Kraken opened trading for USELESS on August 13 and published the notice on its asset-listings blog.

The post describes network details and notes that app access depends on liquidity conditions, which is standard for the venue. Those references remain Kraken’s latest dated action for the token.

Coinbase followed in the same window. The Coinbase Assets accountstated on August 20 that USELESS was live on Coinbase.com and in its mobile apps, confirming support after earlier roadmap chatter. That post is the clearest timestamp for Coinbase availability.

Binance focused on derivatives. On August 15, Binance Futures announceda USELESSUSDT perpetual contract with up to fifty times leverage, and set a specific launch time. That derivatives listing is the venue’s latest formal reference tied to the asset.

Bitvavo added support last week

Meanwhile, European exchange Bitvavo signaled a new listing on September 11, directing users to its venue and tagging the project’s official handle. The post confirms the addition and marks the most recent exchange communication about USELESS.

Third-party trackers echoed the Bitvavo move shortly after the post, noting the pair’s appearance on the platform. While these trackers are secondary sources, they align with Bitvavo’s announcement.

Bitvavo’s public docs outline release cadences and platform changes on a rolling basis. However, the September 11 social post remains the specific listing reference for USELESS.

Project profile and network remain consistent

Useless Coin USELESS/USD presents itself as a Solana-based meme token that “promises nothing,” a positioning repeated across its site and about pages. The branding emphasizes intentional lack of utility and a “roadmap to nowhere.” These materials have not changed in substance this month.

Public token pages and explorers identify USELESS as an SPL asset, which matches the project’s own references. Exchange and wallet guides also frame it within the Solana ecosystem for custody and transfers.

Aggregators list circulating supply near one billion tokens and track the asset across centralized and decentralized venues. Those profiles serve as secondary confirmation of contract details and network identity.

What to watch for next

Operational changes for this project typically surface first on official web pages or the primary X account, followed by venue blogs and asset pages. That pattern held for the August actions. Therefore, any new steps would likely appear in those same places.

Derivatives or spot additions on major exchanges usually arrive with dated posts that specify instruments and launch times. The August Binance Futures notice is a recent example of that cadence. Monitoring those feeds provides clear timestamps when actions occur.

As of publication on September 16, 2025, the dated operational record is unchanged since the Bitvavo post last week and the broader August wave of listings. Subsequent updates would be expected to post through the same official channels.

