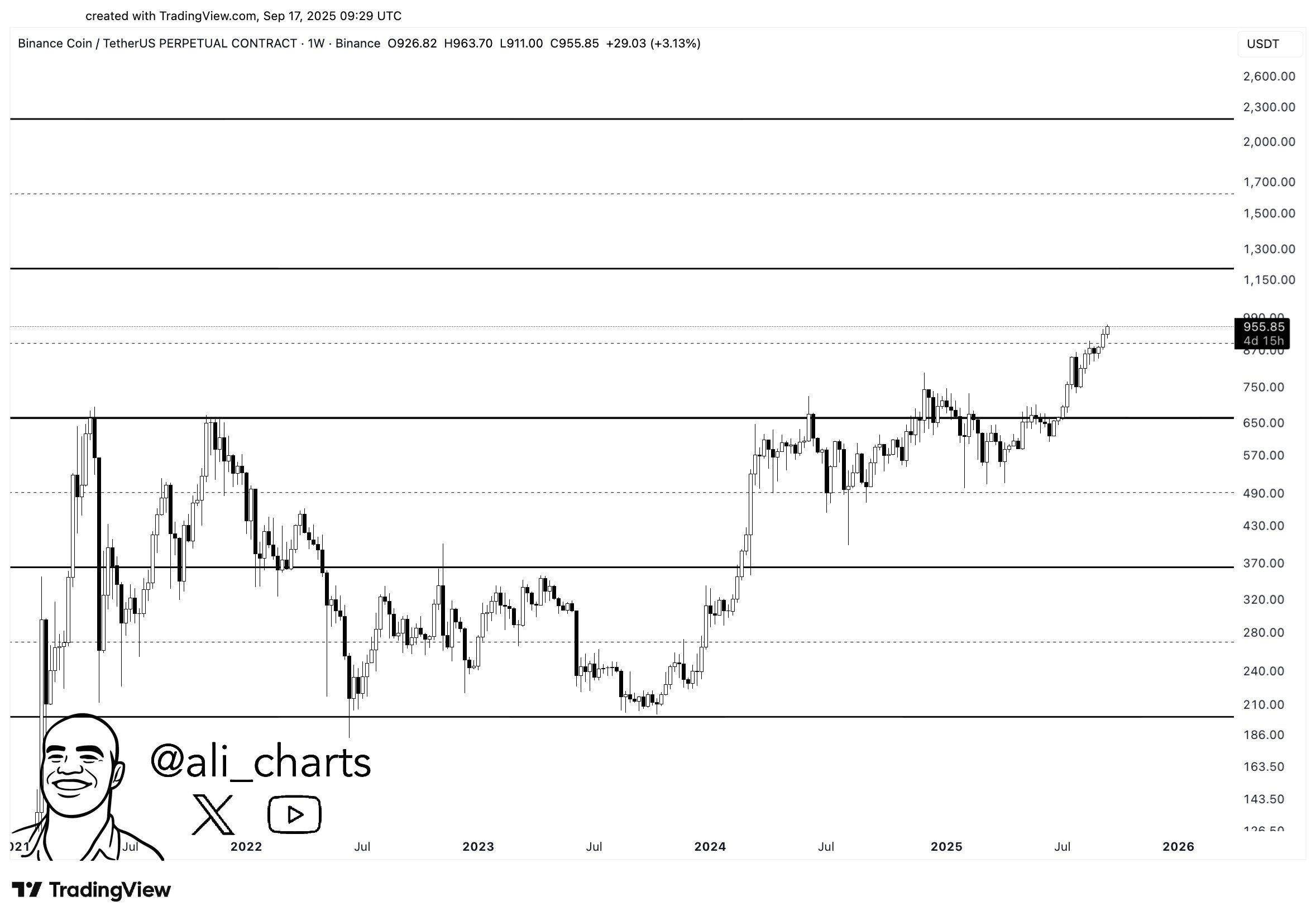

Binance Coin continues its climb on the weekly BNB/USD chart, pressing into the resistance band that sits between 1,150 and 1,300. Price holds a clear sequence of higher highs and higher lows after reclaiming the former ceiling near 750, which now acts as support. The structure shows steady momentum rather than a single spike, with candles closing above prior swing highs and keeping the trend intact.

