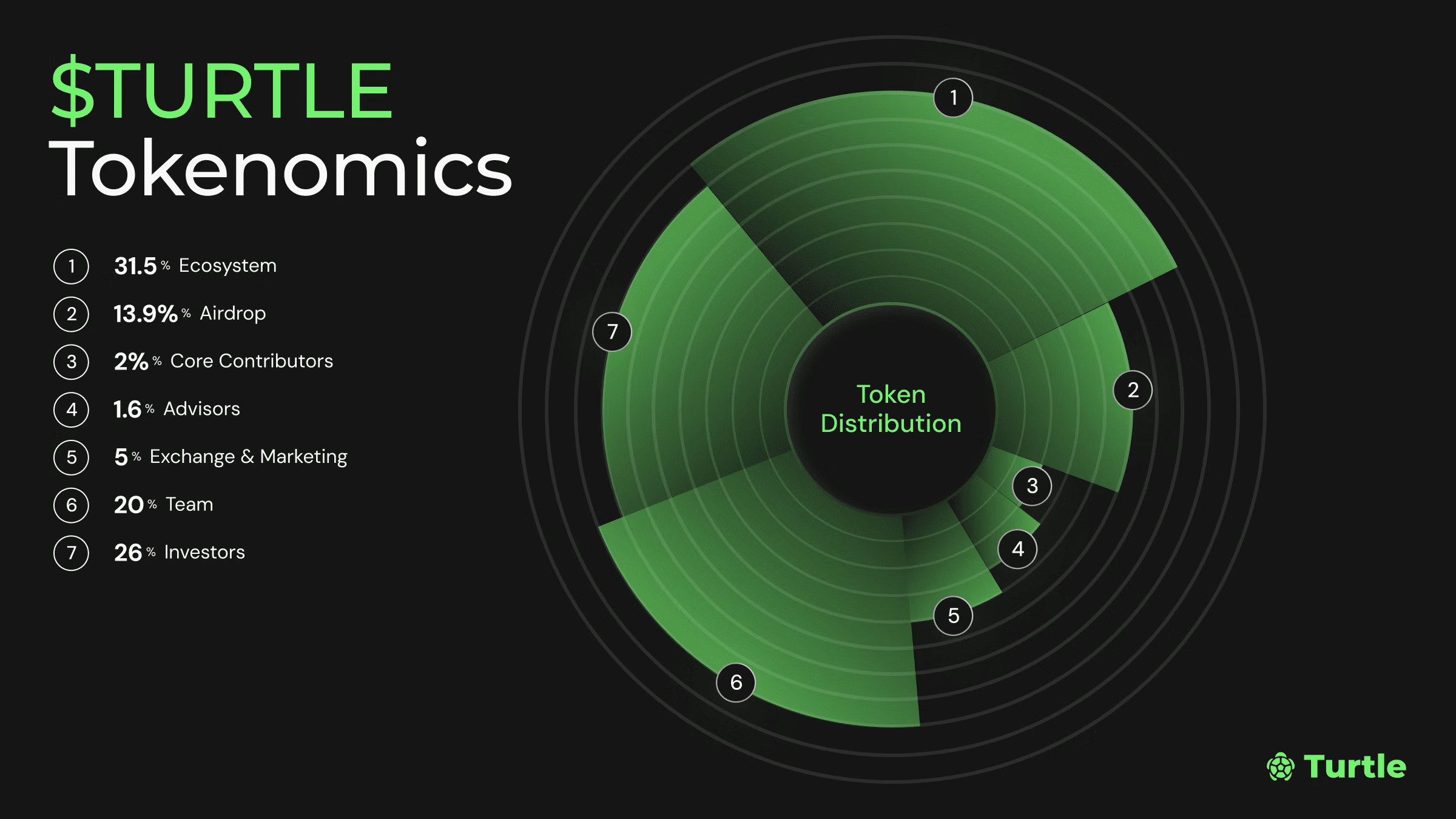

Investor confidence stemmed partly from Turtle’s $5.5 million strategic round, which was backed by Amber, FalconX, and GSR. The project’s tokenomics, however, raised questions about its long-term sustainability.

Nearly half of the supply was allocated to investors and the team, with unlocks scheduled to accelerate through 2026–2029. This slow-release design aimed to prevent early dilution but also implied sustained token issuance pressure over time.

With roughly one-third of the supply reserved for ecosystem rewards and a notable portion for early backers, the project’s future appeal may depend on whether its liquidity incentives outlast market hype or fade once initial rewards taper off.