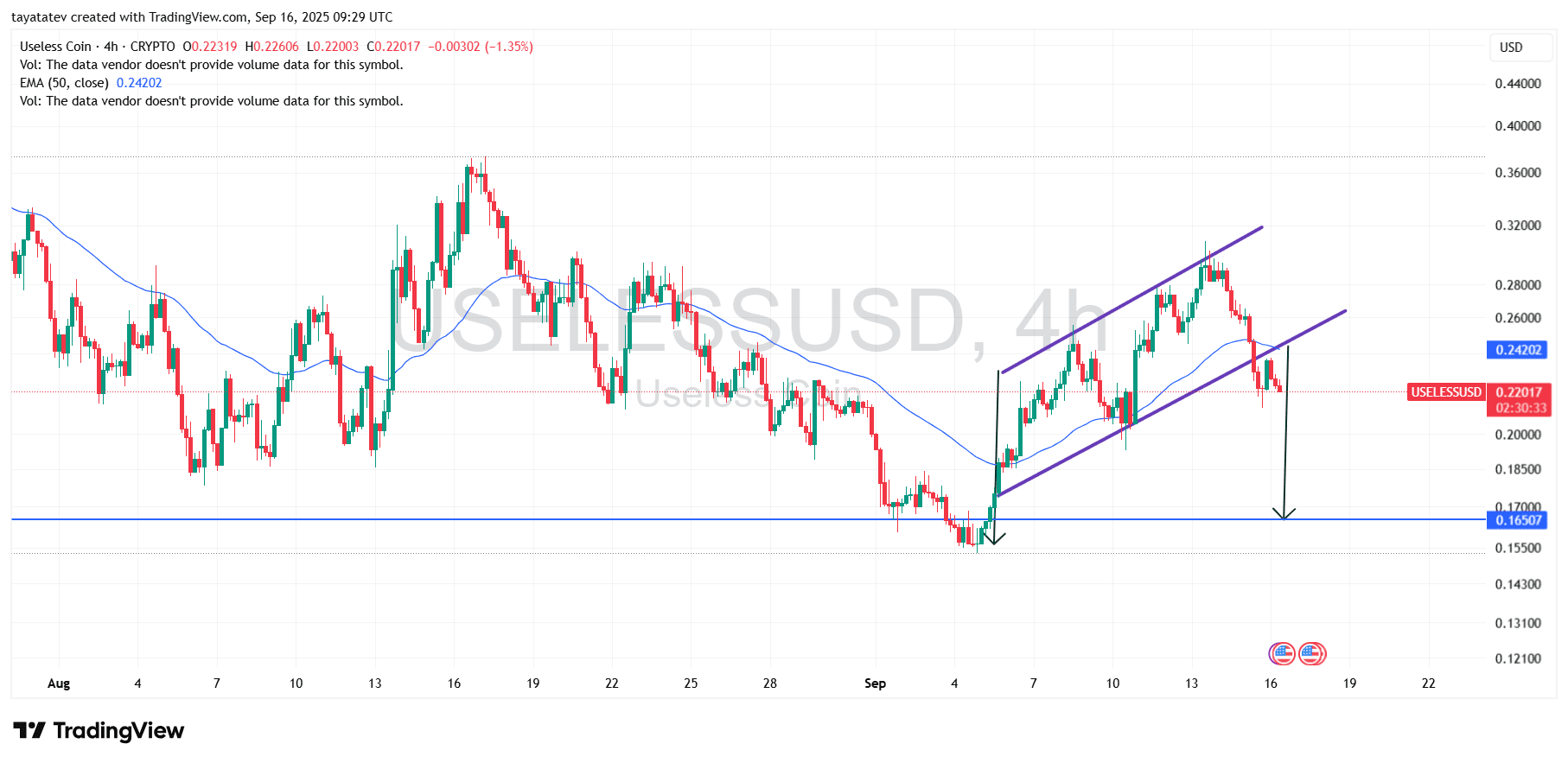

Useless Coin printed a rising channel in early September and then broke below it today on the four hour chart. A rising channel is a structure of higher highs and higher lows contained by two parallel upward lines. Price now trades beneath the lower boundary and below the 50 period exponential moving average, which is the EMA, near 0.242 dollars.

After the rebound from the early September base, candles advanced inside the channel through September 14. However, momentum weakened as pullbacks grew deeper and closes hugged the lower rail. Today the market slipped through that rail and failed an intraday attempt to reenter, which turns the broken boundary and the 50 period EMA into immediate overhead resistance. The current print sits around 0.220 dollars.

Therefore the break favors continuation to the downside. Using a simple percent projection from the present level, a thirty three percent decline implies a target near 0.1475 dollars. Prior demand around 0.165 dollars may stall the move, yet the channel failure and the position under the 50 period EMA keep the pressure on sellers. Invalidation would require a decisive close back inside the old channel and a recovery above the 0.242 dollar EMA, which would show that buyers have regained trend control.

