- Senator Cynthia Lummis introduces the BITCOIN Act, targeting Bitcoin reserve.

- Plan includes buying 1 million Bitcoins over five years.

- Industry and government explore non-budget-impacting funding options.

Several U.S. congressmen and Bitcoin industry leaders convened on September 17 in Capitol Hill to discuss the BITCOIN Act, which proposes adding Bitcoin to the national strategic reserve.

The proposal, led by Senator Cynthia Lummis, could reshape Bitcoin’s role in national finance and impact market liquidity without increasing the federal budget.

Strategic Vision of the U.S. Bitcoin Reserve Proposal

The proposal, introduced by Senator Cynthia Lummis, suggests the United States purchase one million Bitcoins over the next five years. The meeting discussed whether Bitcoin should be included in a national reserve without affecting the federal budget. These discussions indicate the growing importance of cryptocurrency in national policy agendas.

Exploring funding options sparked significant conversation, notably on achieving the acquisition without impacting taxpayer funds. The plan, if executed, could heavily influence Bitcoin’s market demand and integration in American economy.

Industry leaders have not publicly commented yet, but responses suggest cautious optimism about policy changes. The lack of immediate official statements from key U.S. leaders may imply ongoing strategic deliberations.

Economic Insights: Bitcoin’s Emerging National Role

Did you know? The notion of a national Bitcoin reserve reflects strategic integration trends seen globally, like El Salvador’s Bitcoin adoption.

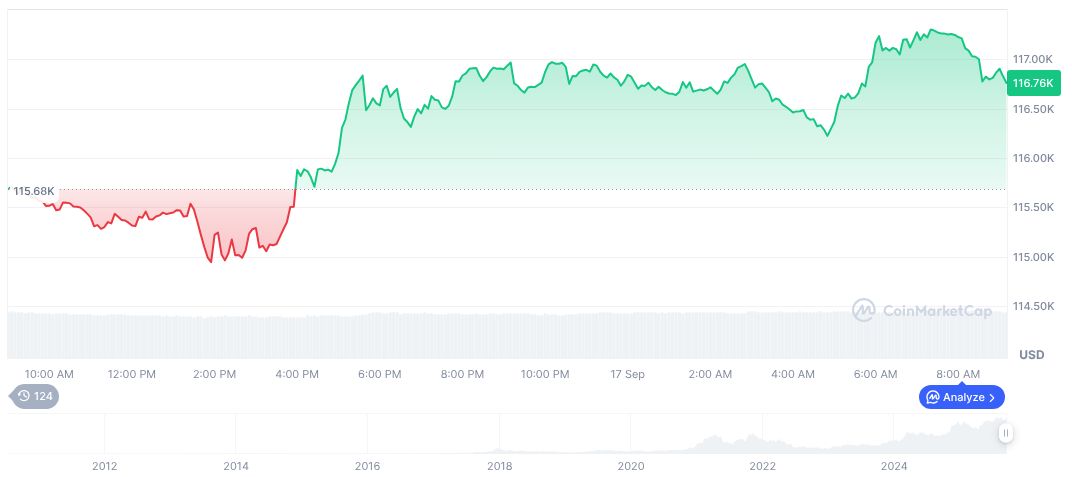

As of the latest data from CoinMarketCap, Bitcoin (BTC) is priced at $115,786.56 with a market capitalization of approximately $2.31 trillion, commanding 57.18% of the market share. Despite a slight decline of 0.92% in 24-hour price movement, Bitcoin shows a beneficial increase of 10.99% over the last 90 days.

Analysts from Coincu suggest that if completed, the purchase could boost Bitcoin’s legitimacy and encourage global regulatory discussions on cryptocurrency as a national asset. The proposal illustrates Bitcoin’s evolving financial and regulatory role.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |