Floki Inu advanced its non price roadmap in 2025. The project launched its Valhalla game on opBNB mainnet, filed a MiCA white paper that trade press said was registered with the European Securities and Markets Authority, and expanded sports and media partnerships tied to Valhalla and sister project TokenFi.

Valhalla goes live on opBNB with an esports partner

Floki launched Valhalla, its play to earn MMORPG, on opBNB mainnet on June 30 2025. The team announced the date in the run up, and industry outlets reported the game’s transition from test to mainnet. Coverage detailed the shift and framed it as a utility push for the ecosystem.

The launch arrived with an esports tie in. Floki partnered with Method, a long running esports brand, to create content, guides, and event programming around Valhalla. Reports said Method would support onboarding and live coverage to draw both Web3 and traditional gamers.

Media recaps after the release confirmed the game was live on opBNB and noted the Method collaboration. Outlets highlighted the game’s play to earn design and the attempt to grow reach beyond crypto native users. Industry trackers also recorded the first weeks of post launch activity.

MiCA white paper enters the EU register as ESMA sets guidance

Trade publications reported on July 22 2025 that Floki’s MiCA compliant white paper was registered with ESMA via a national competent authority process. LCX, a Liechtenstein platform, also published a note describing its role in preparing and notifying the document. These accounts placed Floki among early movers on the MiCA disclosure track.

ESMA maintains the EU’s interim MiCA register and updates it on a weekly basis. The authority explains that the register lists crypto asset white papers, service providers, and non compliant entities, with information flowing from national regulators. ESMA’s page sets out how the interim files work during the rollout phase.

At the same time, ESMA warned firms in July to avoid using regulated status to market unregulated products on the same platforms. The statement described a halo effect risk and asked providers to clearly separate regulated and unregulated offerings in their communications. Reuters and legal briefs summarized the warning and the related guidance.

Trading bot pushes utility and fee routing

Floki continued to promote its Telegram based trading bot during 2025. The tool lets users trade from chat while managing a dedicated wallet. The project’s site presents the bot as part of its product suite.

Project materials and partner posts describe a revenue model that directs a share of trading fees to buy and burn Floki tokens and to the treasury. External modeling write ups repeated that design and tested the flows. Community updates also referenced a fifty percent split after beta.

Technical explainers added that the bot aims for fast token swaps from inside Telegram. They emphasized a chat first interface and support for multiple chains as the rollout expands. These descriptions positioned the bot as a utility layer for the ecosystem.

TokenFi, a Floki related platform, became title sponsor of the West Indies tour of Ireland in May and June 2025. Cricket Ireland and third party outlets carried the announcement and broadcast details. The series ran between May 21 and June 15.

Separately, Valhalla joined the Baroda Premier League in India as an official partner in June. The project’s blog outlined expected visibility across matches and venues. Independent news feeds also relayed the partnership and the tournament schedule.

These placements followed the mainnet launch and supported broader audience exposure. Announcements cited broadcast partners and in stadium branding for both cricket properties. The campaigns ran alongside ongoing esports content tied to Method.