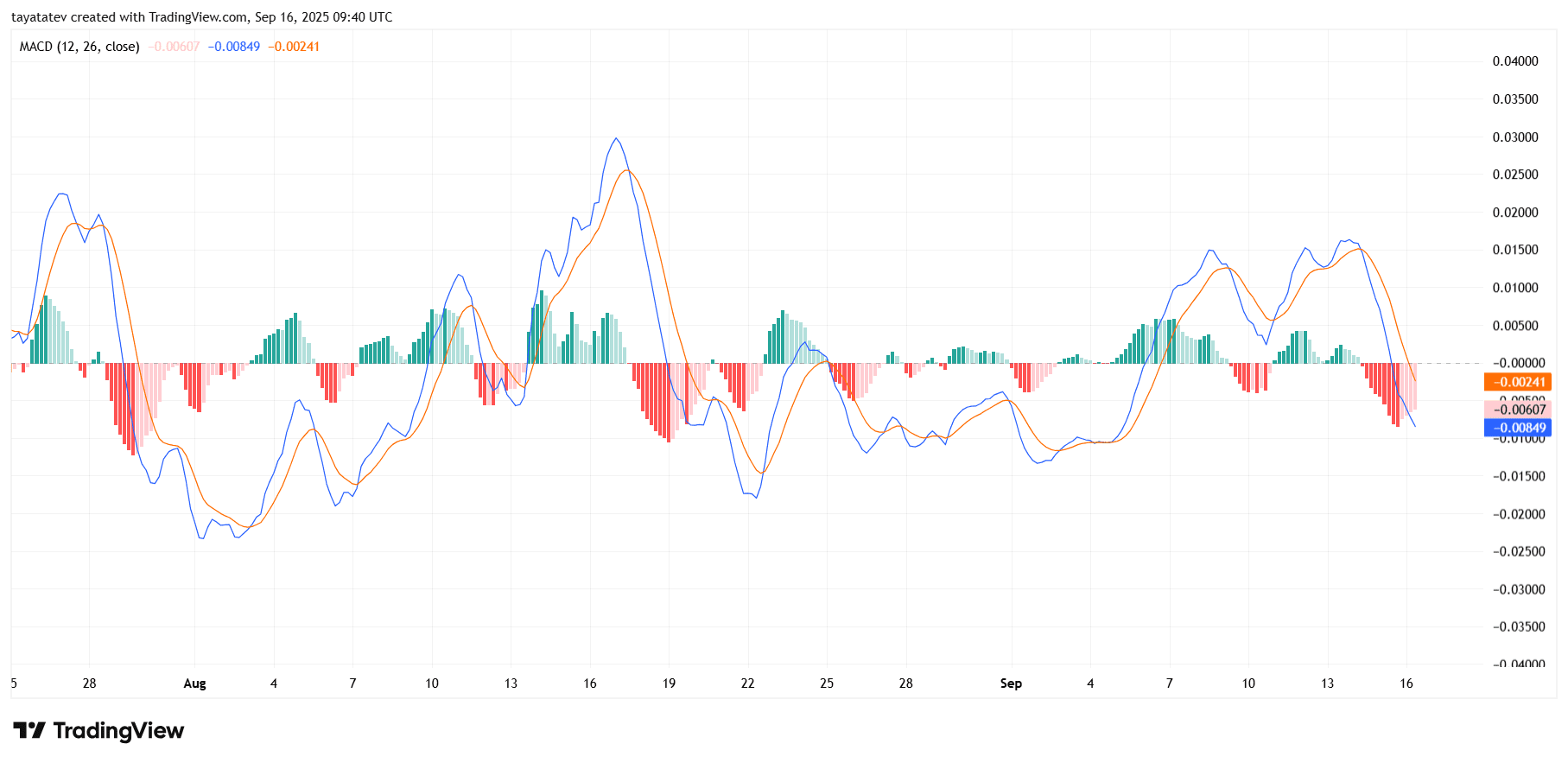

Useless Coin momentum turns down on MACD

The Moving Average Convergence Divergence indicator flipped decisively lower on the four hour chart today. Both the MACD line and the signal line sit below the zero line while the histogram prints deeper red bars. That alignment signals downside momentum rather than a neutral pause.

Momentum already softened between September 12 and 14. Price set a higher high, yet the MACD peaks rose less, which created a mild bearish divergence. Soon after, the MACD line crossed below the signal line and stayed there as the histogram expanded on the negative side.

The gauge now confirms the breakdown seen on price charts. Because the MACD lines remain under zero and the spread between them widens, sellers keep control in the near term. A momentum recovery would require the MACD line to curl up, cross back above the signal line, and push the histogram toward zero. Until that sequence appears, the indicator continues to favor pressure to the downside.