The chart maps long term levels that traders have watched since the 2021 peak. BNB first based near 370, then advanced through 570 and 750. It is now approaching the next supply area where historical reactions occurred, roughly 1,150 to 1,300. This zone represents the final overhead region before the open space toward prior extremes on the instrument, which underscores why a weekly close inside or above it would be notable from a market structure perspective.

Risk sits at the breakout shelf. If BNB pulls back, the 870 to 900 pivot and the 750 level are the nearest areas where the market previously accepted price. Until that changes, the weekly trend points higher and the path of least resistance remains toward the 1,150 to 1,300 band that the chart highlights.

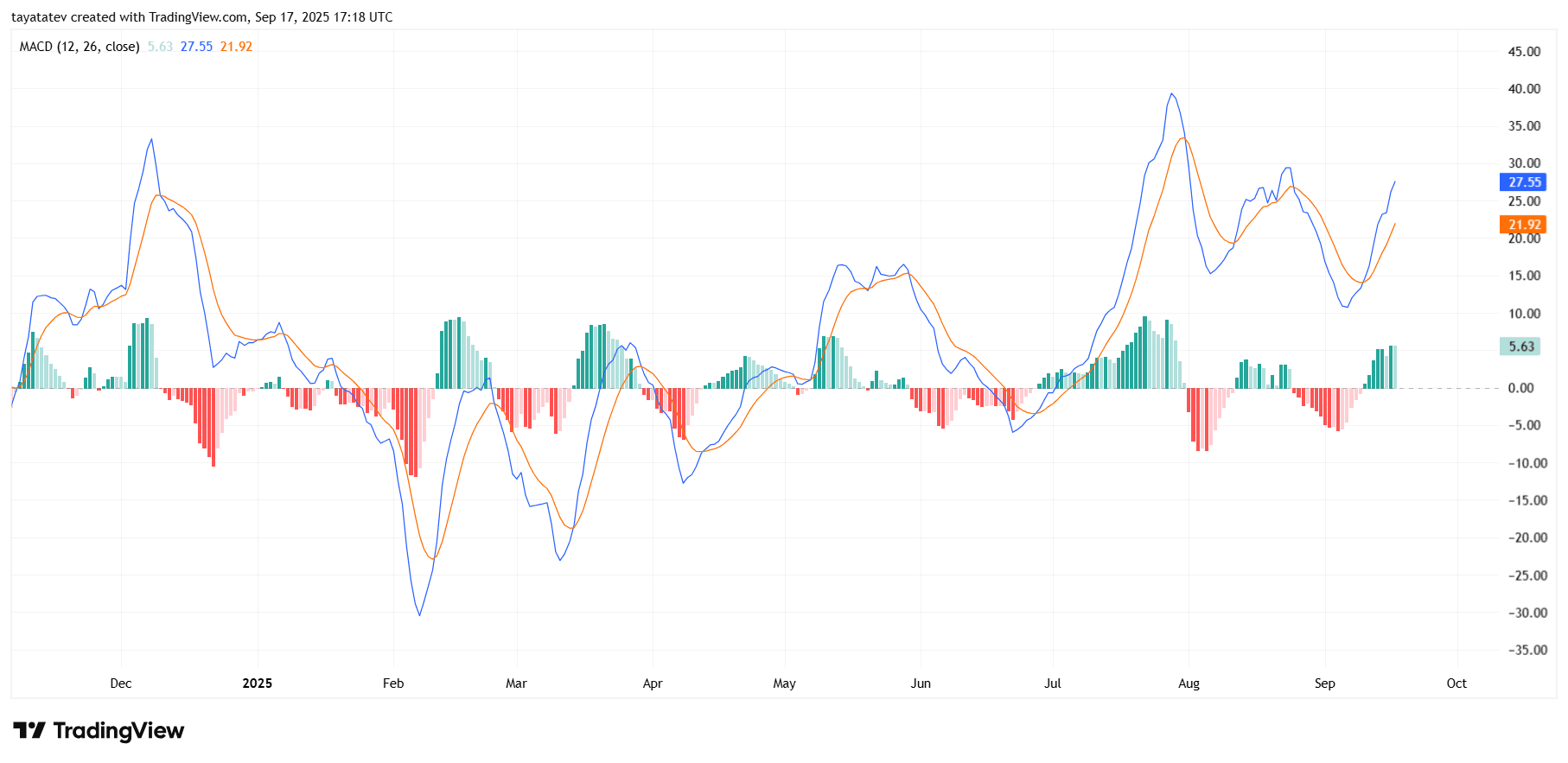

BNB momentum improves as MACD widens above zero

September 17, 2025 — Binance Coin’s daily Moving Average Convergence Divergence (MACD) shows strengthening upside. The MACD line prints 27.55, above the signal line at 21.92, while the histogram is +5.63. Both lines sit well above zero, which places trend momentum in a constructive phase.

The MACD compares two exponential moving averages to gauge trend strength. A rising histogram signals that the distance between the MACD and its signal line is expanding. Here, the histogram has flipped positive and is building, which confirms acceleration rather than a one-day jump.

Momentum typically stays favorable while the MACD holds above its signal line and the histogram grows. However, if the histogram starts to contract or a downside cross appears, momentum would be cooling and a pause could follow. For now, the alignment supports the prevailing uptrend seen on price.