Analysts Track Mixed Signals For TURTLE Price

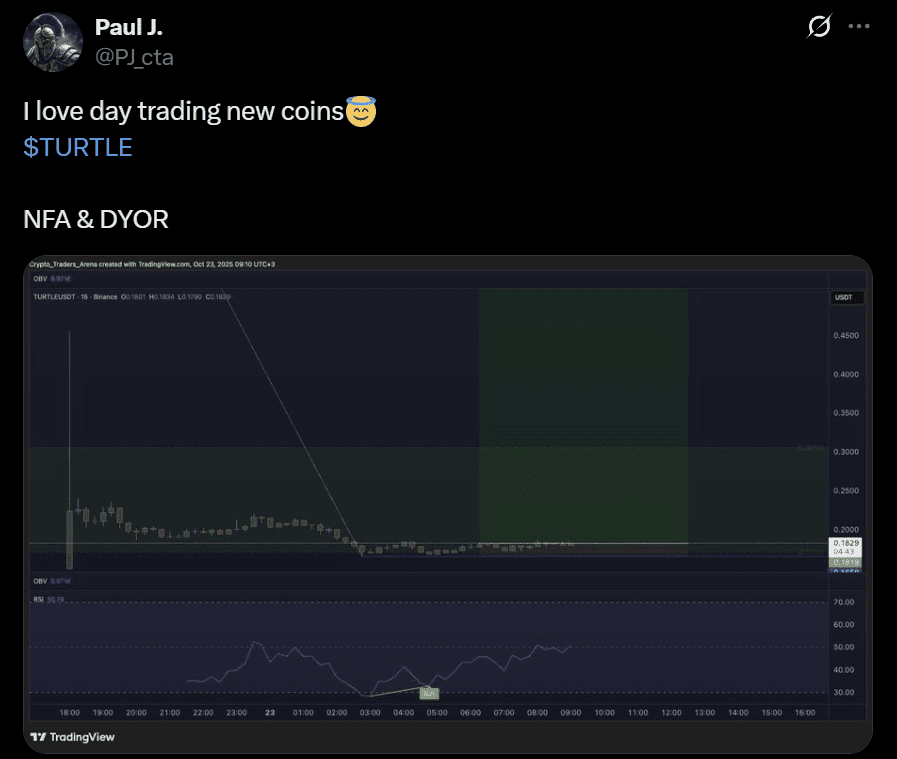

Analysts began dissecting TURTLE’s short-term setup soon after its Binance debut, pointing to mixed early patterns. Paul J. shared a 15-minute chart noting sharp post-listing volatility and thin volume recovery.

The trader’s post hinted that the token’s initial move resembled a standard liquidity flush common to new listings. The relative strength index held near neutral levels, reflecting indecision rather than clear accumulation.

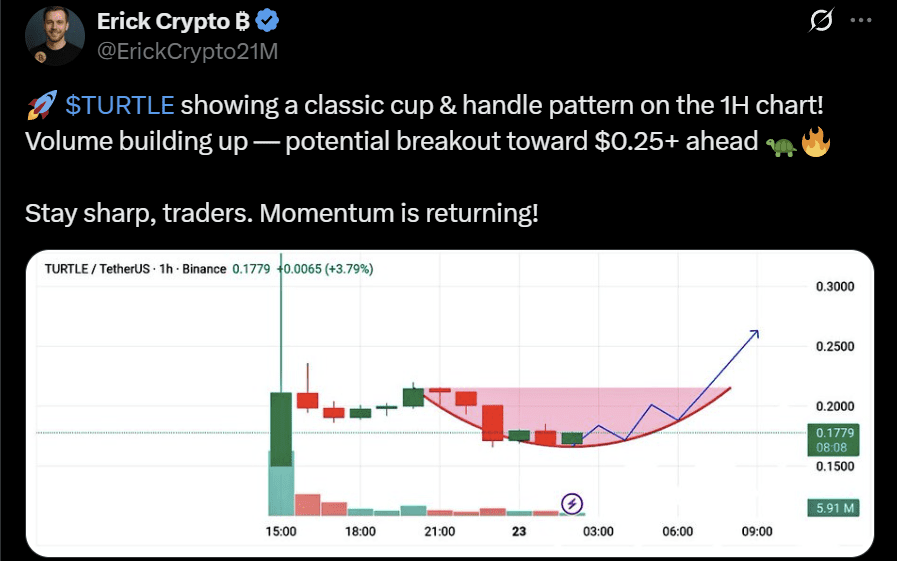

Another trader, Erick Crypto B., highlighted a one-hour chart showing what he called a “classic cup and handle pattern.”

The trader projected a potential breakout above $0.25 if momentum built up around the consolidation zone. His observation aligned with early trading data showing volume stabilization after a steep correction from the opening spike. However, the setup’s validity remained uncertain given the token’s limited historical structure and low liquidity depth.

Meanwhile, Hector, another trader tracking the TURTLE USDT pair, projected a 50% rise within 48 hours, citing renewed interest from speculative desks. His analysis leaned on a short-term volatility play rather than a structural recovery call. The price hovered near $0.18, down roughly 25% from launch but supported by steady turnover above $20 million.

Overall sentiment across trader circles pointed to cautious optimism. While early technical patterns showed recovery attempts, the token’s broader unlock schedule and investor allocations suggested that long-term upside would depend more on sustained ecosystem growth than short-lived chart setups.

Can utility drive momentum for LINK? Read here to know more