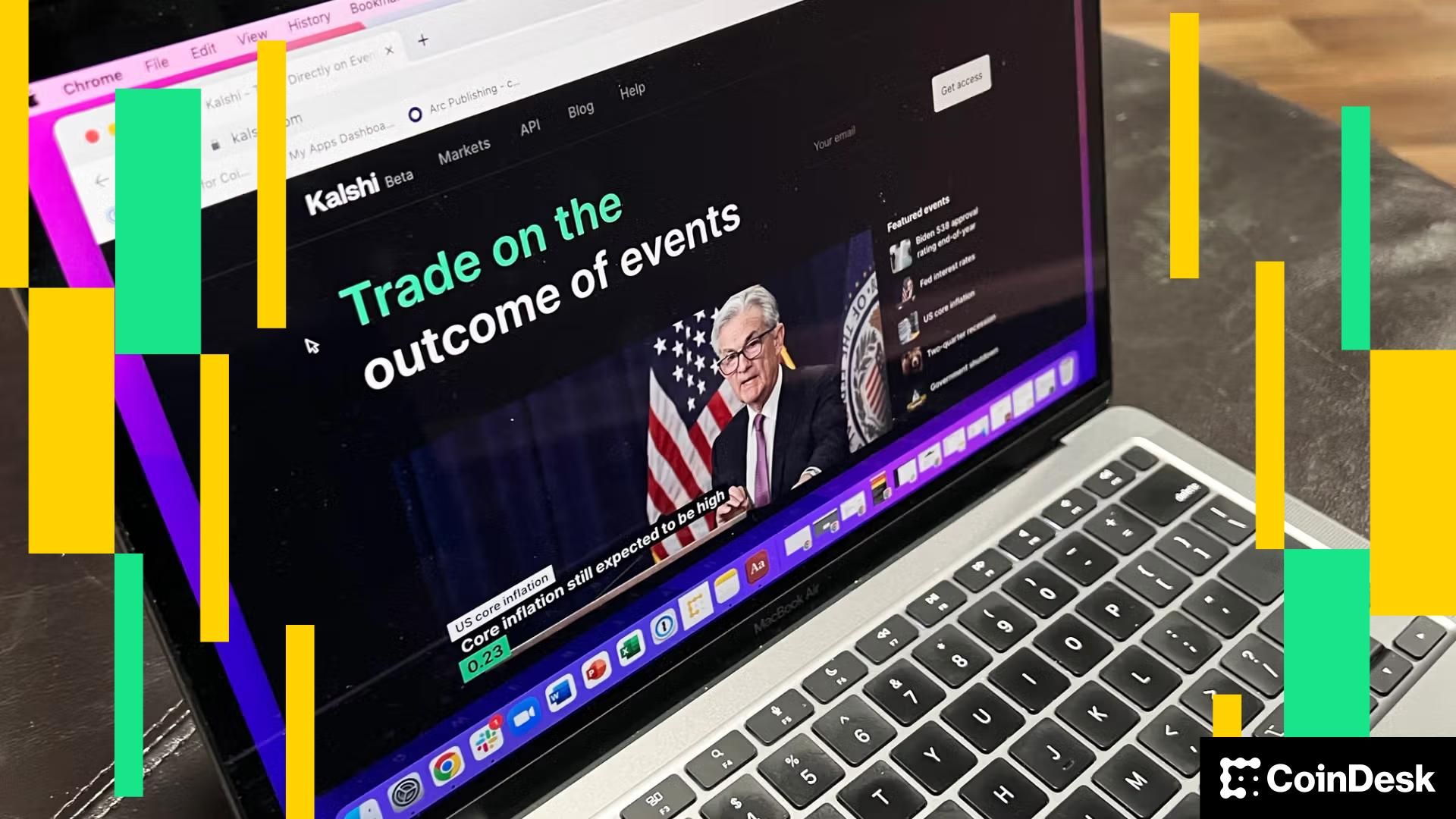

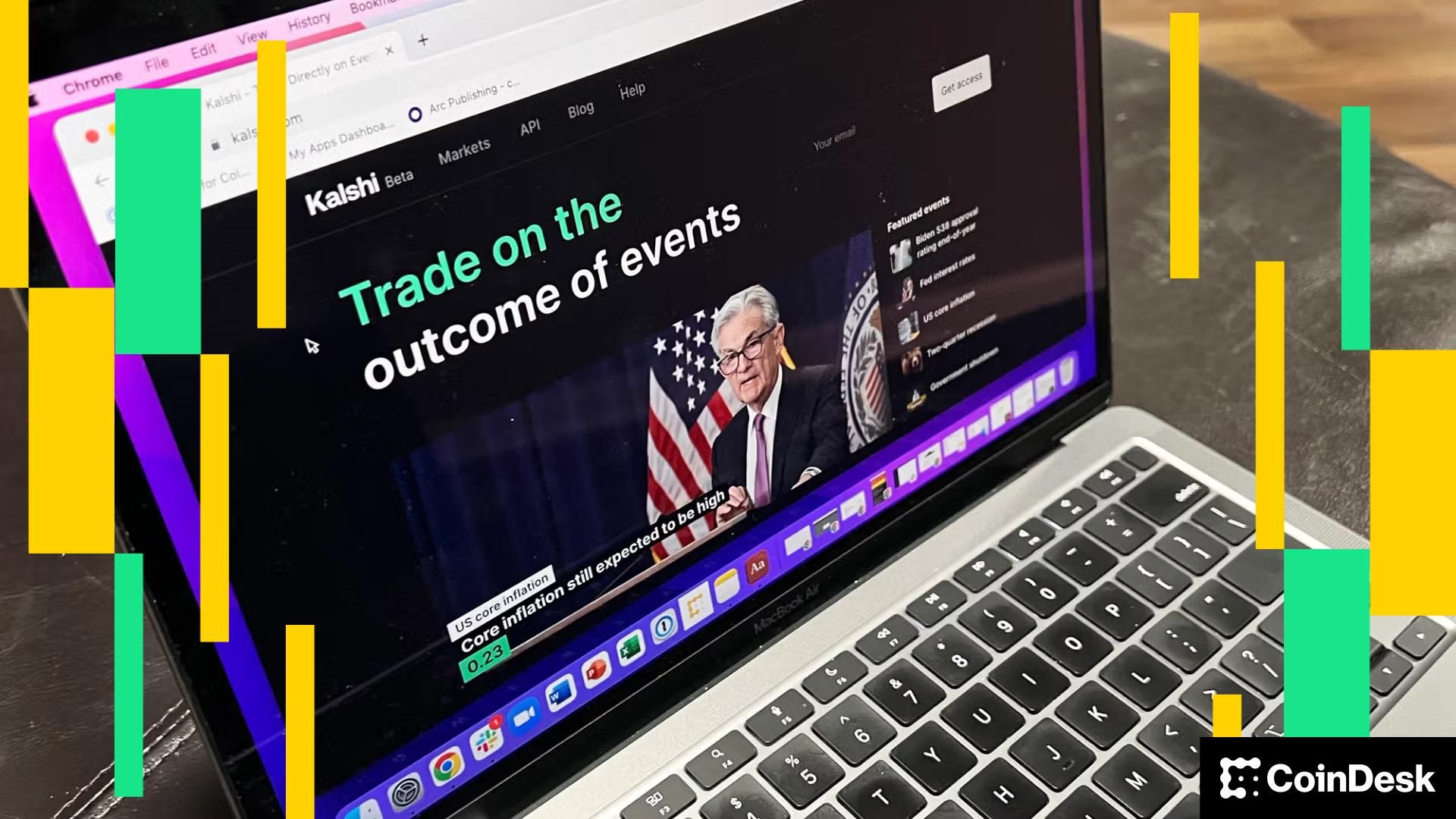

A research paper at the U.S. Federal Reserve praised the usefulness of prediction markets — specifically looking at Kalshi — in getting a real-time handle on economic policy.

“Kalshi’s forecasts for the federal funds rate and [the U.S. Consumer Price Index] provide statistically significant improvements over fed funds futures and professional forecasters, all while providing continuously updated full distributions rather than infrequent point estimates,” according to the paper published on Thursday.

And the markets, in which retail investors can buy contracts in virtually any yes-no question in such diverse fields as economics, politics and sports, are looking at topics on a live basis that other sources of information don’t.

Prediction markets “provide unique insights — particularly for variables like [gross domestic product] growth, core inflation, unemployment and payrolls, for which no other market-based distributions currently exist.”

And in this study, Kalshi predictions “perfectly matched the realized federal funds rate by the day of each meeting since 2022, a feat not achieved by either surveys or futures.”

Part of the secret sauce that sets prediction markets apart as a useful tool may be the inclusion of retail participants, which makes them “distinct from institutionally dominated markets,” the paper noted.