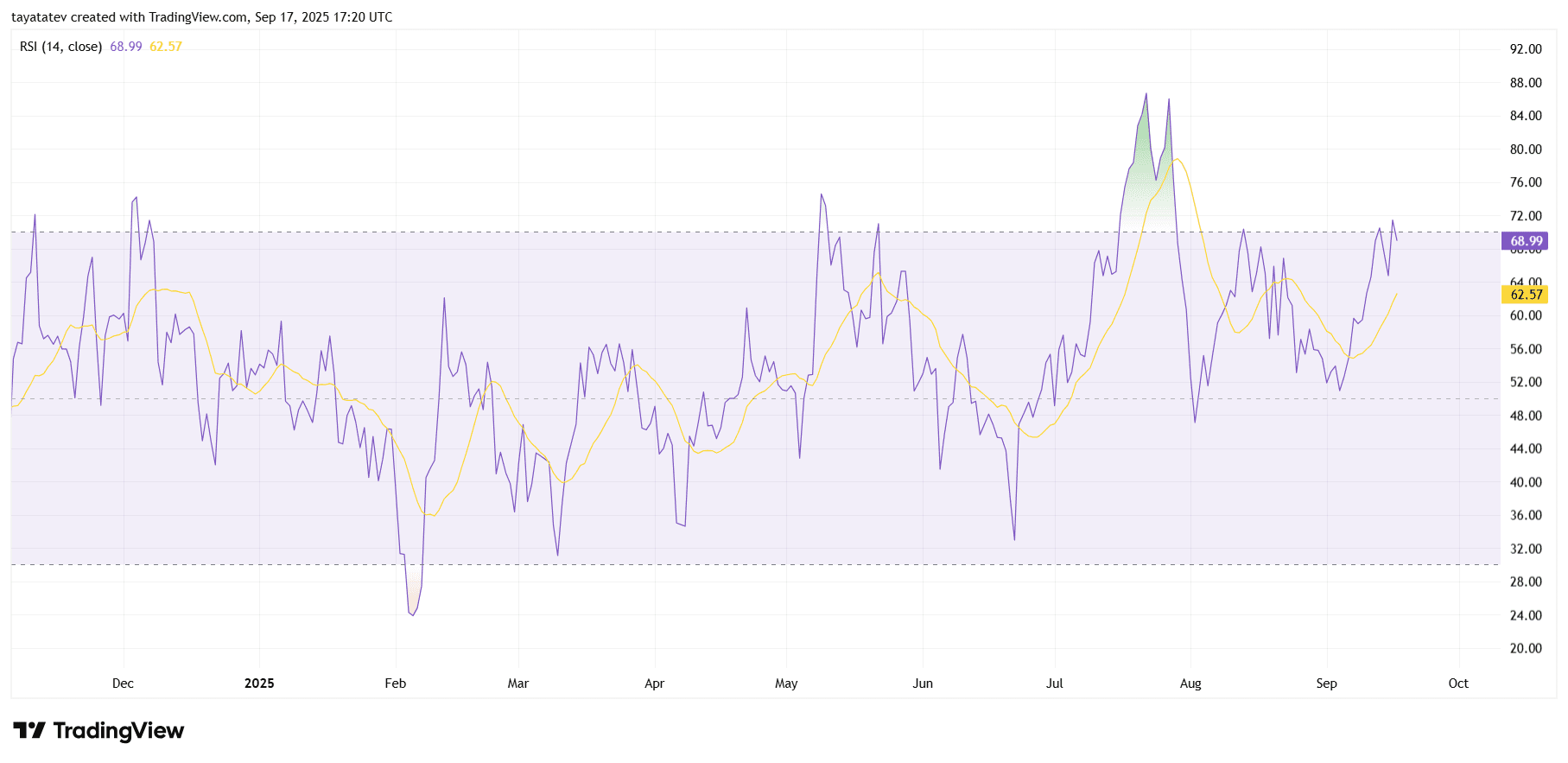

BNB RSI nears 70, momentum stays constructive

Binance Coin’s daily Relative Strength Index (14) prints 68.99, above its signal average at 62.57. The oscillator holds in a bullish regime while it remains above 50 and close to the 70 threshold, showing buyers still control momentum.

The RSI has made higher lows since early September and now sits above its own moving average. That alignment typically appears during trend continuation. Price action has reflected this strength with sustained closes above recent swing highs, which keeps the momentum profile firm.

Risk concentrates near the 70 band, where pullbacks often start. A decisive push through 70 would confirm strong trend strength, while a drop back below the low-60s would flag momentum fatigue. Until then, the indicator supports the prevailing uptrend.

BNB Chain Wallet Extension Sunset

BNB Chain began sunsetting its official browser wallet extension this week. The team said support started winding down on September 15 and will end on October 15. It asked users to migrate and back up seed phrases ahead of the cutoff.

Developers noted that core functions will degrade during the sunset period. They flagged potential issues with updates, bug fixes, and security patches as the deadline approaches. Therefore, they urged users to switch to supported wallets.

The project also published short migration guides. These walk users through exporting keys and importing them into alternatives. In turn, they aim to reduce service disruptions as the extension retires.

0-Fee Stablecoin Transfers Extended

BNB Chain kept its “0 Fee Carnival” for stablecoin transfers active into September. The program covers core rails for U.S. dollar-pegged coins, including common routes for retail users. It remains positioned as a throughput test and an adoption push.

