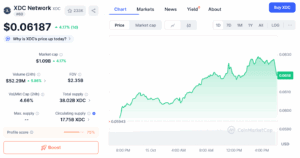

XDC gained 4% after a sharp reversal on Oct. 11, recovering from a steep sell-off triggered by former U.S. President Donald Trump’s renewed tariff threat on Chinese technology exports. The rebound came after days of heavy liquidation across the market. Let’s see what makes XDC a coin to watch in 2025.

You May Also Like: Will XDC hit $1 dollar?

Institutional Adoption Expands in 2025

The XDC Network, developed by the XinFin Foundation, focuses on bridging blockchain with real-world finance. Specifically, it is designed for tokenizing trade documents, invoices, and assets — areas where blockchain adoption has practical demand.

Its hybrid architecture blends the transparency of public blockchains with the control of private networks, making it suitable for enterprises. The network’s ISO 20022 compliance also aligns it with the same messaging standards used by global financial systems like SWIFT, improving interoperability with banks and payment processors.

XDC’s progress through 2025 has centered on institutional access, tokenization initiatives, and regulatory alignment.

-

USDC integration: Circle added native USDC and CCTP V2 to XDC, allowing seamless transfers across more than 15 networks.

-

ETP launch: The 21Shares XDC ETP began trading on the SIX Swiss Exchange and Euronext, expanding regulated investment exposure.

-

Tokenization in Brazil: Brazil’s Asset manager VERT Capital announced a plan to tokenize $1 billion in corporate receivables and debt on XDC over the next 30 months..

-

RWA Accelerator: In partnership with Plug and Play, XDC launched an accelerator to attract projects developing tokenized finance applications.

-

Merchant payments: Through AEON Pay, the network aims to enable XDC transactions at over 20 million retail points worldwide.

Apart from all these, the XDC 2.0 upgrade, rolled out in late 2024, modernized the network’s consensus and introduced subnet architecture for modular scalability. Current development focuses on performance tuning, staking refinements, and research into gasless subnets, designed to reduce transaction fees for enterprise applications.

Moreover, by aligning with European MiCA regulations and maintaining ISO 20022 certification, XDC is continuing its push for regulatory readiness in tokenized finance.

XDC’s Technical Setup After the October Sell-Off

On the daily chart, XDC trades around $0.061, showing a mild recovery after breaking below a long-term descending triangle pattern.

All major exponential moving averages are trending downward. This alignment confirms that sellers still control the broader trend. However, the RSI (14) at 27.18 now signals oversold conditions. Historically, similar readings have often led to short-lived rebounds.

Additionally, if buyers defend the $0.058–$0.06 area, XDC price could rebound toward $0.069–$0.073. That range aligns with the 20- and 50-day EMAs, where earlier breakdown attempts began.

Conversely, a daily close above $0.075 would suggest the first sign of trend recovery. If that fails, however, $0.05 remains the next major support level.