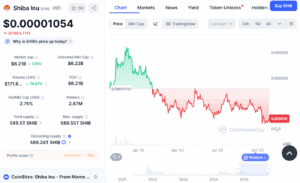

Shiba Inu (SHIB) is trading at $0.00001060, up 1.5% in the past 24 hours but still nearly 40% lower than a year ago. While optimism has resurfaced after a short-term rebound from October lows, data shows that a jump to $0.0001 by year-end—a tenfold rise—is unlikely under current market conditions. But why? Read this analysis to learn more.

SHIB Faces a Supply Wall Too Large to Overcome

As of today, Oct. 27, SHIB’s circulating supply stands at 585.22 trillion tokens, with a total supply of 589.24 trillion. Even after the burn of more than 410.75 trillion SHIB since launch, the remaining supply is still massive.

At the current price, Shiba Inu’s market capitalization is about $6.2 billion. To reach $0.0001, the token would need to grow to roughly $60 billion—a valuation higher than many leading altcoins, including Cardano (ADA) and Solana (SOL). Given the slowdown in liquidity and trading volume across the broader crypto market, such a rally in just two months would require historically unrealistic capital inflows.

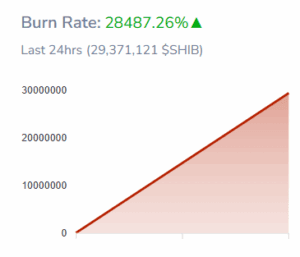

The SHIB burn rate has surged in recent weeks. Data from Shibburn shows a 28,487% increase in the past 24 hours, with about 29.37 million tokens permanently removed from circulation. While this sounds impressive, it accounts for just 0.000005% of total supply.

Over the past quarter, SHIB’s burn rate rose by over 340,000%, bringing the total burned supply to around 410.75 trillion SHIB. However, on-chain data shows that the absolute volume of burns remains too small to meaningfully affect the token’s valuation.

At this pace, even an annual burn of 50 billion tokens would take more than a decade to eliminate just 1% of the total circulating supply.

Technical Charts Show Persistent Downtrend

SHIB price chart shows that the token is struggling to break above its descending trendline resistance, currently around $0.00001138–$0.00001202. Prices have been confined to a lower range since mid-September, failing to close above key exponential moving averages (EMA 20/50/100/200).

The Relative Strength Index (RSI) sits near 39, signaling weak momentum and continued seller pressure. Unless SHIB closes above $0.00001299, a reversal toward $0.00002 appears unlikely. Conversely, a drop below $0.00000999 could invite another wave of selling before December.

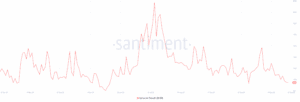

Apart from technicals, on chain data shows that SHIB’s network growth — a metric tracking new wallet creation — has fallen sharply since July 2025, dropping from over 2,000 daily new addresses to below 1,000 by late October.

This decline indicates fewer new participants are entering the SHIB ecosystem, despite ongoing burn efforts and ecosystem updates.

Historically, major SHIB price rallies in 2021 and mid-2023 were accompanied by rapid spikes in new addresses. The current stagnation, therefore, highlights a lack of organic user expansion. This is a key reason the token struggles to maintain upward momentum, even when short-term trading activity increases.