Network posts said the waiver applies to qualifying transactions during the window. They emphasized standard compliance checks and throughput monitoring. As a result, users continue moving funds at no network cost under the promo.

The team added that the extension helps measure real demand. It also provides data on settlement patterns across wallets and apps. Consequently, engineers can tune capacity while fees are waived.

Tokenization Push Highlights VBILL on BNB Chain

BNB Chain spotlighted real-world asset tokenization this week. Materials pointed to Securitize’s issuance of VanEck’s VBILL on BNB Chain. The flow packages short-term U.S. Treasury exposure in a token format for qualified investors.

Project notes cited programmable compliance and venue connectivity. They said on-chain rules can manage eligibility and transfers. Moreover, the setup aims to streamline secondary liquidity.

The ecosystem framed tokenization as a priority track. It plans to publish more documentation for institutions and developers. In turn, it expects new pilots to follow the VBILL template.

Binance User and Miner Programs

Separately, Binance rolled out two non-price initiatives. First, it launched a Word-of-the-Day quiz focused on Launchpool concepts. Participants can earn Binance Points that convert into platform perks.

Second, Binance Pool opened a promotion for Bitcoin miners. The campaign distributes USD Coin vouchers to eligible participants. Terms outline hash-rate thresholds and payout windows.

Both programs target engagement rather than trading activity. They also supply small, trackable rewards inside the exchange’s ecosystem. Consequently, Binance keeps users active while markets evolve.