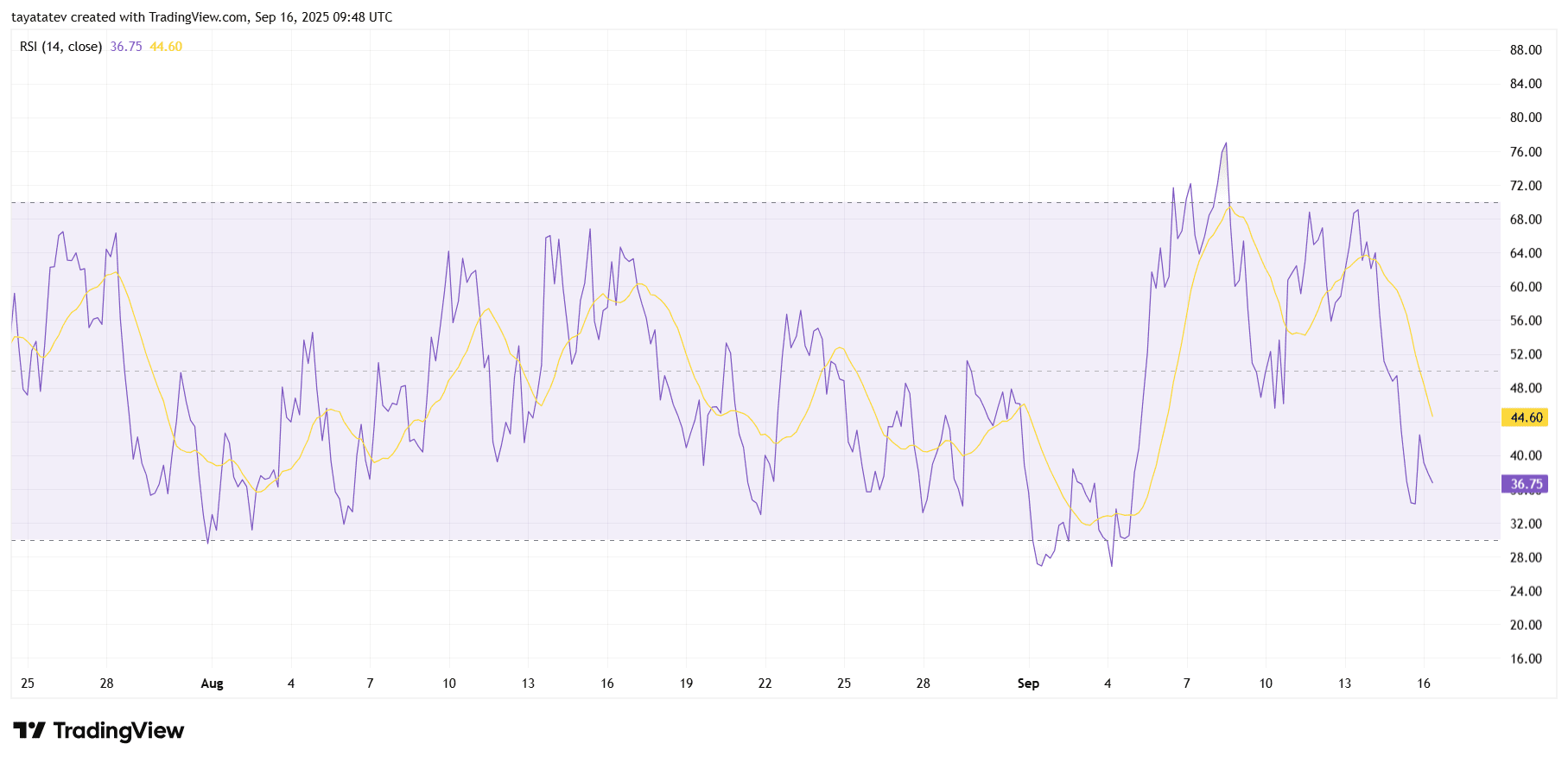

Useless Coin RSI slips below 50 as momentum weakens

The four hour Relative Strength Index sits near 36 on September 16, 2025. It fell through the 50 midpoint and through its RSI moving average around 45. That shift marks a bearish momentum regime rather than a neutral pullback.

Earlier this month the RSI reached the high 70s as price rallied. However, subsequent peaks showed less strength while price attempted higher highs. That sequence created a mild bearish divergence. Then the RSI crossed below its signal and stayed below it while the reading trended lower.

The oscillator now approaches the 30 zone but has not tagged oversold. Therefore sellers retain control until the RSI curls upward and reclaims 50. A recovery above the moving average would add confirmation. Absent that change, the RSI continues to validate the recent breakdown seen on price charts.