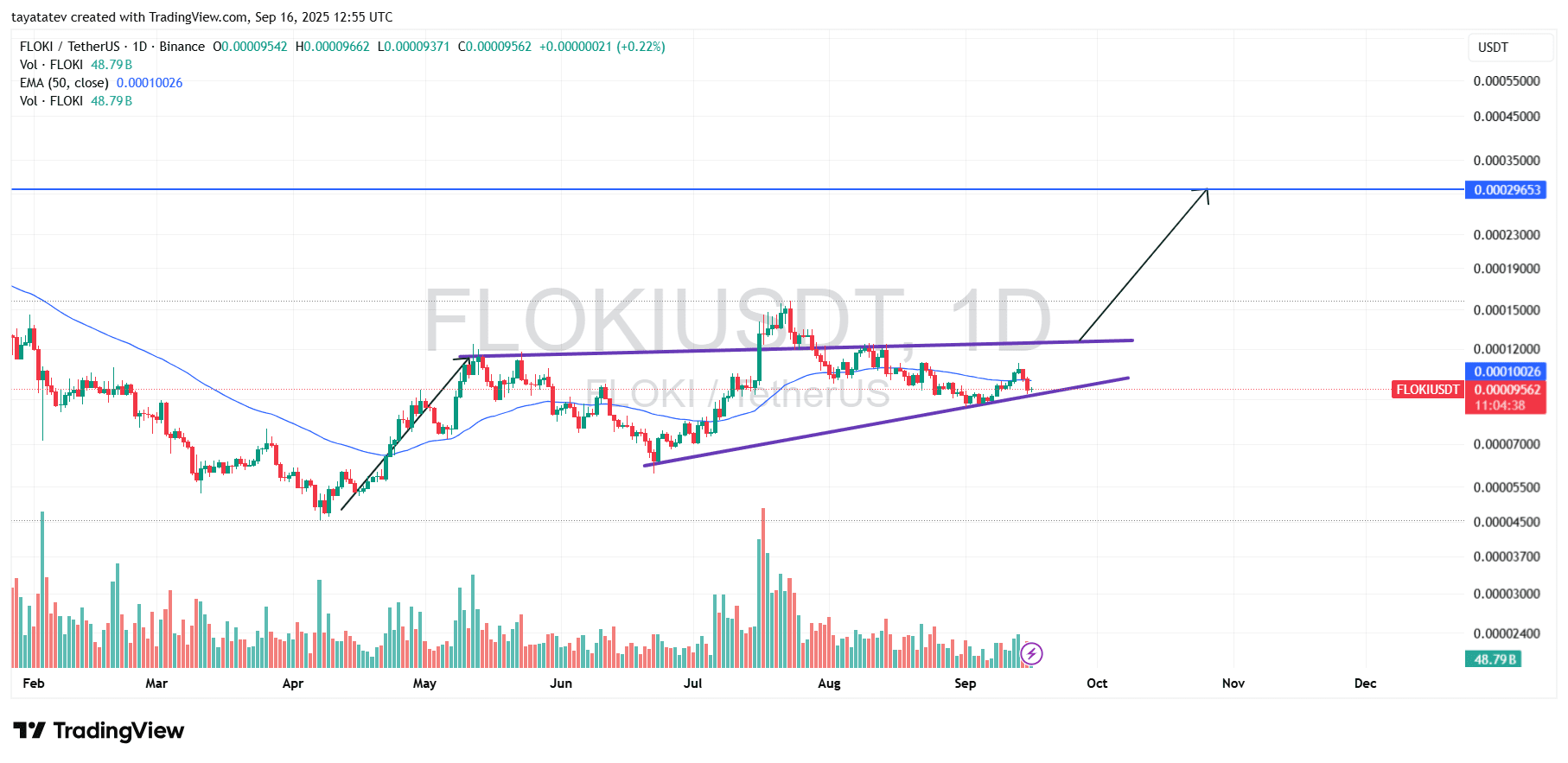

FLOKI forms rising wedge; upside path needs confirmation to target ~0.0002926 (206%)

Sep 16, 2025 FLOKI/ USDT trades near $0.00009562 on the daily chart. The structure now shows a rising wedge between upward-sloping, converging trendlines. A rising wedge is a pattern of higher highs and higher lows inside narrowing upward lines that often signals fading momentum, though breakouts can still occur. Meanwhile, the 50-day Exponential Moving Average (EMA) sits around $0.00010026, slightly above spot.

However, bulls need a clean daily close above the wedge’s upper boundary to confirm strength. That boundary aligns roughly with the mid-$0.00012 area on this chart. Furthermore, volume has remained moderate, so confirmation would also benefit from expanding activity to validate follow-through. Until then, price continues to coil between the rising support line and the capping resistance line.

If the breakout confirms, the charted objective implies roughly 206 percent upside from the current price, which maps to about $0.0002926. That level sits just below the marked horizontal resistance near $0.00029653, so the zone between those prices becomes the logical target area. Conversely, if price loses the rising support, sellers could test the 50-day Exponential Moving Average first, and then prior swing levels; nevertheless, the upside case remains viable while the wedge holds and momentum improves.

FLOKI in Indian rupees retreats from midweek high, then steadies near ₹0.0086

Sep 16, 2025 — On the intraday view, FLOKI/INR (Indian rupees) trades sideways after a sharp decline. The chart shows a climb into Sep 14 that topped just above ₹0.010, then a fast reversal toward the ₹0.008 area by Sep 16. Consequently, price now holds a narrow band around ₹0.0085–₹0.0087 while the prior surge unwinds.

However, the path into the peak featured rising turnover, and the slide that followed came as activity eased, which often signals profit taking rather than a trend change. Moreover, buyers attempted to base above ₹0.0083 multiple times today, which frames that zone as near-term support. Therefore, as long as that floor holds, the market can consolidate after the drop.

Meanwhile, immediate resistance sits near ₹0.0090–₹0.0092, where rebounds stalled during the session. Above that, the next cap appears around ₹0.010, the area of the Sep 14 high. Conversely, a clean break below ₹0.0082 would reopen the lower range from early Sep. In sum, the chart prints a pullback from the spike and then a stabilization phase around mid-₹0.008s.